The US dollar strengthened quickly at the start of today's European session, while the DXY dollar index moved back into positive territory after yesterday's decline.

It was provoked by weak macro statistics from the United States. Thus, according to data presented on Monday, the volume of new home sales in June fell by -6.6% after declining by -7.8% in May (the forecast assumed an increase of +3.5%).

Nevertheless, the demand for the dollar remains ahead of the Fed meeting, which starts today and ends on Wednesday with the publication (at 18:00 GMT) of the decision on the interest rate. The Fed buys $ 80 billion in Treasury bonds and $ 40 billion in mortgage-backed bonds monthly, and keeps interest rates in the 0.00% -0.25% range. Although, earlier, Fed officials have repeatedly stated that they will not slow down the rate of bond purchases until they see "significant further progress" in achieving the target inflation of 2% and the labor market reaching pre-crisis (before the pandemic) levels, nevertheless, the intrigue around the intentions and the Fed's actions remain, because after the meeting in June, 13 out of 18 Fed leaders predicted a rate hike until the end of 2023, and 7 - until the end of 2022.

Market participants expect to hear hints of an early winding up of the quantitative easing program against the backdrop of the continuing rise in inflation in the country.

At the same time, a surge in the incidence of coronavirus in certain US states could force the authorities of these states to return quarantine restrictions, which will create obstacles to the further recovery of the American labor market and economy affected by the pandemic.

Earlier, Fed Chairman Jerome Powell called the coronavirus pandemic a "significant risk" for the economy.

Concerns about coronavirus continuing to spread in different regions of the world support the demand for defensive assets, in particular, the dollar and have a negative impact on the dynamics of stock markets and the quotes of commodities and commodity currencies.

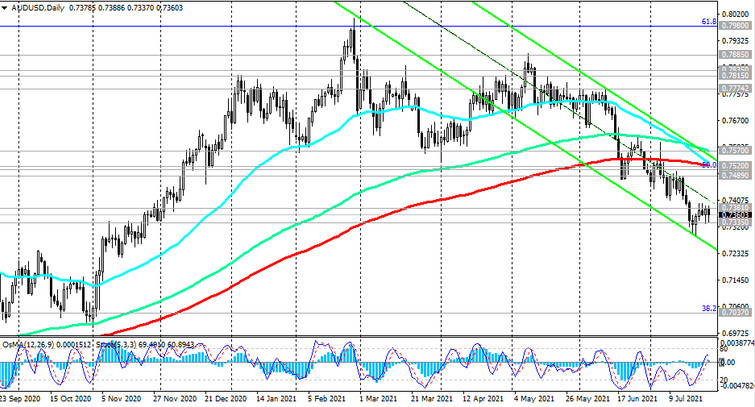

In particular, the Australian dollar remains under pressure even against other major commodity currencies such as the Canadian and New Zealand dollars. The AUD / USD pair remains in a steady downtrend for the second month in a row.

Australian Finance Minister Josh Freidenberg said last week that lockdowns are costing the Australian economy about AUD300 million a day. There are now over 13 million Australians in lockdown due to the coronavirus, and Freidenberg believes this will affect both Australia's GDP and subsequent employment data. The coronavirus crisis is not over yet. So, despite the weekly quarantine, in one of the most densely populated states of Australia on Monday, an increase in the incidence of COVID was again noted. Last weekend's protests in major cities of the country are also putting pressure on the AUD quotes.

Tomorrow, the volatility in its quotes and in the AUD / USD pair, respectively, will increase at 01:30 (GMT), when the RBA consumer price and core inflation indices (for the 2nd quarter) will be published. These indicators are published by the RBA and the Australian Bureau of Statistics and reflect the dynamics of retail prices for goods and services. CPI is the most significant indicator of inflation and changes in consumer preferences. A high reading is positive for the AUD, while a low reading is negative. According to the forecast, the value of the CPI for the 2nd quarter of 2021 is expected to be +0.7% (+3.8% in annual terms), and the RBA core inflation index (by the truncated average method) +0.5% (+1.6% in annual terms). Indicators point to the growth of inflation in the country, which may put pressure on the RBA towards tightening monetary policy and support for the AUD. If the indicators turn out to be worse than forecast, it is likely to put pressure on the AUD.