The beginning of the month and the new week promises to be very volatile. The economic calendar is scheduled to publish important macro statistics, as well as meetings of the world's two largest central banks - RB of Australia and the Bank of England. And the week will end with a key event - the publication of monthly data from the American labor market.

The central bank of Australia will host its regular monetary policy meeting on Tuesday.

At the end of the previous meeting in July, the RBA kept its key interest rate and target level of yield on 3-year government bonds at a record low of 0.10%, having also announced plans to launch the 3rd round of QE. In the accompanying statement, it was also noted that “the Central Bank will not raise rates until the actual inflation is stable in the range of 2% -3%. According to the baseline scenario, the optimal conditions for the start of the rate hike will not be created earlier than 2024”.

At a meeting on Tuesday, the RBA is likely to take a neutral to moderately negative position, in particular due to the spread of the delta strain of coronavirus in the country and new quarantine restrictions.

The Australian dollar still finds support, in particular, from rising inflation in the country. So, according to data published last week, the consumer price index in Australia for the 2nd quarter of 2021 increased by +0.8% (+3.8% in annual terms). Despite the fact that the Reserve Bank of Australia considers the rise in inflation to be temporary, some economists believe that the RBA may revise its plans for the volume of bond purchases in the direction of decreasing them, for example, instead of the current volume of monthly purchases of AU $ 100 billion, make purchases of assets for 50 Aussie billion less.

In essence, this would mean the beginning of the phasing out of the stimulus policy. If the RBA really decides at a meeting on Tuesday to reduce the volume of purchases on the national bond market, it will mean a reduction in liquidity and a strengthening of the Australian dollar.

Thus, the intrigue regarding further actions of the RBA leadership remains, which contains the possibility of increased volatility and sharp movements of a multidirectional nature, providing a lot of trading opportunities.

The RBA's decision on the interest rate will be published at 04:30 (GMT). Investors will carefully study the text of the accompanying statement, in which the leaders of the RBA will assess the current situation in the Australian economy and comment on the bank's monetary policy decision.

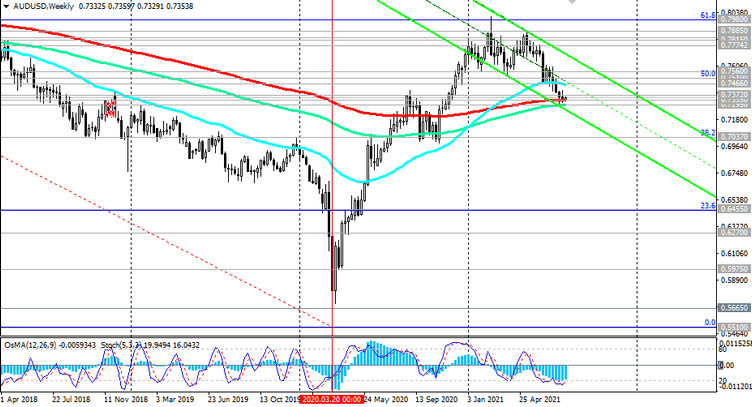

Any signals from them regarding changes in monetary policy plans will cause a sharp increase in volatility in the AUD and AUD / USD, which at the time of publication of this article is traded near 0.7350 mark and an important long-term support level.

Meanwhile, at the start of the new week and month, the DXY dollar index declines. The DXY is at 92.03 at the time of this posting, 116 pips below last month's high.

The dollar fell from more than 3-month highs reached earlier after the Fed meeting in mid-July. Its head Jerome Powell reiterated that the Fed's top priority is to support the American economy and labor market, which have been hit hard by the pandemic. The Fed will not rush to tighten monetary policy, relying on inflation alone, and only with the cumulative dynamics of these indicators (inflation growth and maximum recovery of the labor market) can the central bank begin to change the parameters of monetary policy.

Nevertheless, inflation, which has shown record growth rates over the past 29 years, will sooner or later force the Fed to start considering the issue of curtailing its stimulating policy.

Macro data coming from the United States, which indicates a significant acceleration of the American economic recovery, also supports market participants' optimism about the outlook for the dollar, keeping it from deeper decline.

Lingering worries about the continuing spread of the coronavirus also support demand for the dollar as a defensive asset.

Thus, from a fundamental point of view, short positions in AUD / USD are still preferable, and a breakdown of the support level 0.7335 (see Technical Analysis and Trading Recommendations) will increase the pressure on the pair towards its further decline.