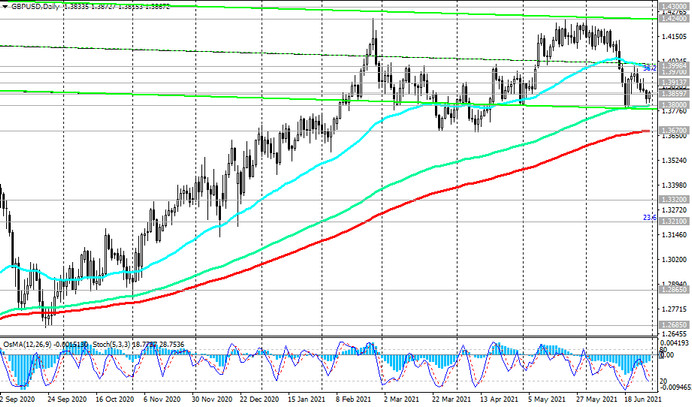

Despite a fairly strong correctional decline observed this month, GBP / USD still maintains positive long-term dynamics, trading in the zone above the long-term support levels 1.3800 (ЕМА144 on the daily chart), 1.3670 (ЕМА200 on the daily chart).

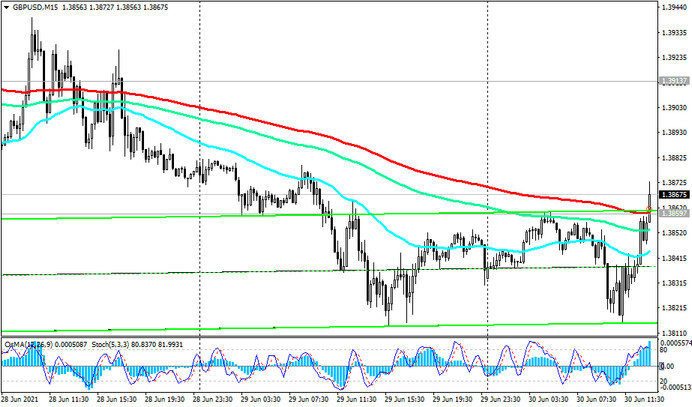

It is also worth noting that the technical indicators OsMA and Stochastic on the 1-hour and 4-hour charts turned to long positions, and the price broke through the short-term resistance level 1.3895 (ЕМА200 on the GBP/USD 15-minute chart).

The breakout of the important short-term resistance level 1.3913 (ЕМА200 on the 1-hour chart) will be the second signal confirming the resumption of the uptrend.

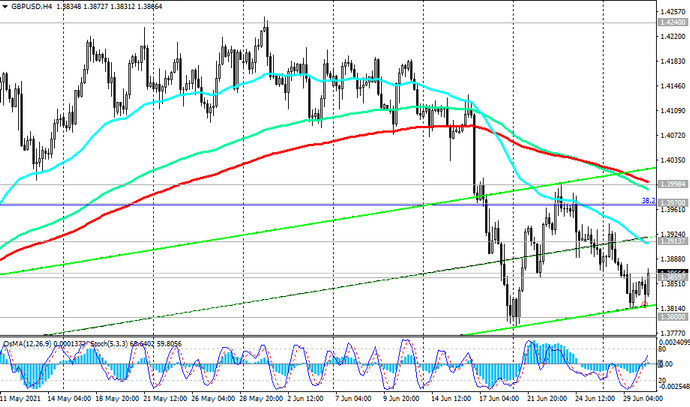

And an increase in the zone above the resistance levels 1.3970 (Fibonacci level 38.2% of the correction to the decline of the GBP / USD pair in the wave that began in July 2014 near the level 1.7200), 1.3998 (ЕМА200 on the 4-hour chart) will indicate the resumption of the bullish GBP / USD trend.

In an alternative scenario and after the breakdown of the support levels 1.3800, 1.3670 GBP / USD may fall to the support levels 1.3320 (ЕМА200 on the weekly chart), 1.3210 (Fibonacci level 23.6%). Their breakdown will increase the risks of a resumption of the global bearish trend in GBP / USD and may provoke a deeper decline towards the support levels 1.2250, 1.2085, 1.2000 (Fibonacci level 0%).

A signal for the implementation of an alternative scenario may be a breakdown of the local support level 1.3815, passing through today's lows.

Support levels: 1.3815, 1.3800, 1.3670, 1.3320, 1.3210

Resistance levels: 1.3913, 1.3970, 1.3998, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830

Trading recommendations

Sell Stop 1.3790. Stop-Loss 1.3880. Take-Profit 1.3700, 1.3670, 1.3320, 1.3210

Buy Stop 1.3880. Stop-Loss 1.3970. Take-Profit .3913, 1.3970, 1.3998, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830