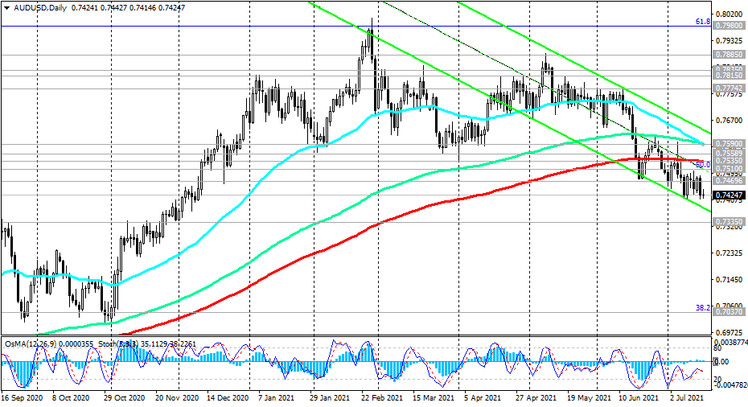

Having finally broken through the key long-term support level of 0.7535 (EMA200 on the daily chart) in June, AUD/USD continues to move within the descending channels on the daily and weekly charts on expectations of an earlier start of the Fed's stimulus policy curtailment and against the background of USD strengthening.

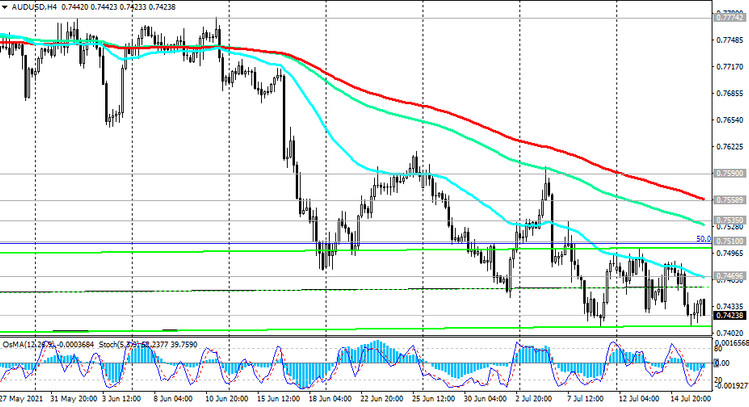

At the time of publication of this article, AUD / USD is traded in the area of the local support level 0.7420, maintaining a tendency to further decline.

A breakdown of the support level 0.7335 (ЕМА200 and the lower border of the descending channel on the weekly chart) will finally return AUD / USD into a long-term downtrend.

In an alternative scenario, the first signal for a reversal and renewal of the uptrend will be a breakdown of the resistance levels 0.7469 (ЕМА200 on the 1-hour chart), 0.7510 (Fibonacci level 50% of the correction to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510).

However, only a convincing rise into the zone above the resistance level 0.7590 (ЕМА144 and ЕМА50 on the daily chart) will indicate the resumption of the long-term upward dynamics of AUD / USD.

In the current situation, short positions are preferred.

Support levels: 0.7420, 0.7335

Resistance levels: 0.7469, 0.7510, 0.7535, 0.7558, 0.7590, 0.7742, 0.7815, 0.7835, 0.7885, 0.8000, 0.8160, 0.8200

Trading Recommendations

Sell by market. Stop-Loss 0.7490. Take-Profit 0.7400, 0.7335

Buy Stop 0.7490. Stop-Loss 0.7410. Take-Profit 0.7510, 0.7535, 0.7558, 0.7590, 0.7742, 0.7815, 0.7835, 0.7885, 0.8000, 0.8160, 0.8200