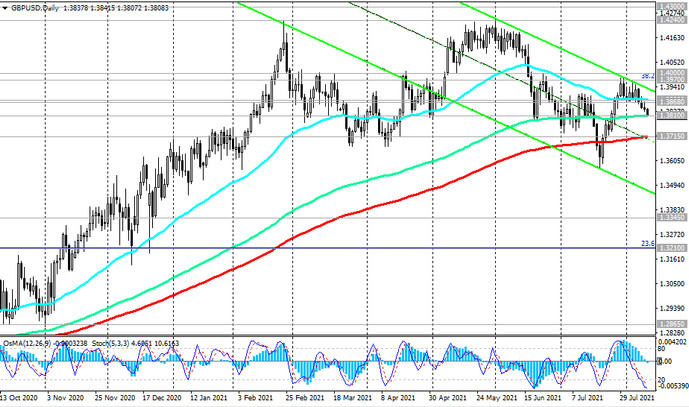

Having broken through the important support level 1.3880 (ЕМА50 on the daily chart) last Friday, GBP / USD continues to decline, moving within the descending channel on the daily chart towards the key support level 1.3715 (ЕМА200 on the daily chart).

At the time of publication of this article, GBP / USD was traded near 1.3810 mark, through which a strong support level (ЕМА144 on the daily chart) passes.

Its breakdown will confirm our assumption of further decline.

A breakdown of the support level 1.3715 will increase the likelihood of further decline towards the long-term key support level 1.3345 (ЕМА200 on the weekly chart), separating the long-term bullish trend from the bearish one.

In an alternative scenario, GBP / USD will rebound from 1.3810 and resume growth. Breakdown of resistance levels 1.3868 (ЕМА200 on the 1-hour and 4-hour charts), 1.3880 (ЕМА50 on the daily chart) will return GBP / USD to the bull market.

The breakdown of the upper border of the descending channel on the weekly chart and the resistance level 1.3970 (Fibonacci level 38.2% of the correction to the decline of the GBP / USD pair in the wave that began in July 2014 near the level of 1.7200) will be a signal for further growth towards the local resistance level 1.4240 and resistance level 1.4300 (ЕМА144 on the monthly chart).

Support levels: 1.3810, 1.3715, 1.3600, 1.3345, 1.3210

Resistance levels: 1.3868, 1.3880, 1.3970, 1.4000, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830

Trading recommendations

Sell Stop 1.3790. Stop-Loss 1.3850. Take-Profit 1.3715, 1.3600, 1.3345, 1.3210

Buy Stop 1.3850. Stop-Loss 1.3790. Take-Profit 1.3868, 1.3880, 1.3970, 1.4000, 1.4100, 1.4200, 1.4240, 1.4300, 1.4350, 1.4440, 1.4580, 1.4830