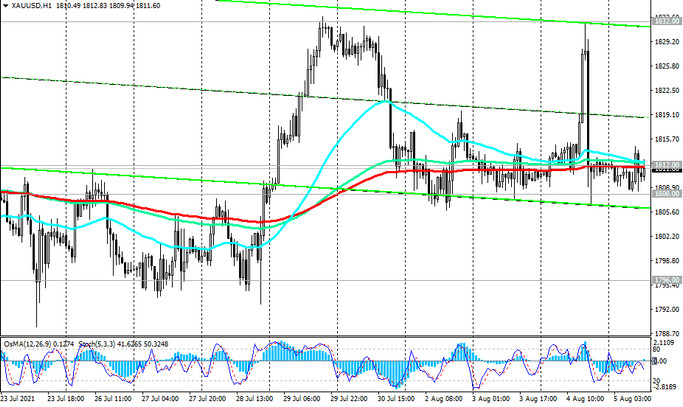

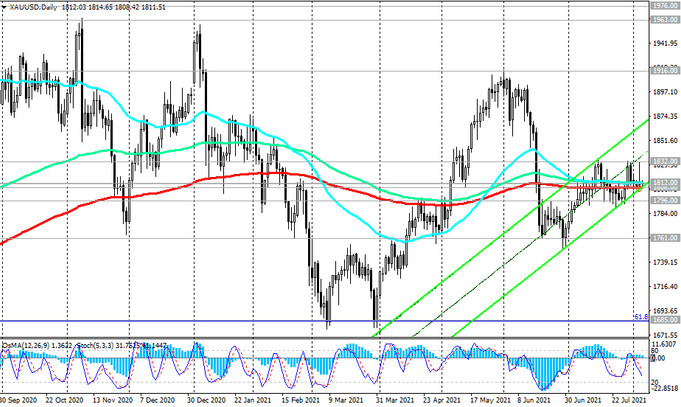

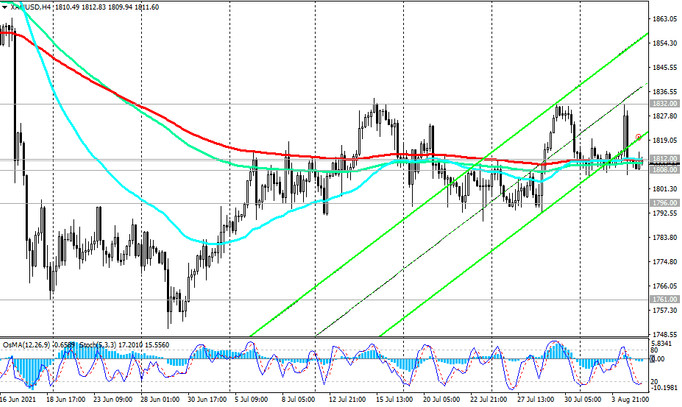

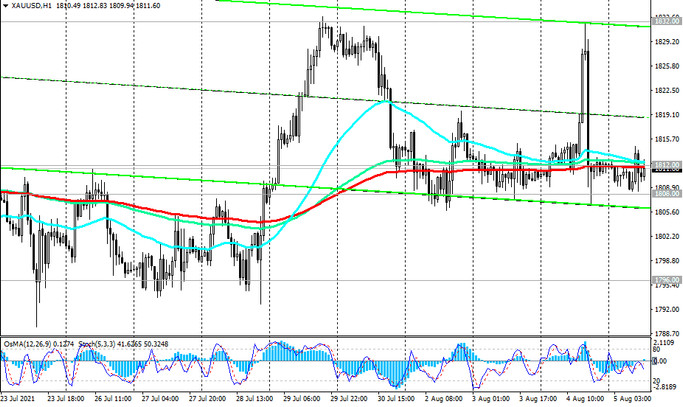

As we noted above, XAU / USD has been trading in a narrow range for several weeks in a row near the long-term key support / resistance level 1808.00 (ЕМА200 on the daily chart), waiting for new drivers to move in one direction or another.

A breakdown of the local support level and EMA50 on the weekly chart 1796.00 may provoke a decline in XAU / USD towards the local support level of 1761.00 with the prospect of a deeper decline to the support level 1685.00 (Fibonacci level 61.8% of the correction to the growth wave since November 2015 and the level 1050.00).

In an alternative scenario and after the breakdown of the local resistance level 1832.00, XAU / USD will strengthen the upward dynamics. Against the backdrop of rising inflation and maintaining the neutral position of the Fed, the XAU / USD pair has the potential for further growth. In this case, the targets will be the marks 1916.00, 1963.00, 1976.00 (local highs), 2000.00.

A breakdown of the local resistance level 1816.00 may become a signal for the implementation of this scenario.

Support levels: 1812.00, 1808.00, 1796.00, 1761.00, 1685.00, 1654.00, 1586.00, 1560.00

Resistance levels: 1816.00, 1832.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1804.00. Stop-Loss 1817.00. Take-Profit 1796.00, 1761.00, 1685.00, 1654.00, 1586.00, 1560.00

Buy Stop 1817.00. Stop-Loss 1804.00. Take-Profit 1832.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00