The new week began with the strengthening of the dollar. Recall that due to a strong decline on Friday, the DXY dollar index ended last week in negative territory, losing 0.4% on its results and dropping to 92.51. At the start of today's European session, DXY futures are traded near 92.57 mark.

Investors re-evaluate the likelihood of an earlier than announced by the Fed, tightening monetary policy after the ambiguous data published last week.

As follows from the report of the US Department of Labor, consumer prices in the US rose 0.5% in July after rising 0.9% in June. In annual terms, consumer inflation rose by 5.4%. The core CPI, which excludes food and energy prices, rose 0.3% in July from the previous month, after rising 0.9% in June.

Thus, the data from the Ministry of Labor indicated a slowdown in inflation, and market participants concluded that the Fed would not rush to start curtailing stimulus measures.

At the same time, consumer sentiment in the US has deteriorated. As follows from the report of the University of Michigan, published last Friday, the consumer confidence index, which reflects the confidence of American consumers in the economic development of the country, fell to 70.2 points in August against 81.2 points in July. The deterioration in consumer sentiment in the United States is likely caused by the spread of the delta strain of coronavirus, which could lead to a deterioration in the prospects for the US economy, and this, in turn, significantly weakens the expectations of market participants regarding an earlier tightening of the Fed's monetary policy.

Now, to determine new benchmarks in the direction of further dynamics of the dollar, market participants need new information and fresh macro data, which will indicate either a slowdown in inflation and the pace of economic recovery, or vice versa, an acceleration of inflation and a continued recovery of the labor market and the economy, which will create preconditions for further growth of the dollar.

And such information may appear tomorrow, when at 12:30 (GMT) the US Census Bureau will submit a report on the state of the retail sector.

Changes in retail sales are the main indicator of consumer spending. A high result strengthens the US dollar, a low one weakens it. It is expected that in July this figure fell to -0.2% (against +0.6% in June). A decrease in the indicator is likely to have a negative impact on the dollar.

But more interesting and important for market participants will be the publication on Wednesday (at 18:00 GMT) of the minutes from the July meeting of the FRS open market committee, which may contain clarifying details regarding the results of the last meeting. The Fed leaders kept key interest rates in the range of 0.00% -0.25%, and the volume of the QE asset purchase program at $ 120 billion per month. The accompanying statement said that the Fed will continue to adhere to the current parameters of monetary policy until the target levels for inflation and maximum employment are reached, and the level of interest rates will not change.

On the other hand, Fed leaders are increasingly expressing their opinion that, from their point of view, the beginning of the curtailment of the stimulating policy is possible earlier than it was planned earlier.

If market participants consider the rhetoric of statements by the Fed leaders regarding the prospects for monetary policy tough, this will push the dollar to further growth.

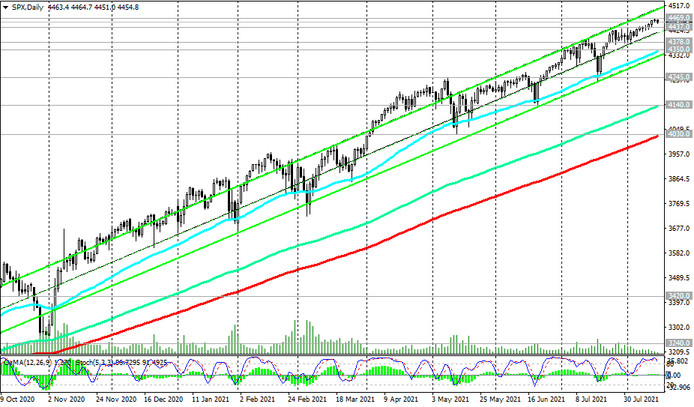

Meanwhile, major US stock indexes maintain long-term positive dynamics. In particular, futures for the US broad market S&P 500 index reached a new all-time high at 4469.0 last Friday. Unlike the dollar, S&P 500 index futures continue a smooth upward trend in quotes. The American stock market has been bullish for many years, also receiving strong support from stimulus actions from the Fed and the US government. Although there are risks of a downward correction, however, there are still no strong arguments in favor of a more or less deep corrective decline. Most likely, the growth of the S&P 500 will continue, and the breakdown of the local resistance level passing through the record high of 4469.0 will be a signal to build up long positions.