The dollar continued to decline on Tuesday after a significant increase last week. As you know, the Fed leaders last Wednesday kept key interest rates in the range of 0.00% -0.25%, and the volume of the QE asset purchase program at $ 120 billion per month. The accompanying statement said that the Fed will continue to adhere to the current parameters of monetary policy until the target levels for inflation and maximum employment are reached, and the level of interest rates will not change.

Nevertheless, despite this decision, the dollar strengthened significantly after the Fed meeting, which was facilitated by some changes in the sentiment of the FRS leaders regarding the timing of a possible start to curtail the extra soft stimulus policy of the central bank. The Fed is now forecasting two rate hikes in 2023, while earlier central bank officials had pledged not to raise rates until the end of 2023. 7 representatives of the FOMC against 4 in March expect the start of rate hikes in 2022.

On Wednesday, the DXY dollar index remains in a range near Tuesday's close level and 91.75 mark, 65 points below last week's high and 92.40 mark, which, in turn, corresponds to levels more than 2 months ago.

US Federal Reserve Chairman Jerome Powell, who spoke yesterday in the US Congress, again tried to calm the markets, saying that he did not consider the threat of strong inflation significant. In his opinion, inflation is unlikely to rise to the highs of the 1970s. At the same time, Powell acknowledged the significant uncertainty surrounding the recovery of the economy. He stressed that the central bank will not rush to tighten monetary policy, relying on inflation alone, noting that the state of the labor market is the main marker of the situation in the country's economy. And only with the cumulative dynamics of these indicators (inflation growth and full recovery of the labor market), the Fed can begin to change the parameters of monetary policy.

On the eve of Jerome Powell's speech, on Monday, ECB President Christine Lagarde gave optimistic comments on the prospects for the European economy. According to Lagarde, "the outlook for the economy is indeed improving", and "a better outlook for global demand and faster-than-expected growth in consumer spending could lead to an even stronger recovery".

She also said that while "the spread of virus mutations is still dangerous", "tightening quarantine measures would be premature and jeopardize economic recovery and the prospects for inflation".

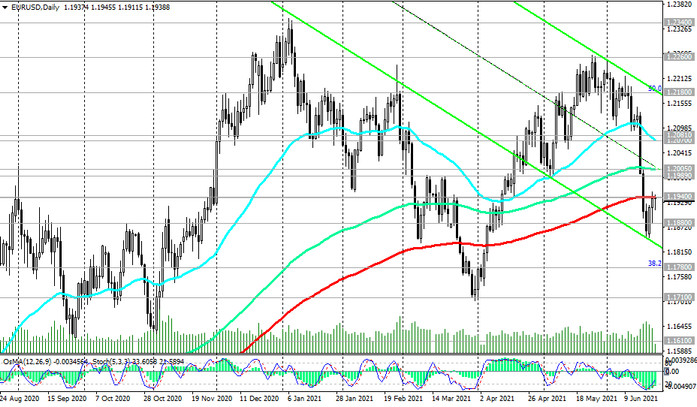

EUR / USD rallied on Monday and Tuesday, returning to the zone of the long-term support level of 1.1940 (see Technical Analysis and Trading Recommendations). However, the growth of EUR / USD should be associated with the weakening of the dollar so far.

If the FRS leadership no longer signals about the possibility of an earlier start to curtail the stimulus policy, provoking a strengthening of the dollar, then the growth of EUR / USD after its consolidation in the zone above 1.1940 mark may resume.

Today, at the beginning of the European session, encouraging macro data from Europe were published, indicating a continuing recovery in business activity in France, Germany and the Eurozone.

Thus, the preliminary composite purchasing managers index (PMI) in Germany, which takes into account the performance of the manufacturing and services sectors, rose to 60.4 in June from 56.2 in May, reaching the highest level since March 2011.

A similar preliminary Eurozone PMI rose to 59.2 in June from 57.1 in May, reaching its highest level since June 2006.

Eurozone activity grew at its fastest in 15 years in June, IHS Markit said, thanks to further relaxation of restrictions and progress in a vaccination campaign that bolstered consumer and business confidence. "The data demonstrates the preconditions for impressive GDP growth in the second quarter, followed by an even stronger rise in the third quarter", IHS Markit also noted.

Nevertheless, the euro reacted rather calmly to the publication of these positive data, having only slightly strengthened in the foreign exchange market and in the EUR / USD pair. The main driver of the EUR / USD dynamics is still the dollar.

In this regard, from the news for today, it is worth paying attention to the publication at 13:15 and 14:00 (GMT) of the PMI indices from IHS Markit of business activity in the US and data on home sales. Another growth in indicators will have a positive impact on the USD and, accordingly, a negative impact on the EUR / USD pair.

Data worse than the forecast and / or previous values will have a negative impact on the dollar.

Also, the volatility in the EUR / USD pair may increase at 18:00 (GMT), when the speech of the head of the ECB Christine Lagarde begins. If she does not touch upon the topic of the ECB's monetary policy, then the reaction to her speech will be weak.