Today investors will focus on the ECB meeting, which will end with the publication (at 11:45 GMT) of its decision on interest rates. It is widely expected that the ECB's key interest rate will remain unchanged at 0%, while the deposit rate for commercial banks will remain at -0.5%.

The press conference following the ECB meeting, which will start at 12:30 (GMT), will be of much greater interest to market participants.

However, one should also bear in mind that the pessimistic sentiments of the ECB leaders and their inclination to continue the stimulating policy are already embedded in the prices and quotations of the euro.

Therefore, the market reaction may be weak to the results of the meeting, if the head of the ECB Christine Lagarde does not say anything new about the prospects for monetary policy at the press conference.

Earlier this month, ECB officials announced that they would change the definition of the inflation target from "just below 2%" to 2%. It is not yet clear what measures will be taken to achieve this level; however, the new strategy of the ECB presupposes a soft monetary policy for a longer period of time.

The Eurozone economy is far from full recovery, economists say. In their opinion, the consequences of a possible curtailment of stimulus in the current economic and political environment will be disastrous for the European economy.

Eurozone GDP is still about 5% lower than before the pandemic, and so far, none of the forecasts suggest a return to pre-crisis levels.

At the same time, fears of a more rapid spread of coronavirus in the Eurozone could force the ECB to announce a new stimulus program, which will put new pressure on the euro.

The ECB may announce an increase in the volume of the emergency PEPP bond purchase program in the 2nd half of the year and extend the bond purchase scheme after March 2022.

The situation with the coronavirus, which may result in the 4th wave of its spread and new lockdowns in Europe and the United States, also has a strong impact on the markets, increasing their volatility and the demand for the dollar as a defensive asset.

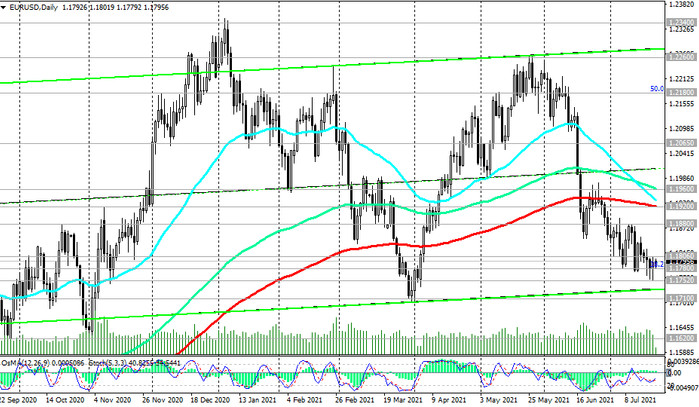

The conclusion suggests itself that the prospects for the dynamics of the euro and the EUR / USD pair are shifted in the negative direction.

Among other events of today, which may affect the dynamics of the financial market and the dollar, and, accordingly, the EUR / USD pair, is the publication at 12:30 (GMT) of the weekly data from the American labor market.

Fed officials are closely following the US labor market recovery. Fed Chairman Jerome Powell, speaking to Congress last week, said the central bank will not rush to cut monthly asset purchases and that the economy is "still far" from the Fed's targets. Powell acknowledged that inflation is growing faster than expected, and if it goes beyond the acceptable limits, monetary policy will have to be tightened ahead of schedule.

However, the Fed leaders consider the full recovery of the labor market and its return to the levels before the pandemic to be more important than the growth of inflation.

The number of initial jobless claims in the US is expected to fall to 350,000 last week (from 360,000, 415,000, 418,000 in previous weekly reporting periods), which is a positive factor for the dollar. If the data turn out to be better than the forecast, then the dollar will receive additional support ahead of the Fed meeting, which will take place next week.