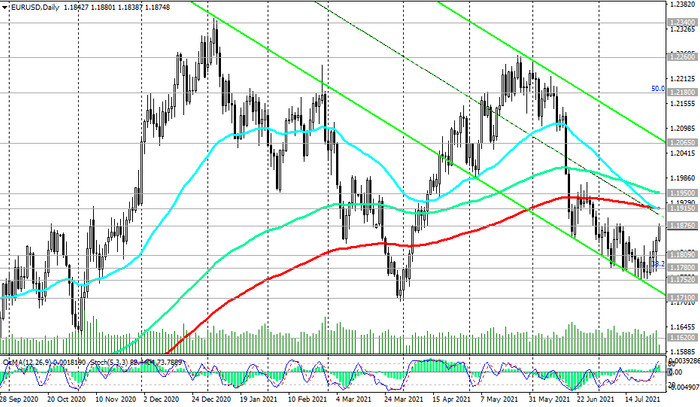

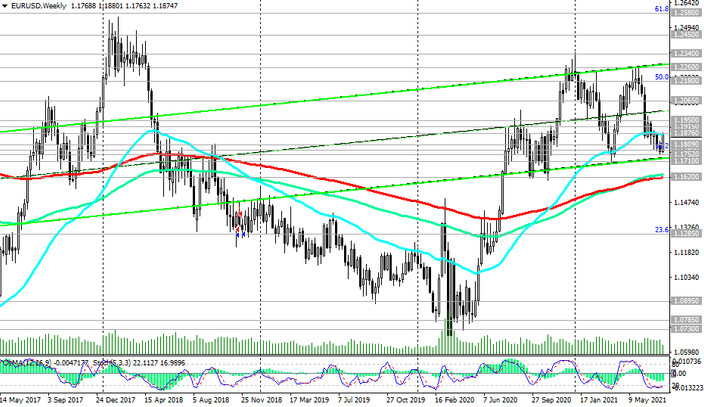

Over the last 4 days of continuous growth, the EUR / USD pair managed to strengthen by 0.9%, rising to the current mark and resistance level 1.1876 (ЕМА200 on the 4-hour chart and ЕМА50 on the weekly chart).

Since the end of June, when the price has broken through the key support level 1.1915 (ЕМА200 on the daily chart), the downward dynamics has been maintained, a rebound is possible near this resistance level 1.1876.

For further growth of the pair and return into the bull market zone, above the resistance level 1.1950 (ЕМА144 on the daily chart), it needs additional drivers. Perhaps they will appear today (at 12:30 GMT) or tomorrow (at 09:00 GMT), when published data on GDP of the US and the Eurozone for the 2nd quarter.

But this data can also become a trigger for renewed EUR / USD decline if the data turns out to be positive for USD and negative for EUR.

In this case, the resistance level 1.1876 will be a good area for placing short positions in EUR / USD with targets at local minimums near the 1.1750 mark.

A break of the key support level 1.1620 (ЕМА200 on the weekly chart) could finally bring EUR / USD back to the bear market.

In the alternative scenario, and after the breakdown of the resistance level 1.1876, further correctional growth towards the resistance levels 1.1915 (ЕМА200 on the daily chart), 1.1950 should be expected. After consolidating in the zone above the resistance level 1.1950 (ЕМА144 on the daily chart), EUR / USD may head towards distant targets at resistance levels 1.2180 (Fibonacci level 50% of upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, and the highs of 2018 years), 1.2260, 1.2340, 1.2450, 1.2500, 1.2580 (Fibonacci level 61.8%), 1.2600.

Support levels: 1.1809, 1.1780, 1.1752, 1.1710, 1.1620

Resistance levels: 1.1876, 1.1915, 1.1950, 1.2065, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.1830. Stop-Loss 1.1885. Take-Profit 1.1809, 1.1780, 1.1752, 1.1710, 1.1620

Buy Stop 1.1885. Stop-Loss 1.1830. Take-Profit 1.1915, 1.1950, 1.2065, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600