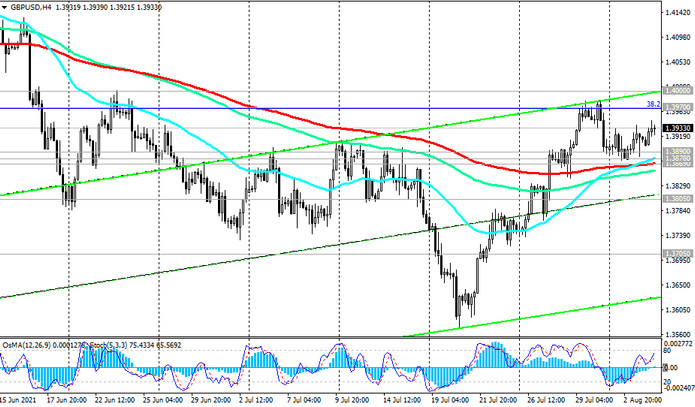

In the previous month (in July), GBP / USD was still able to enter positive territory, completing it with a minimal gain. In the first days of August, the pair continues to gradually develop positive dynamics, receiving support, including from the weakening dollar.

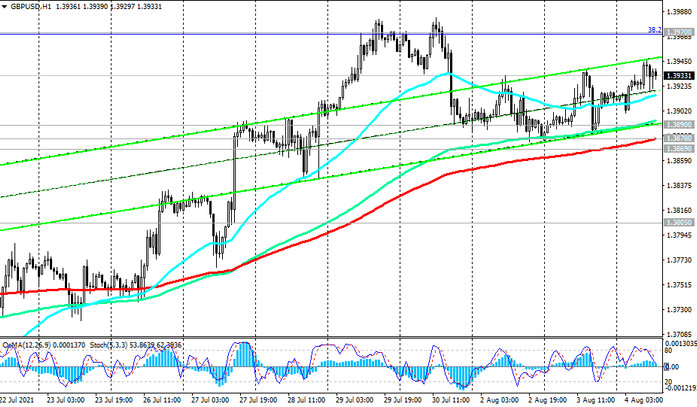

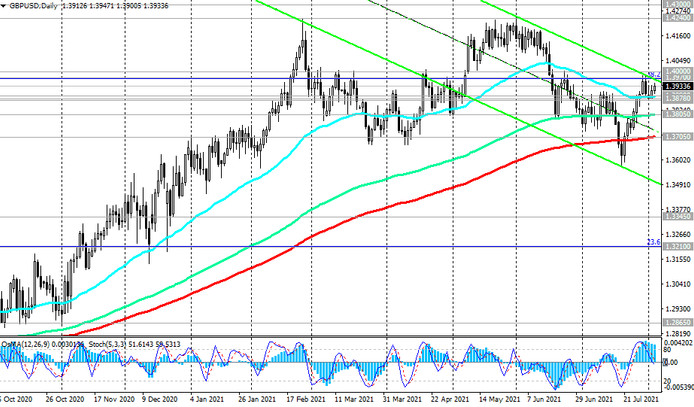

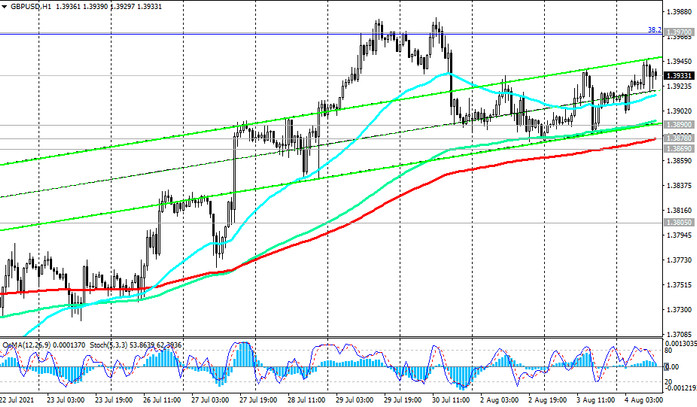

At the time of this publication, GBP / USD is traded near 1.3930 mark, remaining in the bull market zone above the key support level 1.3705 (EMA200 on the daily chart).

Breakdown of the upper border of the descending channel on the daily chart and resistance levels 1.3970 (Fibonacci level 38.2% of the correction to the decline of the GBP / USD in the wave that began in July 2014 near the mark of 1.7200), 1.4000 (local resistance level) will be a signal for further growth towards the local resistance level 1.4240 and resistance level 1.4300 (ЕМА144 on the monthly chart).

In the alternative scenario and after the breakdown of the support levels 1.3878 (ЕМА200 on the 1-hour chart), 1.3869 (ЕМА200 on a 4-hour chart) GBP / USD may decline to support level 1.3705.

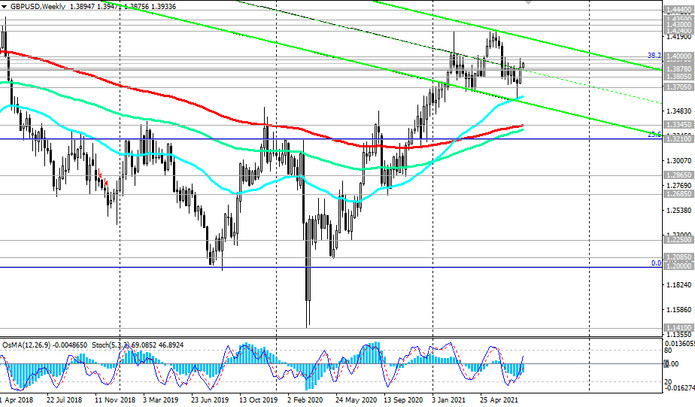

In case of a deeper decline - to support levels 1.3345 (ЕМА200 on the weekly chart), 1.3210 (Fibonacci level 23.6%). Their breakdown will increase the risks of a resumption of the global bearish trend in GBP / USD and may provoke a deeper decline towards the support levels 1.2250, 1.2085, 1.2000 (Fibonacci level 0%).

Support levels: 1.3890, 1.3878, 1.3869, 1.3805, 1.3705, 1.3600, 1.3345, 1.3210

Resistance levels: 1.3970, 1.4000, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830

Trading recommendations

Sell Stop 1.3860. Stop-Loss 1.3950. Take-Profit 1.3805, 1.3705, 1.3600, 1.3345, 1.3210

Buy Stop 1.3950. Stop-Loss 1.3860. Take-Profit 1.3970, 1.4000, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830