Having strengthened on Tuesday, the DXY dollar index also maintains positive dynamics today, staying in the zone of 7-day highs and the mark of 92.09. The dollar continues to dominate the foreign exchange market after the Fed meeting ended on June 16.

As you know, following the results of this meeting, the heads of the Federal Reserve System kept key interest rates in the range of 0.00% -0.25%, and the volume of the QE asset purchase program at the level of $ 120 billion per month. The accompanying statement said that the Fed will continue to adhere to the current parameters of monetary policy until the target levels for inflation and maximum employment are reached, and the level of interest rates will not change.

Nevertheless, despite this decision, the dollar strengthened significantly after the Fed meeting, which was facilitated by some changes in the sentiment of the FRS leaders regarding the timing of a possible start to curtail the extra soft stimulus policy of the central bank. Now, Fed officials are forecasting two rate hikes in 2023, whereas they previously promised not to raise rates until the end of 2023. 7 representatives of the FOMC against 4 in March expect the start of rate hikes in 2022.

Macro data coming from the US, which indicates an accelerating recovery in the US economy, is also fueling investor optimism and strengthening the dollar.

As the Conference Board reported on Tuesday, the consumer confidence index rose to 127.3 in June from the revised value of 120.0 in May (against the forecast of 118.7). Conference Board data show that Americans are more and more positive about the current situation. The rise in the index signifies a resumption of an uptrend that picked up steam in March and April amid easing coronavirus restrictions and another round of fiscal stimulus. The index approached the pre-coronavirus level of February 2020, which is 132.6.

"Consumer confidence rose in June and is now at its highest level since the start of the pandemic (in the US) in March 2020", said Lynn Franco, Conference Board director of economic indicators. The data indicates the willingness of Americans to spend money on goods and services, which is an important driver of the growth of the American economy. According to Lynn Franco, the business environment and financial prospects for consumers will continue to improve in the coming months.

Today, market participants will be watching the publication (at 12:15 GMT) of the ADP report on the number of jobs in the US private sector. Although the ADP report does not directly correlate with the official US Labor Department data, which will be released on Friday, the ADP report is often a harbinger of it, having a noticeable impact on the market. US private sector workforce growth is expected to be +600,000 in June (versus an increase of 978,000 in May, 742,000 in April, 517,000 in March, 117,000 in February, 174,000 in January, a drop of -123,000 in December). The market reaction may be negative and the dollar may decline if the data turns out to be worse than forecast. However, a strong ADP report will signal that Friday's official employment data will also be positive.

Market participants hope that strong statistics will help the Fed move to more "hawkish" rhetoric regarding monetary policy, and this will further strengthen the dollar.

Fed officials see the current rise in inflation as temporary, but sooner or later they will face stronger and longer-term price pressures. And if data from the labor market also speaks of approaching pre-crisis levels, when the American labor market remained one of the strongest in the world, then the chances of an earlier increase in US interest rates will increase.

Speaking in Congress last week, Fed Chairman Jerome Powell said that with the cumulative dynamics of inflation growth and the maximum recovery in the labor market, the central bank could begin to change the parameters of monetary policy.

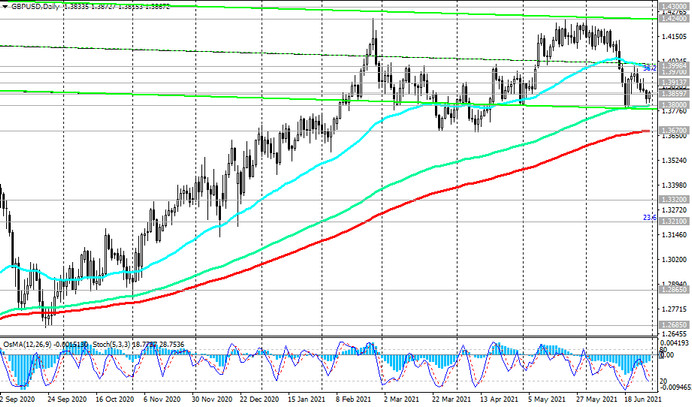

Meanwhile, among the main competitors of the dollar there is a currency that has strengthened against it since the opening of today's trading day. This is the British pound.

It declined against the dollar on Tuesday, fueled by the strengthening of the dollar and other safe-haven currencies in response to the worldwide spread of a new strain of coronavirus.

Additional pressure on the pound is exerted by the end today of the grace period (after Brexit) on the export of British meat to Northern Ireland. If the EU agrees to postpone the introduction of a ban on the sale of chilled meat to Northern Ireland from the UK, this will have a positive effect on the pound.

According to the updated estimate published on Wednesday morning, the UK GDP in the 1st quarter compared with the 4th quarter of last year decreased by 1.6% (the first estimate assumed a decrease of 1.5%). Nevertheless, economists expect the data to be stronger in the future, including due to consumer spending from the savings made by them during the lockdowns.

While the UK is seeing a sharp rise in new cases (on Monday, the UK recorded the highest number of new coronavirus cases since 30 January), the UK government is still looking to fully reopen its economy as early as 19 July, following a successful vaccination campaign. Economists expect the UK economy to recover solidly this year amid a successful vaccination campaign.

But for now, in determining the direction of movement of the GBP / USD pair, you should still focus more on the dynamics of the dollar.

The results of last week's meeting of the Bank of England, at which the bank upheld a soft monetary policy and did not consider inflationary risks to be high, indicate that the market seems to have hurried to take into account in quotes the increase in rates in the summer of 2022.

Bank of England executives were unanimous in favor of keeping the key rate at 0.1% and by eight votes to one - in favor of maintaining the current pace of asset purchases.

Bank of England executives echoed the Fed's rhetoric on inflation, which could be an argument in favor of postponing the first rate hike to August 2022 from June 2022, economists say.

The Bank of England, like the Fed, expects inflation at its peak to exceed 3%, but this will be temporary. The bank also noted the uncertainty of the prospects for the labor market and the fact that almost 1.5 million people receive salaries under the employment support program.

In this regard, it will be interesting to hear the opinion of the head of the Bank of England Andrew Bailey, whose speech is scheduled for Thursday (at 08:00 GMT). Financial market participants will expect clarification of the situation regarding the further policy of the central bank of Great Britain from him. If Bailey does not touch on monetary policy issues, then the reaction to his speech will be weak.