Today, world and American stock indices are declining again, while the dollar is strengthening. This is how investors reacted to the publication of the minutes of the Fed's July meeting last Wednesday. Although, in the ranks of the Fed's leadership, there is no consensus on the decision to start curtailing the asset purchase program, the controversial position of the regulator disappointed investors. Some of the Fed leaders, as follows from the protocols, believe that it is too early to start curtailing incentives now, at least until the spring of 2022, while others of them are in favor of starting the curtailment of the program by the end of this year.

In addition to the protocols of the US Federal Reserve, stock indices are under pressure from the high rate of spread of the delta coronavirus strain. So, according to the US Department of Health, the number of new cases of infection in the country is already approaching the indicators of the beginning of the year, having long exceeded the mark of 100,000 new infections per day.

In the short term, a new strain of coronavirus could negatively impact employment growth and consumer demand.

The decline in stock indices is taking place against the backdrop of falling commodity prices, which, in turn, are also declining due to threats of new lockdowns in different regions of the world, which will entail a drop in demand for oil and oil products, and against the backdrop of a strengthening dollar.

The DXY dollar index, which tracks the dollar against a basket of 6 major currencies, has risen 1.22% since the beginning of this week, exceeding March local highs near 93.47. The DXY index has not been at current levels since mid-November 2020.

Positive statistics on jobless claims in the US, published on Thursday, provide additional support to the dollar. According to the weekly data provided by the US Department of Labor, the number of initial applications for the week of August 13 fell from 377 thousand to 348 thousand, which is significantly better than the forecast of 363 thousand. This is the most positive indicator since the beginning of the pandemic in March 2020, which indicates the ongoing recovery of the American labor market, and this, in turn, reinforces expectations of an imminent start to curtail the Fed's stimulus programs.

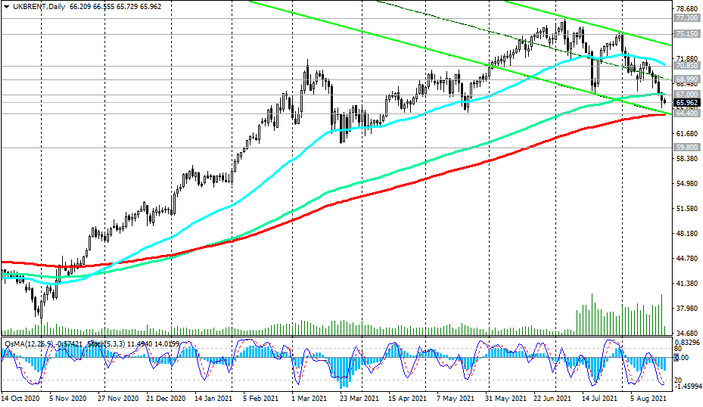

Meanwhile, oil prices hit new 13-week lows this week. So, futures for Brent crude oil fell on Thursday to $ 65.23 per barrel. Today, at the beginning of the European session, they are traded in the zone of yesterday's lows, near the mark of 65.95, showing an inclination to further decline. At the same time, near the key support level and the marks of 64.00, 65.00 dollars per barrel of Brent oil price stabilization is possible with the likelihood of a subsequent rebound.

Anyway, the weekly report of the Energy Information Administration of the US Department of Energy, published last Wednesday, pointed to another drop in reserves in the country's oil storage facilities (by -3.234 million barrels), and this is a positive factor for oil prices.

During today's American trading session, a large number of macroeconomic publications are not expected. The general tone of investor sentiment is likely to remain the same. At the same time, at the end of the week, some weakening of the dollar is possible due to the propensity of some investors to take profits in long positions on it.

Oil market participants will also pay attention to the publication at (at 17:00 GMT) of a report on oil platforms from the oilfield services company Baker Hughes. Previous data from Baker Hughes reflected an increase in the number of active rigs to 397 units (versus 387, 385, 387, 380, 378, 376, 372, 365, 359, 356, 352, 344 in previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil quotes, although it will be of a short-term nature.