It seems that the head of the Fed, Jerome Powell, managed to stop the strengthening of the dollar for a while.

At the time of publication of this article, the DXY dollar index was at the close of Wednesday and around 91.77 mark, which also corresponds to levels more than 2 months ago.

Speaking to the US Congress on Tuesday, he reiterated that the Fed's top priority is to support the US economy and labor market, which have been hit hard by the pandemic. The growth of inflation, in his opinion, is a secondary, albeit no less important, factor in determining the parameters of the central bank's monetary policy.

He stressed that the Fed will not rush to tighten monetary policy, relying on inflation alone, noting that the state of the labor market is the main marker of the situation in the country's economy. And only with the cumulative dynamics of these indicators (inflation growth and full recovery of the labor market) the central bank can begin to change the parameters of monetary policy.

In this regard, today market participants will follow the publication at 12:30 (GMT) of weekly data from the US labor market. It is expected that the number of initial jobless claims last week through June 18 was 380,000 against 412,000 in the previous reporting week. Obviously, this figure is almost steadily declining after it reached 6.867 million applications in March 2020. The decrease in the value indicates a gradual improvement in the state of the American labor market. Considering the attention paid by the FRS leaders to it, this is a positive factor for the dollar. If the data matches the forecast or turns out to be better than it, then the dollar will receive additional short-term support.

Millions of Americans are returning to work, and despite new signals of a labor shortage, the pace of recruitment in the United States is accelerating. High rates of vaccinations, fiscal stimulus and relaxation of quarantine measures are helping to improve the situation in the labor market, while also supporting the growth of the American economy. However, the U.S. labor market is still far from full recovery to pre-coronavirus levels, and the country's total jobs are still about 7 million below pre-coronavirus levels.

This will hold back the Fed from earlier rate hikes, even though some Fed officials are increasingly hawkish in their comments on the outlook for central bank monetary policy.

For example, on Wednesday, Fed officials Robert Kaplan and Rafael Bostic signaled their inclination to be tough. In particular, the president of the Federal Reserve Bank of Atlanta, Rafael Bostic, said that he now expects interest rate hikes next year. In addition, according to him, the time will soon come to reduce the volume of purchases of assets by the FRS.

Nevertheless, given the relatively high rate by historical standards of the American currency, the recovery of the global economy and the still extremely loose monetary policy of the Fed, many economists and market participants expect the dollar to weaken in the medium term, at least until the end of 2021.

Today, investors will also focus on the publication (at 12:30 GMT) of a block of important macroeconomic statistics from the United States: updated data on the dynamics of US GDP for the 1st quarter of 2021, as well as data on the dynamics of orders for durable goods. Improvement in indicators and, as expected, their relative growth may also support the dollar.

Participants in the oil market continue to analyze yesterday's publication by the US Department of Energy of weekly data on oil reserves. According to data released on Wednesday by the Energy Information Administration (EIA) of the US Department of Energy, commercial oil reserves in the country in the week of June 12-18 fell by 7.6 million barrels, to 459.1 million barrels, which is the lowest since the week of June 29 - March 6 2020. The data indicate a lack of supply.

Meanwhile, total US oil production last week fell 100,000 barrels to 11.1 million barrels a day, according to the EIA.

Now, oil market participants will follow the OPEC+ meeting on July 1. Within the framework of this meeting, an increase in production can be agreed. The more additional production volumes are agreed upon, the more this may negatively affect oil prices.

At the same time, despite media reports that the OPEC+ coalition is discussing the possibility of further easing restrictions on the volume of total production, the US Department of Energy data indicate a lack of supply, which is one of the reasons for the positive dynamics of the oil market.

The world economy continues to recover, which increases the demand for oil and oil products, supporting the positive dynamics of their prices.

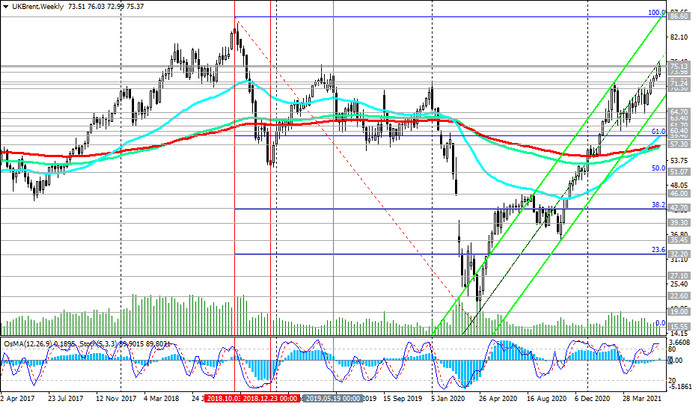

And this week, oil market participants will pay attention to tomorrow's publication (at 17:00 GMT) of the weekly report of the American oilfield services company Baker Hughes. The week before last, the number of active drilling rigs in the United States amounted to 373 units (against 365, 359, 356, 352, 344 in the previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil quotes. However, it will be short-lived. In general, at the moment, long positions in oil seem to be more preferable, the quotes of which have returned to the levels of September-October 2018.