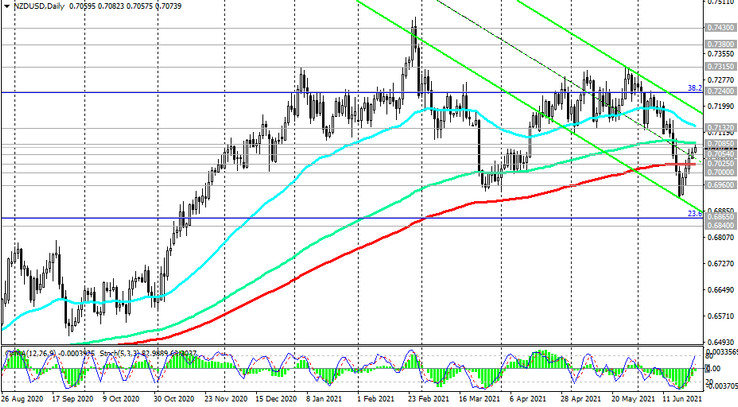

Trading above the key support levels of 0.6840 (EMA200 on the weekly chart), 0.7025 (EMA200 on the daily chart), NZD/USD remains in the bull market zone.

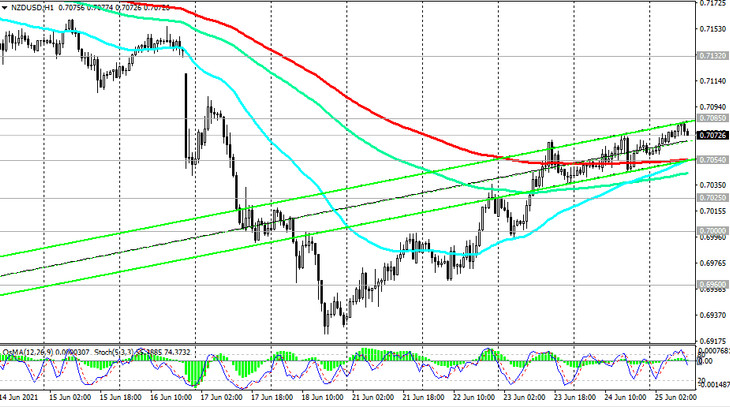

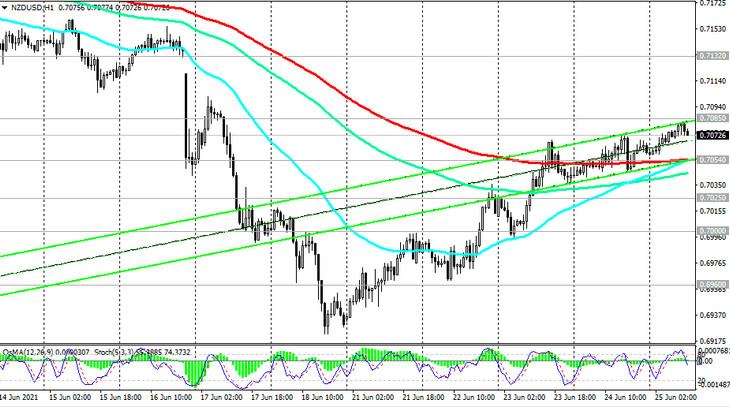

The breakdown of the important short-term resistance level 0.7054 (ЕМА200 on the 1-hour chart) indicated the completion of the downward correction and became a signal for the resumption of long positions in NZD / USD.

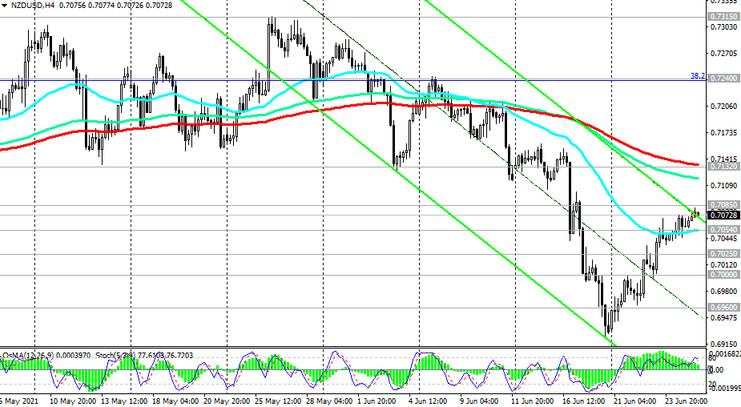

After the breakdown of the resistance levels 0.7085 (ЕМА144 on the daily chart) and 0.7100, the growth target will be the resistance levels 0.7132 (ЕМА200 on the 4-hour chart and ЕМА50 on the daily chart) and 0.7240 (38.2% Fibonacci retracement in the global wave of the pair's decline from 0.8820). More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

In an alternative scenario and after the breakdown of the support level 0.7054, NZD / USD will resume its decline with the target at the support levels 0.7025, 0.7000. A breakdown of the support levels 0.6865 (Fibonacci level 23.6%), 0.6840 (ЕМА200 on the weekly chart) will increase the likelihood of a further decline in NZD / USD and its return into the global downtrend that began in July 2014.

Support levels: 0.7054, 0.7025, 0.7000, 0.6960, 0.6900, 0.6865, 0.6840

Resistance levels: 0.7085, 0.7100, 0.7132, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.7040. Stop-Loss 0.7110. Take-Profit 0.7025, 0.7000, 0.6960, 0.6900, 0.6865, 0.6840

Buy Stop 0.7110. Stop-Loss 0.7040. Take-Profit 0.7132, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600