On the eve of the publication later on Friday of the monthly data from the US labor market, the DXY dollar index rose to the highs of the last 12 weeks, approaching 92.70 mark.

As expected, the US Department of Labor report will indicate an acceleration in the pace of hiring in the context of the further opening of the economy. The labor market forecast was revised upward yesterday after the publication of a strong report from ADP on Wednesday, according to which the growth in the number of workers in the US private sector in June was +692,000 (against the preliminary forecast of +600,000 and an increase of 978,000 in May, 742,000 in April, 517,000 in March, 117,000 in February, 174,000 in January, a drop of -123,000 in December). Economists are now forecasting 700,000 non-farm jobs to grow in June, following a 559,000 rise in May and a previous forecast of 675,000 new jobs. US unemployment is expected to fall to 5.6% in June from 5.8% in May. These are strong indicators that (if confirmed) can give the dollar a new impetus for further growth.

At the same time, if the forecast does not come true, then the dollar may decline. The weaker the report of the Ministry of Labor turns out to be (this will weaken the expectations of an earlier tightening of the FRS policy), the more the dollar will fall.

In the meantime, it is growing, also receiving support from fears around the spread of a new delta strain of coronavirus, which have strengthened the dollar's status as a safe haven currency. It is possible that if the epidemiological situation worsens, the authorities of many countries with the largest economies will be forced to introduce new quarantine measures that will limit economic and consumer activity.

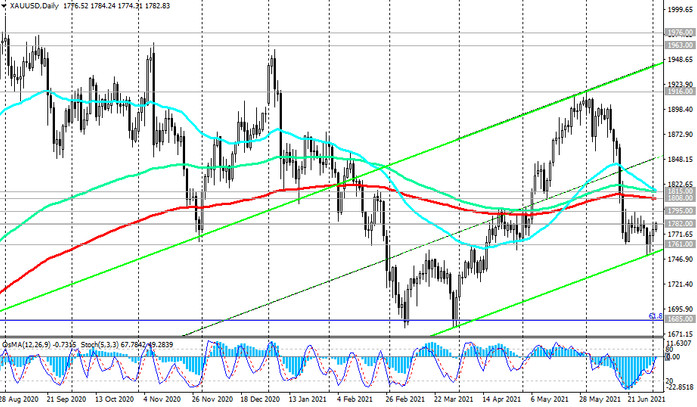

Meanwhile, the quotes of gold and the XAU / USD pair are growing today for the third day in a row. At the time of this article's publication, the XAU / USD pair is attempting to break into the zone above the important short-term resistance level 1782.00 (see Technical Analysis and Trading Recommendations). From a technical point of view, if the XAU/USD is successfully fixed in this zone, it is necessary to return to long positions on it.

Gold does not generate investment income, and it is extremely sensitive to changes in the interest rates of the Fed and other major central banks in the world. However, many economists believe that the recent drop in gold prices and the decline in the XAU / USD pair was excessive. Assessing the results of the Fed's June meeting and the scale of the fall in the price of gold last month, economists believe that raising rates on a two – year horizon (now Fed officials expect that the interest rate will be raised twice in 2023) is too distant a prospect to ensure such a decline in prices, especially against the background of treasury bond yields, which are significantly lower than projected inflation and its current growth.

If the publication today at (12:30 GMT) of June data from the US labor market does not meet expectations and a strong forecast, then we should expect an increase in quotations of gold and the XAU / USD pair. And only with very strong NFP, the decline in XAU / USD will resume.