Last week, the DXY dollar index reached a new 3-month high at around 92.84, although it slightly declined by the end of the week, while the major American stock indices S&P 500 and Nasdaq Composite rewrote absolute records, and the Dow Jones Industrial Average again approached them.

There is increased volatility in the financial markets as investors have many factors to consider. Among the factors shaking the market recently, several main ones stand out - these are the likelihood of an imminent start to reduce the Fed's asset purchase program and the situation on the front of the fight against coronavirus. Moreover, along with an increase in the number of new cases of infection, there is also a factor of lifting a significant part of quarantine restrictions in some European countries (the UK, for example, despite the increase in the number of new cases of coronavirus infection, still intends to fully open its economy on July 19) and in a number of states. One way or another, all this translates into uncertainty about the prospects for the global economy.

But against the backdrop of growing inflation, investors continue to view popular stock market assets as a serious alternative to investing in bank deposits and fixed-rate products, while the yield on, for example, 10-year US government bonds continues to decline. Now it is 1.333%, in line with February levels, while 3 months ago it exceeded 1.700%.

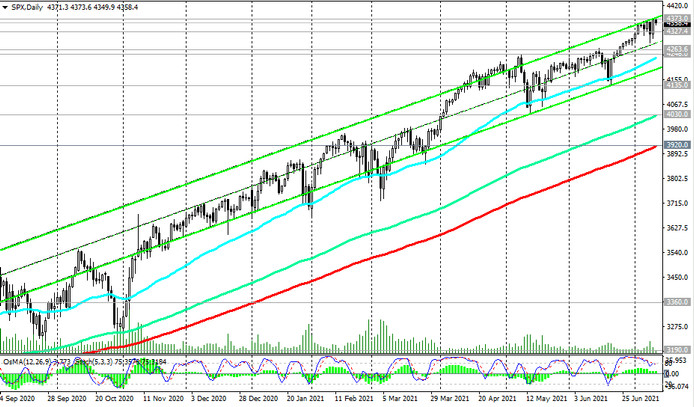

American stock indices also receive additional positive due to the approaching second wave of corporate reporting. Thus, according to the assumptions of economists, the profits of companies included in the index of the broad market S&P 500, in the 2nd quarter may increase by 63.6%, which will be a record growth since 2009. This will create the preconditions for further growth in the S&P 500, futures for which are traded at the time of this article publication near 1.4358 mark, falling from an intraday high and a record level of 4373.0.

Today, important macro statistics are not expected, which, however, does not negate the likelihood of a sharp short-term increase in volatility and multidirectional dynamics in financial markets.

Market participants, in turn, will wait for the speech in Congress by Fed Chairman Jerome Powell. It is likely that he will again try to contain the strengthening of the dollar, citing lower inflation expectations, and reassure market participants, assuring them in the Fed's commitment to maintaining the current parameters of monetary policy, in which the American central bank buys assets in the stock market in the amount of $ 120 billion every month. and keeps the interest rate close to zero (0.25%). The dollar may decline on Powell's statements, while US stock indices may rise. Powell's speech is scheduled to begin on Wednesday at 16:00 (GMT).