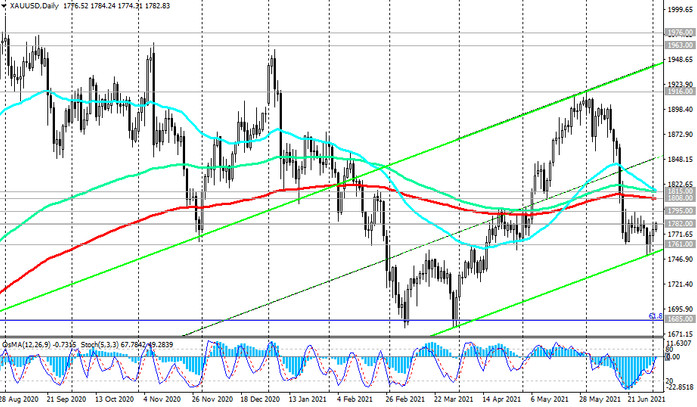

XAU / USD dropped significantly last month as the dollar strengthened, especially after the Fed meeting ended on June 16. XAU / USD down 8.6% from the 5-month high reached earlier in June near 1916.00 mark and reached a local 11-week low near 1751.00 mark earlier this week.

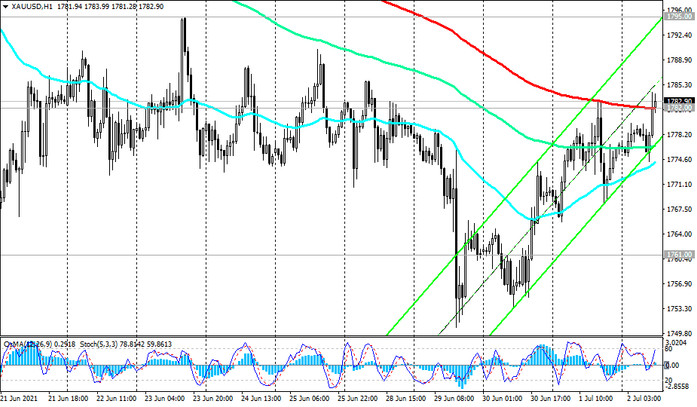

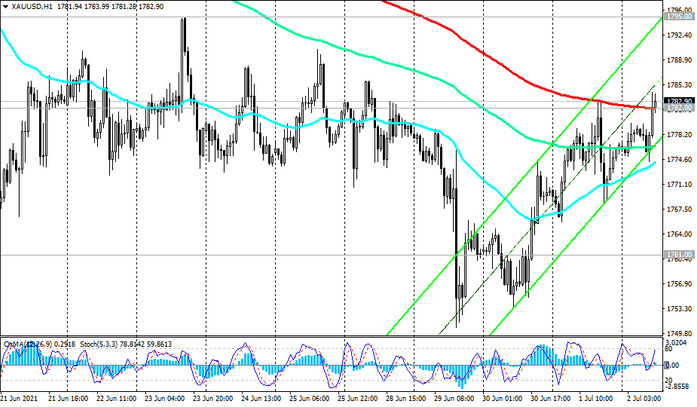

Nevertheless, amid rising inflation and if the Fed continues to remain neutral, the XAU / USD pair has the potential to resume growth. In this case, the targets will be the marks of 1916.00, 1963.00, 1976.00 (local highs), 2000.00, and the first signal to resume long positions will be the breakdown of the short-term resistance level 1782.00 (ЕМА200 on the 1-hour chart) and consolidation in the zone above this level.

Growth into the zone above the key resistance level 1808.00 (ЕМА200 on the daily chart) will confirm the scenario for the resumption of the bullish trend of the XAU / USD pair.

In the alternative scenario, XAU / USD will strengthen the downward dynamics, and the downward correction may continue inside the downward channel on the weekly chart, the lower border of which passes through the support level 1645.00 (ЕМА144 on the weekly chart).

A signal for the development of the scenario for XAU / USD decline will be a breakdown of the local support level 1751.00, and the nearest target is the support level 1685.00 (local minimums and 61.8% Fibonacci level of correction to the growth wave since November 2015 and the level 1050.00).

Support levels: 1751.00, 1685.00, 1645.00, 1580.00, 1560.00

Resistance levels: 1782.00, 1795.00, 1808.00, 1815.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1770.00. Stop-Loss 1791.00. Take-Profit 1751.00, 1685.00, 1645.00, 1580.00, 1560.00

Buy Stop 1791.00. Stop-Loss 1770.00. Take-Profit 1795.00, 1808.00, 1815.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00