The dollar is correcting, and the DXY dollar index declines early this week from last week's new 9-month highs near 93.75 mark.

The DXY index, which tracks the dollar against a basket of 6 major currencies, gained more than 1% over the past week, exceeding the March local highs located near the mark of 93.47. At the start of today's European session, DXY futures are traded near 93.25 mark.

This week is marked by an important event for investors. From August 26 to 28, Jackson Hole, Wyoming, will host the annual Fed-sponsored Economic Symposium. At the symposium, representatives of the world's central banks and economists will discuss issues of the global economy and comment on the prospects for monetary policy of central banks. Their statements can have a significant impact on national currencies, including the US dollar exchange rate. The degree of this influence will depend on the tone of the statements of the representatives of the central banks.

The main question for market participants is the likelihood and timing of the start of curtailing the stimulating policy of the Fed this year or next.

Comments from Fed Chairman Jerome Powell may affect short-term USD trading and stock indices. If he makes unexpected statements about the Fed's monetary policy, the volatility in trading in the financial markets could increase dramatically.

Recently, some representatives of the Fed's leadership have increasingly made statements in favor of an earlier than previously planned start of curtailing the stimulating policy of the central bank.

So, in the minutes from the July meeting of the Fed published last week, in addition to concerns about the threat to the economy from the coronavirus, it was also reported that the leaders of the central bank discussed the possibility of starting to reduce the volume of asset purchases by the end of the year.

Although the planned start of the reduction of the quantitative easing program will not be a harbinger of a rate hike, market participants considered this information as a signal to actively buy the dollar and sell high-yielding stock market assets.

As a result, major US stock indexes fell sharply after the publication of the FOMC minutes. And, although last Friday the indices switched to growth again, last week they still closed with a decline.

Market participants still hope that Powell will again try to reassure investors, as he had to do repeatedly in previous months, and reassure them of the commitment of the Fed leadership to continue pursuing the course of the current extra soft policy. As you know, Powell has repeatedly stated that rates will not rise until 2023, and before starting this, the Fed will first begin to reduce the volume of monthly purchases in the bond market. This, too, as promised Powell, market participants will be warned in advance to avoid sharp fluctuations in the financial markets. But so far, with the exception of some Fed officials, there have been no such signals from Powell.

As follows from the July protocols, despite significant growth rates, employment has not reached the required level to start raising the interest rate.

In addition, last week Powell reiterated concerns about the continued spread of the coronavirus in the world and the United States, which carries the threat of lockdowns and a new economic slowdown.

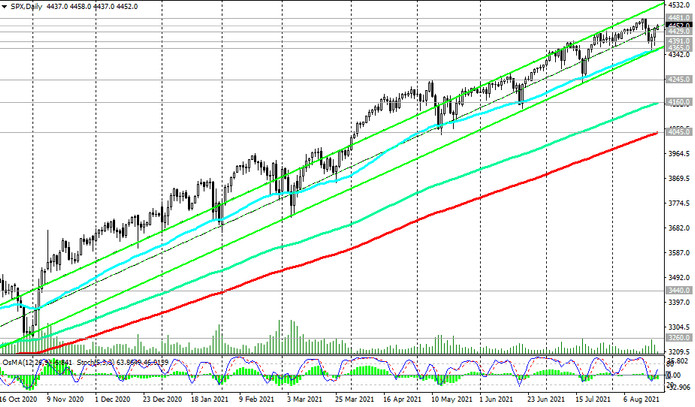

Considering these moments, most likely, the dollar will decline this week, while stock indices will rise, which, however, they are already demonstrating at the beginning of today's trading day. Thus, futures for the American broad market S&P 500 index are traded at the beginning of today's European session near 4452.0 mark, moving towards a record high of 4481.0, reached at the beginning of last week.

From the news for today, concerning the dynamics of the dollar and American stock indices, it is worth paying attention to the publication (in the period from 12:30 to 14:00 GMT) of macro statistics for the United States, including the PMI indexes from the Federal Reserve Bank of Chicago and the Markit Economics agency. The indices are well above the mark of 50, which separates the growth of business activity from its slowdown. A slight relative decrease in indicators is expected. However, this will only have a short-term negative impact on US stock indices, especially since investors are expecting support from Powell in the form of "dovish" rhetoric regarding the near-term prospects of the Fed's monetary policy. His speech at the Jackson Hole Forum is scheduled for August 27 (14:00 GMT).