The dollar significantly strengthened last Friday, and the DXY dollar index completed the past week on a positive territory with an increase of 0.44% (+40 points).

At the end of a successful week, the dollar received another support from the published data, according to which the consumer sentiment index increased to 86.4 points from 82.9 in May, which is higher than the forecast of economists who waited that the index would grow to 84.4.

The indicator is still far from the value of 101.0 fixed in February 2020, when the Pandemic COVID-19 has not yet begun, but it should improve as the growth of jobs accelerates, economists consider. The assessment by consumers of the current economic situation in June rose to 90.6 from 89.4 in May. Consumer expectations index reflecting the share of respondents awaiting improving the conditions for doing business over the next six months, rose to 83.8 from 78.8 in May.

Consumers expect the US economy to grow faster, while also expecting unemployment to fall. At the same time, the acceleration of inflation continues to cause alarm among consumers.

Thus, a previously published consumer price index (CPI), manufacturers price index (PPI) and personal consumption costs index (PCEPI) came out with record values.

The above facts suggest that the Fed may begin to wind down its stimulus policy somewhat earlier than its leaders say. They continue to adhere to a very soft monetary policy, considering the jump in inflation is still a temporary phenomenon.

In this regard, market participants will carefully study the results of the Fed's meeting, which will end on Wednesday with the publication of the interest rate decision at 18:00 (GMT), as well as follow the progress of the Fed's press conference, which will begin at 18:30.

The rate is widely expected to remain at 0.25% at this meeting. However, during the period of publication of the rate decision, volatility may sharply increase throughout the financial market, primarily in the US stock market and in dollar quotes, especially if the rate decision differs from the forecast, or the Fed management makes unexpected statements. The comments of the head of the Federal Reserve Jerome Powell, which may affect both short-term and long-term USD trading, will be of greater interest to investors. They want to hear from Powell about his views on the Fed's future plans for this year.

Any hints from Powell about the possibility of changing the current monetary policy towards its tightening will cause a reduction in short positions on the dollar and, accordingly, its growth.

In an official statement following the April 27-28 meeting, Fed officials said the economy must "demonstrate further substantial progress" toward the targets set by the regulator before they consider reducing asset purchases.

Most likely, Powell will again try to calm the markets and its participants, who are betting on further growth of stock indexes and a weakening of the dollar, repeating his previous statements about the need to adhere to the current parameters of the stimulus policy.

Earlier, the head of the Federal Reserve Jerome Powell also said that before the central bank begins to raise interest rates, it will first begin to reduce the volume of purchases of government bonds, and market participants will be notified in advance.

During today's Asian session, the dollar index DXY declined, by 9 points falling below the closing price of last week, to the level of 90.46, which is also 14 points below the high of last week. At the same time, a strong decline in the dollar index is also not observed. Most likely, it will remain in the current range until the end of the Fed meeting.

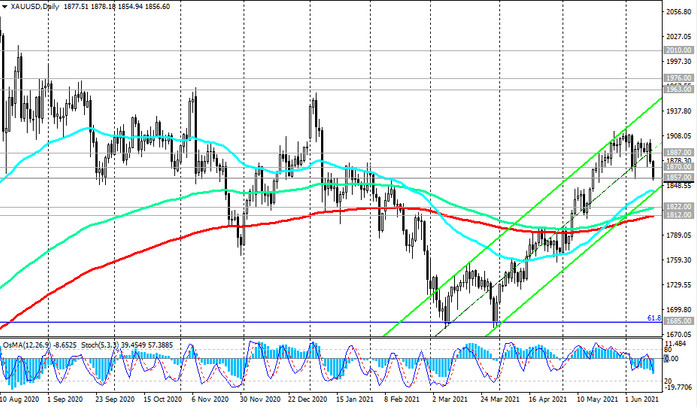

Meanwhile, gold prices on Monday are also declining in anticipation of the outcome of the Fed meeting, which looks somewhat strange against the background of falling US government bond yields and rising inflation. Probably, participants in the precious metals market still hope to hear tough comments from the Fed leadership on the prospects for its monetary policy.

The price of gold is declining today for the second trading day in a row, while the XAU/USD pair has fallen to a strong short-term support level of 1857.00 (see Technical Analysis and Trading Recommendations).

If Powell confirms on Wednesday that the acceleration in inflation is a temporary phenomenon, and the central bank intends to stick to a soft monetary policy in the near future, then gold prices are likely to rise.