The dollar is strengthening ahead of the publication later on Wednesday (at 18:00 GMT) of the minutes from the June Fed meeting. DXY dollar index futures are traded near 92.56 mark at the time of this article, holding their previous gains and staying in the 13-week highs.

By all appearances, investors and financial market participants expect to see confirmation signals in the minutes about the propensity of some Fed leaders to start curtailing the central bank's stimulus policy earlier.

As you know, following the results of the June meeting, the Fed leaders kept key interest rates in the range of 0.00% -0.25%, and the volume of the QE asset purchase program - at the same level of $ 120 billion per month. The accompanying statement said that the Fed will continue to adhere to the current parameters of monetary policy until the target levels for inflation and maximum employment are reached, reiterating that the level of interest rates will not change.

However, the Fed is now forecasting two rate hikes in 2023, whereas earlier central bank officials promised not to raise rates until the end of 2023. Now 7 out of 12 FOMC representatives (versus 4 in March) expect the rate hike to begin in 2022. This is a strong signal that has alerted investors. During the 3 weeks following the FOMC meeting on June 16, the DXY dollar appreciated 2.2%, returning to early April levels.

Nevertheless, despite the strengthening of the dollar, gold quotes are also growing.

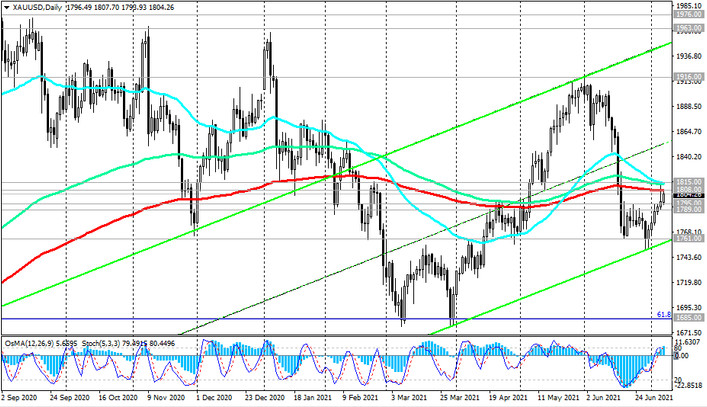

The XAU / USD pair is rising today for the sixth day in a row and, at the time of this article's publication, is traded near 1804.00 mark, in close proximity to the key resistance level 1808.00 (see Technical Analysis and Trading Recommendations).

It seems that investors are nevertheless inclined to hedge against the growing inflation in the United States, which shows a record growth rate over the past 29 years. Assessing the results of the June Fed meeting, many long-term investors and economists believe that raising rates even on a two-year horizon (now some Fed leaders expect that the interest rate will be raised twice in 2023) is too distant prospect to move on to the strategic gold and the XAU / USD pair sales (gold quotes are extremely sensitive to changes in the interest rates of the Fed and other major central banks in the world).

Thus, the XAU / USD pair has returned to the zone of balance and the key long-term support / resistance level 1808.00. Depending on what market participants understand today from the minutes from the June Fed meeting, the XAU / USD pair should be expected to move in that direction - either a breakdown of the 1808.00 level and further growth (if the general rhetoric of statements by the Fed leaders remains "dovish"), or a rebound from the level 1808.00 and a resumption of decline (if the rhetoric of statements by the Fed leaders regarding the growing inflation and the need to preemptively contain it will be considered by the market participants as “hawkish”, really testifying in favor of an earlier start of the Fed's stimulus policy curtailment).

We, for our part, believe that all the main statements regarding the near-term prospects of the Fed's monetary policy have already been made, including during the recent speech in Congress by Fed Chairman Powell. Therefore, there is no strong intrigue in the publication of these protocols.