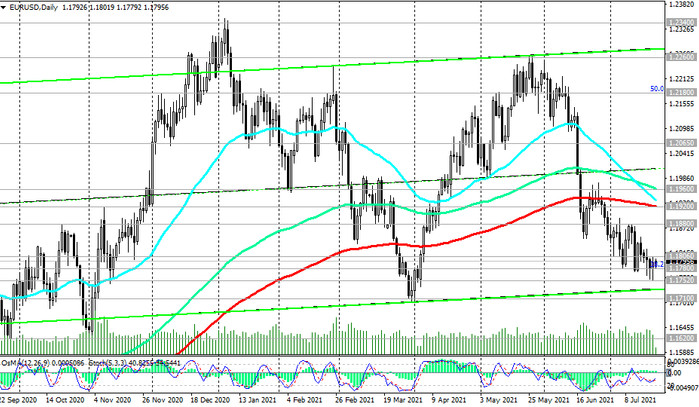

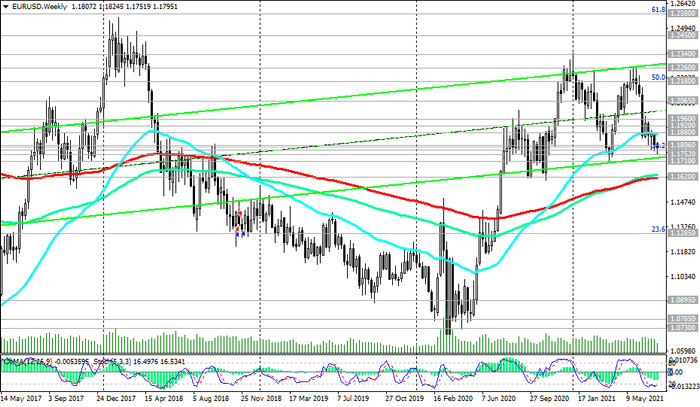

Since the beginning of today's trading day and at the time of the publication of this article, EUR / USD has been trading in a range between the support level 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014, and the highs of 2018) and resistance level 1.1806 (ЕМА200 on the 1-hour chart), remaining under pressure, including against the background of the strengthening dollar.

The main scenario implies a breakdown of the local support level 1.1752 (yesterday's and more than 3-month lows) and a further decline in EUR / USD towards the key support level 1.1620 (ЕМА200 on the weekly chart), separating the long-term bullish trend from the bearish one. The first signal for the implementation of this scenario may be a breakdown of the support level 1.1780.

In the alternative scenario and after the breakdown of the short-term resistance level 1.1806, further correctional growth towards the resistance levels 1.1880, 1.1920 (ЕМА200 on the daily chart) should be expected. After consolidating in the zone above the resistance level 1.1960 (ЕМА144 on the daily chart), EUR / USD may head towards distant targets at resistance levels 1.2180 (50% Fibonacci level), 1.2260, 1.2340, 1.2450, 1.2500, 1.2580 (61.8% Fibonacci level) , 1.2600.

Support levels: 1.1780, 1.1752, 1.1710, 1.1620

Resistance levels: 1.1806, 1.1880, 1.1920, 1.1960, 1.2065, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.1765. Stop-Loss 1.1815. Take-Profit 1.1710, 1.1620

Buy Stop 1.1815. Stop-Loss 1.1765. Take-Profit 1.1880, 1.1920, 1.1960, 1.2065, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600