As we noted above, EUR / GBP rallied sharply at the start of today's European session after IHS Markit reported gains in the manufacturing sector in Germany and the Eurozone and contraction in the UK manufacturing sector.

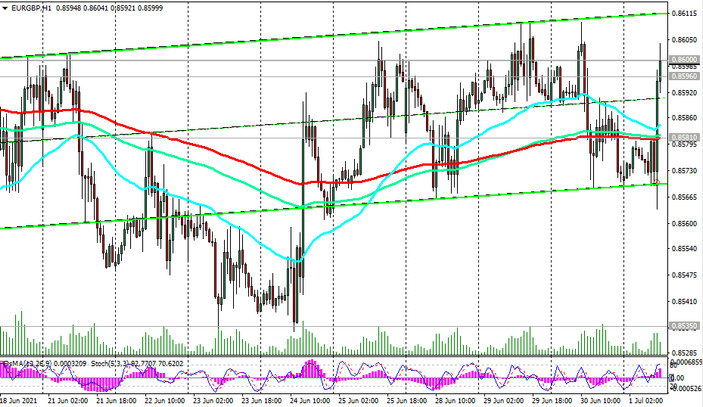

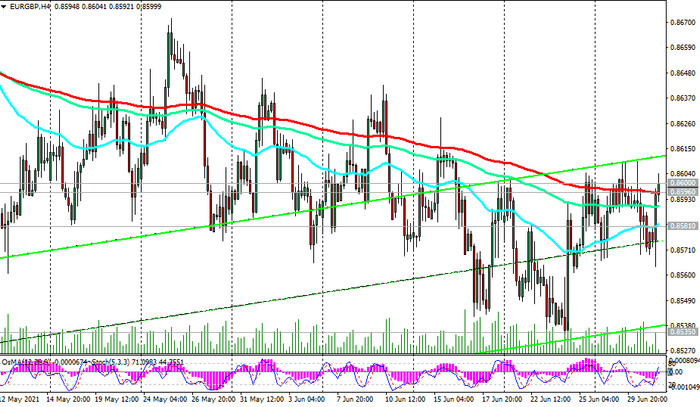

EUR / GBP has broken two strong short-term resistance levels 0.8581 (ЕМА200 on the 1-hour chart), 0.8596 (ЕМА200 on the 4-hour chart) and attempted to break through the medium-term resistance level 0.8605 (ЕМА50 on the daily chart).

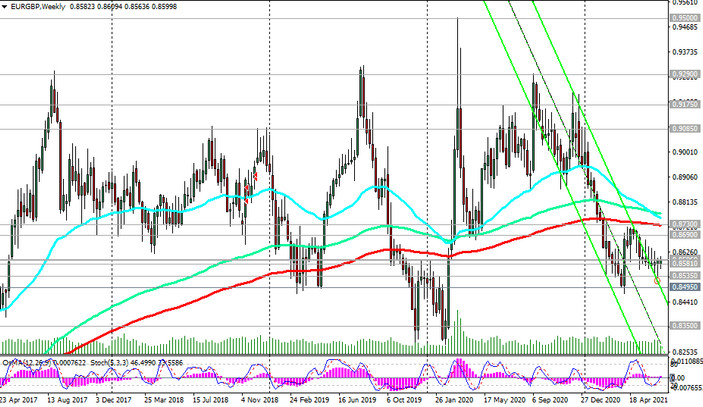

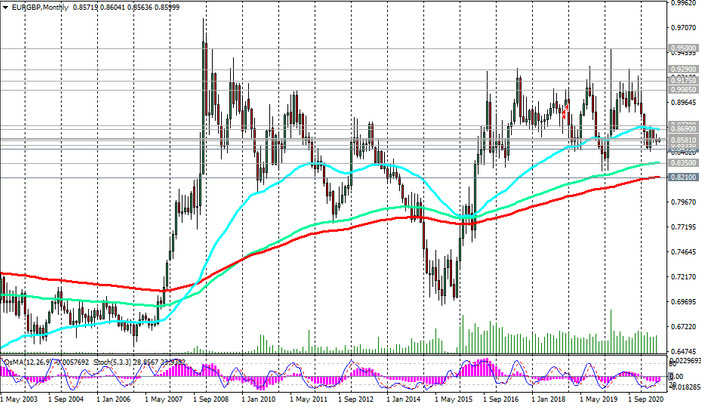

Nevertheless, the current growth in EUR / GBP is most likely only of a short-term corrective nature. EUR / GBP is traded in a steady downtrend, in the zone below the key resistance level 0.8730 (ЕМА200 on the daily and weekly charts).

Sustainable growth above 0.8600 can hardly be expected without strong economic or political drivers.

After stabilization in the current zone, a renewed decline in EUR / GBP should be expected after some time. The first signal for the implementation of the scenario for the resumption of the decline is the breakdown of the support level 0.8596.

In an alternative scenario, the corrective growth of EUR / GBP may continue towards the resistance level 0.8690 (ЕМА144 on the daily chart).

The breakdown of the resistance level 0.8730 will be a signal for the resumption of the global uptrend that began in 2000.

Support levels: 0.8596, 0.8581, 0.8535, 0.8495, 0.8400, 0.8350, 0.8210

Resistance levels: 0.8605, 0.8690, 0.8730

Trading Recommendations

Sell by market, Sell Stop 0.8590. Stop-Loss 0.8620. Take-Profit 0.8581, 0.8535, 0.8495, 0.8400, 0.8350, 0.8210

Buy Stop 0.8620. Stop-Loss 0.8590. Take-Profit 0.8690, 0.8730