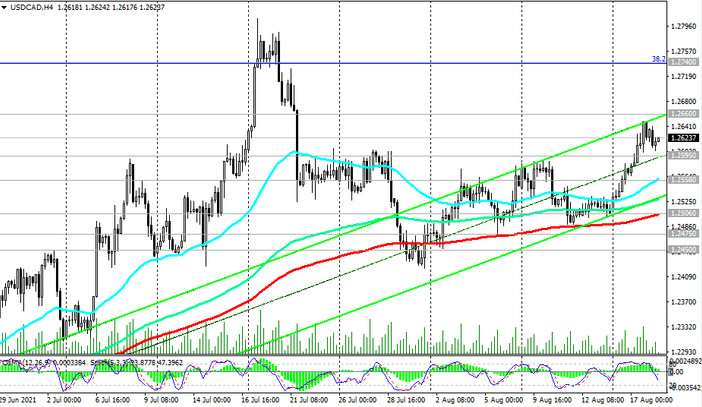

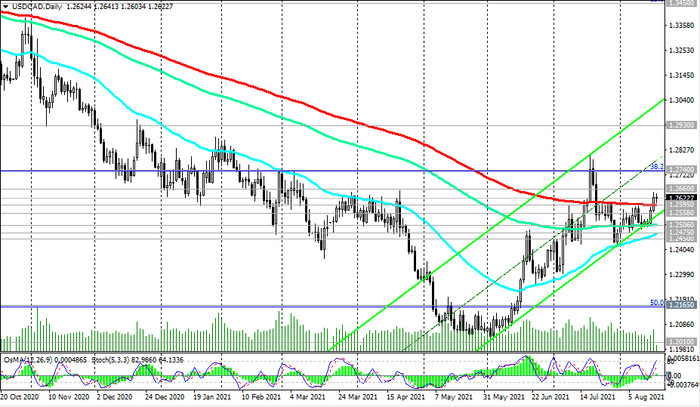

At the time of publication of this article, USD / CAD is traded near the 1.2625 mark, roughly in the middle of the range between the important long-term levels - support 1.2595 (EMA200 on the daily chart) and resistance 1.2660 (EMA50 on the weekly chart).

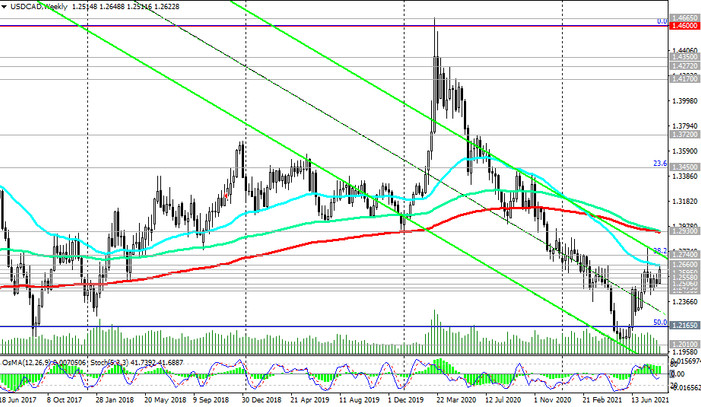

Slightly above the resistance level 1.2660, there is another strong resistance level 1.2740 (the upper line of the descending channel on the weekly chart and the 38.2% Fibonacci level of the downward correction in the wave of USD / CAD growth from 0.9700 to 1.4600).

The breakdown of these resistance levels will confirm the recovery of the bullish dynamics of USD / CAD with the prospect of growth to the resistance level 1.2930 (ЕМА200 on the weekly chart).

In an alternative scenario, the first signal for selling USD / CAD will be a breakdown of the support level 1.2595. The breakout of the support levels 1.2475 (ЕМА50 on the daily chart and local lows), 1.2450 (ЕМА200 on the monthly chart) will confirm the return of USD / CAD into the long-term downtrend that formed at the end of March 2020.

Support levels: 1.2595, 1.2558, 1.2506, 1.2475, 1.2450

Resistance levels: 1.2660, 1.2740, 1.2825, 1.2930

Trading scenarios

Sell Stop 1.2585. Stop-Loss 1.2670. Take-Profit 1.2558, 1.2506, 1.2475, 1.2450, 1.2330, 1.2200, 1.2165, 1.2100

Buy Stop 1.2670. Stop-Loss 1.2585. Take-Profit 1.2700, 1.2740, 1.2825, 1.2930