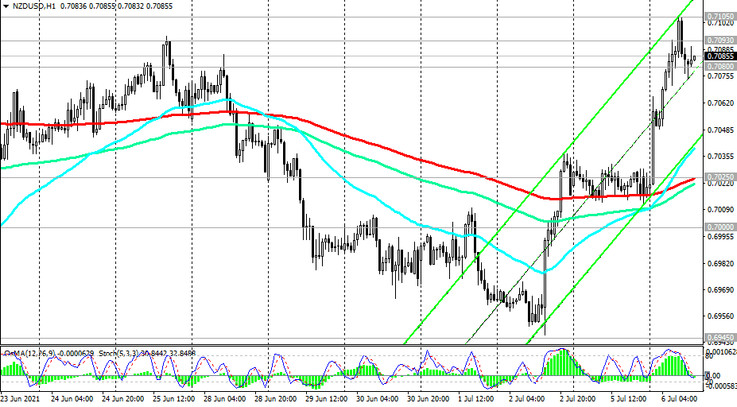

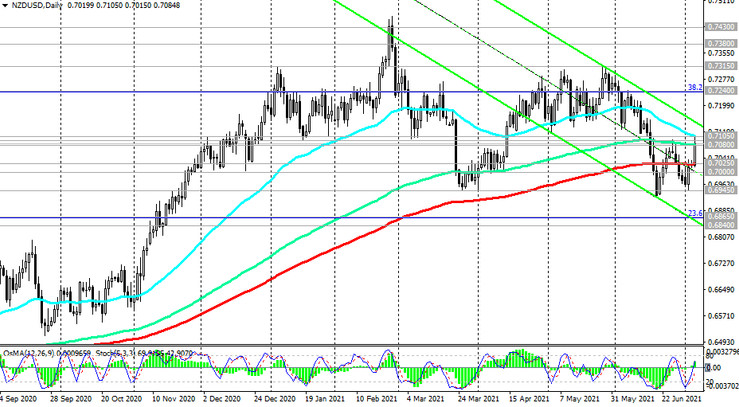

As we noted above, NZD / USD broke into the bull market zone again today, breaking through the key resistance level of 0.7025 (EMA200 on the daily chart).

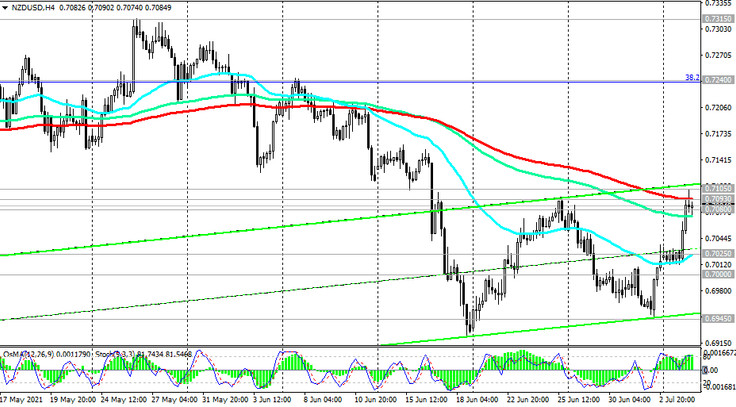

The breakdown of the important short-term resistance level 0.7093 (ЕМА200 on the 4-hour chart) will confirm the completion of the downward correction and will become an additional signal for the resumption of long positions in NZD / USD.

After the breakdown of the local resistance level of 0.7105, the growth target will be the resistance levels 0.7240 (Fibonacci 38.2% level of the correction in the global wave of the pair's decline from the level 0.8820), 0.7300. More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

In an alternative scenario and after the breakdown of the support level 0.7025, NZD / USD will resume its decline with the target at the support levels 0.7000, 0.6945.

A breakdown of the support levels 0.6865 (Fibonacci level 23.6%), 0.6840 (ЕМА200 on the weekly chart) will increase the likelihood of a further decline in NZD / USD and its return into the global downtrend that began in July 2014.

Support levels: 0.7080, 0.7025, 0.7000, 0.6945, 0.6900, 0.6865, 0.6840

Resistance levels: 0.7105, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

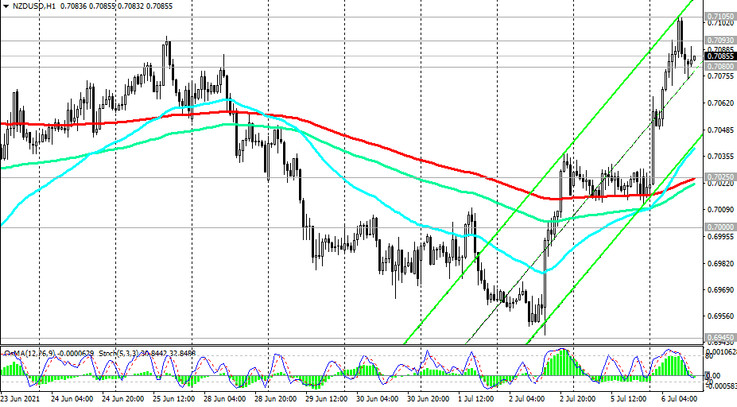

Trading recommendations

Sell Stop 0.7070. Stop-Loss 0.7110. Take-Profit 0.7025, 0.7000, 0.6945, 0.6900, 0.6865, 0.6840

Buy Stop 0.7110. Stop-Loss 0.7070. Take-Profit 0.7200, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600