The price of WTI oil is currently showing positive dynamics again, having recovered from a sharp decline two weeks ago.

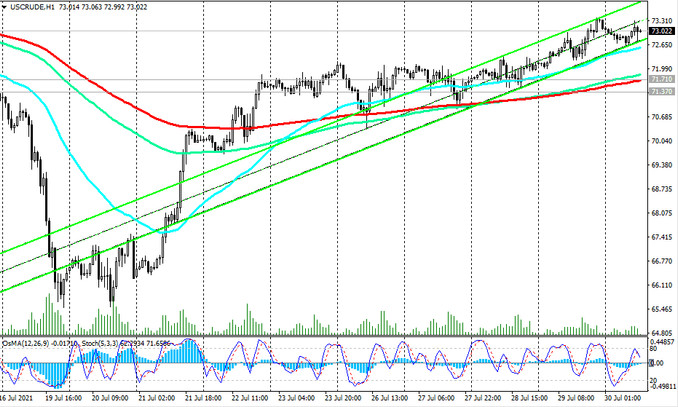

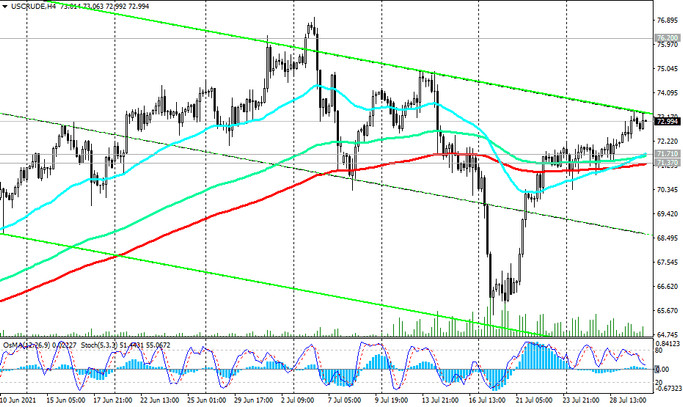

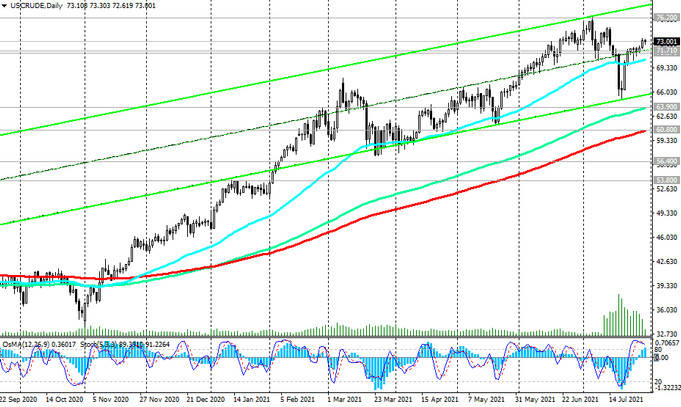

At the time of publication of this article, WTI futures are traded in a zone that is comfortable for "bulls", above important short-term support levels 70.44 (ЕМА50 on the daily chart), 71.37 (ЕМА200 on a 4-hour chart), 71.71 (ЕМА200 on a 1-hour chart), maintaining space for further growth. Its target is the level 76.20 (local resistance level and highs in July and almost 3 years).

In the event of its breakout, the price may move higher, however, some of the important fundamental factors described above will hold back more aggressive buying and price increases.

In an alternative scenario, the breakdown of the support level 70.44 will provoke a deeper corrective decline to the lower border of the rising channels on the daily and weekly charts and 66.00 mark.

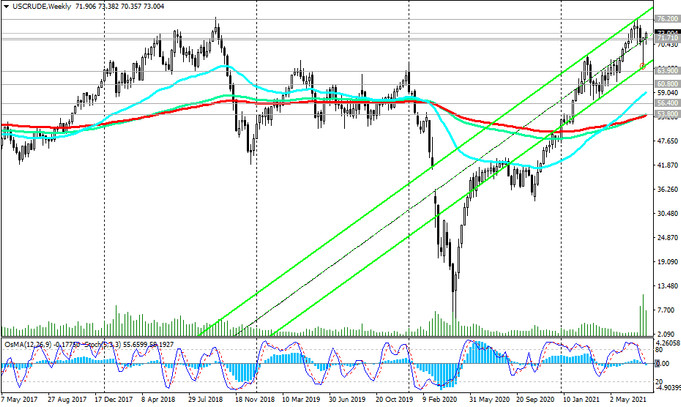

Nevertheless, above the key support levels 63.90 (ЕМА144 on the daily chart), 60.80 (ЕМА200 on the daily chart), 53.80 (ЕМА200 on the weekly chart), a long-term upward trend prevails. Only their breakdown can increase the risks of breaking the bullish trend.

One way or another, WTI oil is traded in the bull market zone. A breakdown of the local resistance level 76.20 will be a signal for further price growth.

Support levels: 71.71, 71.37, 70.44, 69.00, 66.00, 63.90, 60.80, 60.00, 56.40, 53.80

Resistance levels: 74.00, 75.00, 76.20

Trading recommendations

Sell Stop 70.40. Stop-Loss 74.10. Take-Profit 69.00, 66.00, 63.90, 60.80, 60.00, 56.40, 53.80

Buy by-market, Buy Stop 74.10. Stop-Loss 70.40. Take-Profit 75.00, 76.00