As a result of the extremely volatile passed trading week, which did not start very well for the dollar, it still managed to grow, having significantly strengthened last Friday after the publication of a strong report from the US Department of Labor. According to it, in July, unemployment fell to 5.4% against 5.9% in June, and the number of jobs outside of agriculture in the United States increased by 943,000, which was significantly better than the forecast of 5.7% and +845,000 jobs, respectively.

The publication of the report on the US labor market provoked a massive closure of short positions in the dollar, which contributed to its significant strengthening.

The DXY dollar index rose 0.6% on Friday, adding as a result 68 points for the week and rising to the highs of the last month and early April.

Jobs growth in July was the largest since August 2020, and now many economists and market participants believe that the Fed will start phasing out its stimulus policy faster than anticipated.

Earlier, the head of the Fed, Jerome Powell, has repeatedly stated that a more important task than taming rising inflation is the full recovery of the US labor market and its return to pre-pandemic levels, and only in the event of a simultaneous rise in inflation and a rapid recovery of the labor market, the FRS will move to normalize its extra soft monetary politics.

Last week, Fed spokesman and FOMC member Richard Clarida said that the US central bank is considering cutting existing incentives this year due to the risks of rising inflation. It is possible that if inflation, which shows the highest growth rates over the past 30 years, does not decline from current levels, and the labor market continues to recover at the current pace, then at the next meeting (September 21-22), Fed leaders may announce on the beginning of the reduction of the monthly program for the purchase of assets, currently amounting to $ 120 billion, already this year. Earlier, Powell also promised to warn market participants in advance about the impending cut in asset purchases on the government bond market. This reduction will actually mean a decrease in the volume of dollar liquidity, which will entail the strengthening of the dollar.

At the beginning of the new week, the DXY dollar index is still at the levels of the end of last week, and market participants assess its prospects after the publication of the report of the US Department of Labor, which significantly exceeded market expectations.

In the second half of today's trading day and on Tuesday, the publication of important macro statistics in the economic calendar is not planned. If there is no other news, in particular, of a political nature, or unexpected statements from representatives of the Fed or the US government, then the dollar will probably try to maintain the positions it won last week.

Major US stock indexes also generally reacted positively to the official data of the US Department of Labor, ending the last week with an increase.

Financial reports of several major companies are expected to be released this week, such as eBay Inc., FedEx Corp., Lenovo, The Walt Disney Co. and others. In addition to the company's profit for the reporting period, market participants pay great attention to indicators of debt, free cash, capital expenditures, return on equity and others.

The reporting season is an active time not only for financial media, but also for investors. The reporting of companies acts as a strong driver of the growth or fall of quotations on stock exchanges, and the change in share prices after the publication of a corporate report can, on average, be up to 5%, sometimes much more, within a few minutes, also determining the dynamics of quotations for the following weeks. Many investors and hedge funds rely on corporate reporting data when making trading decisions.

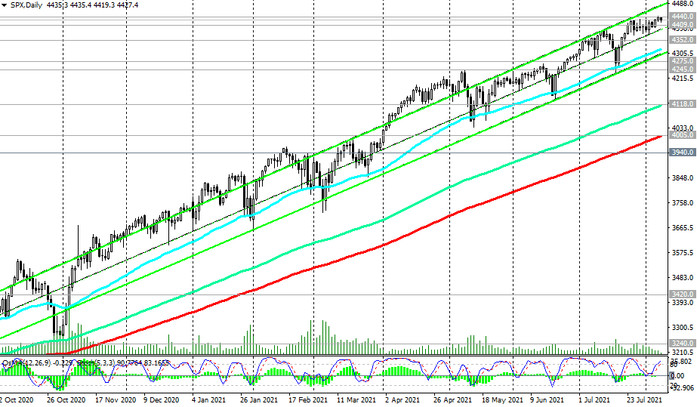

In general, the American stock market has been showing bullish dynamics for many years now, also receiving strong support from stimulating actions from the Fed and the US government.

Thus, the S&P 500 broad market index last week reached a new all-time high near 4440.0, and at the beginning of the new week, the S&P 500 remains close to this record level (at the time of publication of this article, S&P 500 futures were traded near 4427.0 mark).

Nevertheless, there are some points that could be the driver of a downward correction in the stock market. So, last Friday, oil futures closed with a sharp decline, and today they fell even deeper, accelerating their decline during the Asian trading session. The rise in the dollar and concerns about the impact of the delta strain of coronavirus on demand have become negative factors for oil prices. The introduction of new quarantine measures in connection with the spread of the delta strain of the virus in various regions of the world may negatively affect not only the demand for commodities, but also the dynamics of stock indices.

The release of strong employment data on Friday boosted confidence that the Fed will announce it will phase out asset purchases later this year, economists say. The dollar will benefit from this, but as for the stock indices, a question arises here, and it is not yet clear how negatively the gradual curtailment of stimulus may affect the stock indices.

Another signal in favor of tightening monetary policy may come on Wednesday, when the latest US inflation data is released at 12:30 (GMT), if it also turns out to be strong. The US CPI is expected to rise another 0.5% in July. On an annualized basis, the CPI is expected to rise +5.3%, well above the Fed's 2% target.