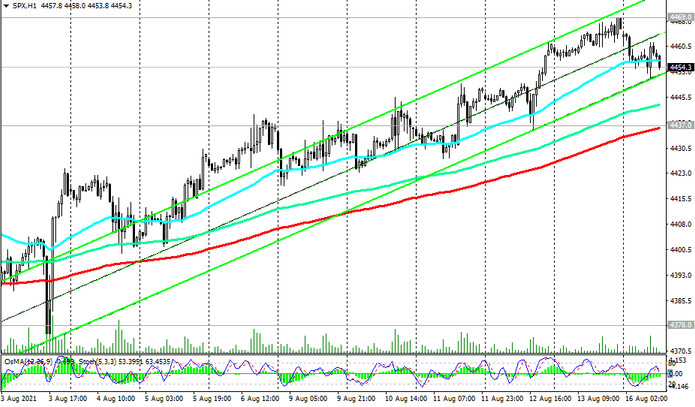

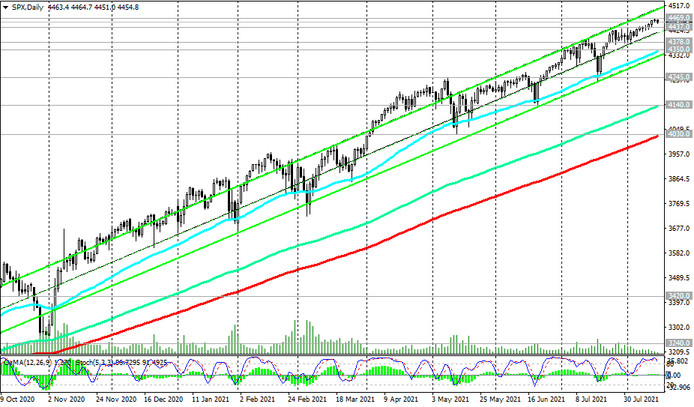

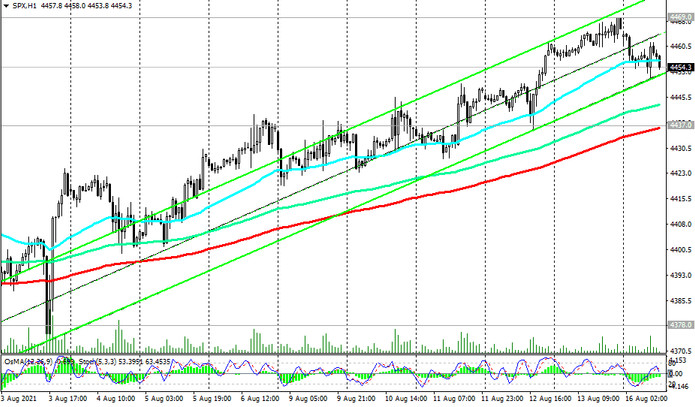

The S&P 500 hit a new all-time high last week near 4469.0 mark, showing bullish dynamics for many years. At the beginning of the new week, there is a slight decrease in the S&P 500 futures quotes.

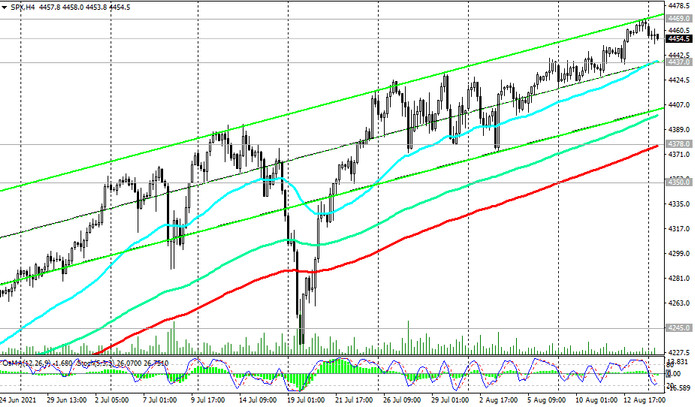

But most likely, the corrective decline will be limited by the important short-term support level 4437.0 (ЕМА200 on the 1-hour chart), and if the growth resumes, the breakdown of the local resistance level at 4469.0 will be a signal to build up long positions.

In an alternative scenario, a breakdown of the support level 4437.0 could trigger a deeper correction to support levels 4378.0 (ЕМА200 on the 4-hour chart), 4350.0 (ЕМА50 and the lower line of the ascending channel on the daily chart. Their breakdown, in turn, will signal a further decline to support levels 4140.0 (ЕМА144 on the daily chart), 4030.0 (ЕМА200 on the daily chart).

Nevertheless, in the current situation, long positions are still preferred.

Support levels: 4437.0, 4378.0, 4350.0, 4245.0, 4140.0, 4030.0

Resistance levels: 4469.0

Trading recommendations

Sell Stop 4435.0. Stop-Loss 4465.0. Targets 4400.0, 4378.0, 4350.0, 4245.0, 4140.0, 4030.0

Buy Stop 4465.0. Stop-Loss 4435.0. Targets 4500.0, 4600.0, 4700.0