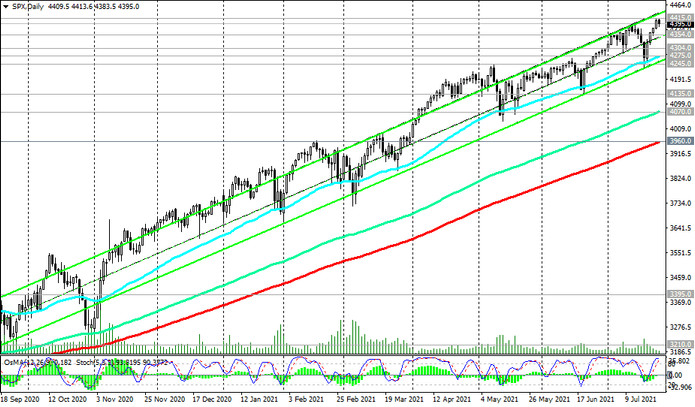

Last week, S&P 500 index futures reached new all-time highs near 4415.0 and, overall, maintain a long-term positive momentum.

A new period of bullish trend in the S&P 500 began in March 2020 after the Fed and other major global central banks launched unprecedented stimulus policies in response to the coronavirus pandemic.

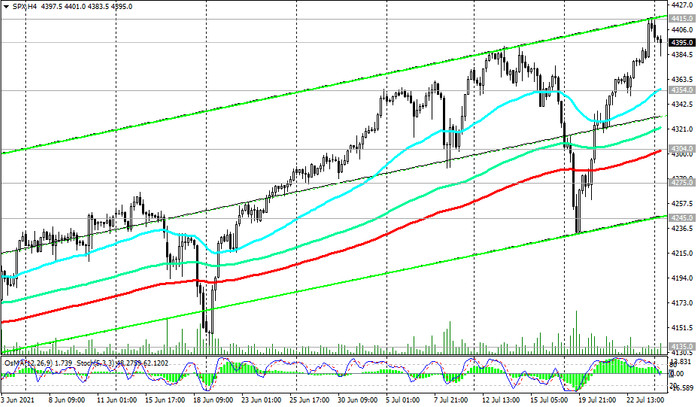

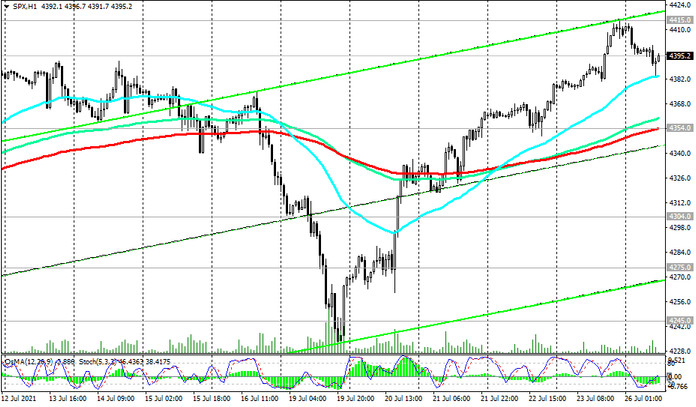

At the start of today's European session, S&P 500 futures are traded just below that all-time high of 4415.0, but with potential for further gains. A signal for building up long positions will be a breakdown of the local resistance level of 4415.0.

Growth will continue until the S&P 500 "gropes" new levels of resistance or fears about the spread of the coronavirus in the world sharply increase, or the Fed begins to wind down its stimulus policy.

In an alternative scenario, a downward correction of the S&P 500 will begin.

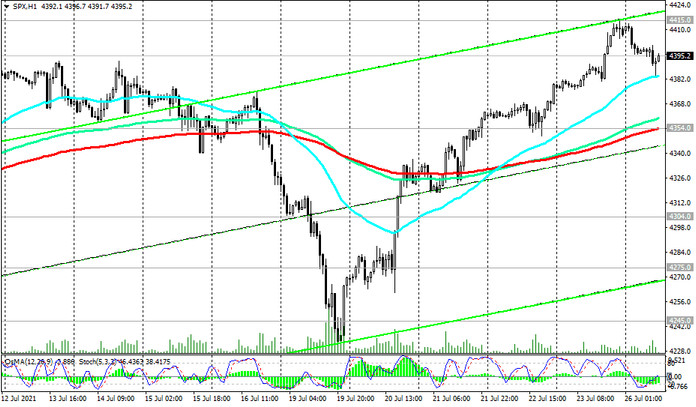

A breakdown of the short-term important support level 4354.0 (ЕМА200 on the 1-hour chart) may become a signal for the beginning of the implementation of this scenario. A breakdown of support levels 4275.0 (ЕМА50 and the lower line of the ascending channel on the daily chart), 4245.0 (May highs) may cause a deeper correction and further decline to support levels 4070.0 (ЕМА144 on the daily chart), 3960.0 (ЕМА200 on the daily chart).

Nevertheless, in the current situation, long positions are still preferable, and the breakdown of the local resistance level 4415.0 will be a signal to build up long positions.

Support levels: 4354.0, 4304.0, 4275.0, 4245.0, 4135.0, 4070.0, 3960.0

Resistance levels: 4415.0

Trading recommendations

Sell Stop 4374.0. Stop-Loss 4417.0. Targets 4354.0, 4304.0, 4275.0, 4245.0, 4135.0, 4070.0, 3960.0

Buy Stop 4417.0. Stop-Loss 4374.0. Targets 4500.0, 4600.0