At the beginning of today's European trading session, there is not so much a lull, but a decline in trading volumes is clearly visible. Major currency pairs move mainly in ranges. Market participants are awaiting the start of the speech (at 14:00 GMT) by the head of the Fed, Jerome Powell, at the economic symposium in Jackson Hole. The DXY dollar index at the time of publication of this article is near the mark of 93.06, which corresponds to the opening price of today's trading day.

Why is Powell's speech receiving so much investor attention? Financial market participants expect him to clarify the situation regarding the prospects for the Fed's monetary policy this year and in the following months.

As you know, in March 2020, in response to the coronavirus pandemic, the Fed lowered its interest rates to almost zero (now the Fed's main interest rate is at 0.25%), and since July 2020, the Fed has been buying back assets in the bond market in the amount of $ 120 billion.

During the July meeting, the Fed kept the current parameters of its monetary policy unchanged. "Against the background of progress in vaccination of the population and strong government support measures, indicators of economic activity and employment continue to grow stronger. The sectors hardest hit by the pandemic have shown some improvement, but have not yet fully recovered", the central bank said, which was considered by some economists and market participants as a change in the position of Fed leaders.

Previously, they have repeatedly stated that they will not slow down the pace of bond purchases until they see "significant further progress" in achieving the inflation target of 2% and the labor market reaching pre-crisis (pre-pandemic) levels. Now consumer inflation is up +5.4% (YoY) in June and July, well above the Fed’s target of 2%.

Earlier, the head of the Fed, Jerome Powell, called the current growth in inflation a temporary phenomenon, and considered creating conditions for the country's labor market to return to pre-coronavirus levels as a more important task for the central bank.

Investors and many economists now believe that strong employment figures, coupled with fast-growing inflation, could force the Fed to raise interest rates faster than anticipated, as well as begin cutting back on its current $ 120 billion monthly asset-buying program.

Expectations that Powell may signal an imminent start to curtail the stimulus program are fueled by recent statements by some Fed officials about the possibility of such a development of events this year, and even this fall.

Nevertheless, the intrigue around the intentions and actions of the Fed, as well as the outcome of Powell's speech at the symposium, remains.

Market participants were divided on the Fed's immediate intentions. Nevertheless, a significant part of investors believes that today Powell will try to calm the markets, assuring their participants in the commitment of the Fed leadership to further pursue the course of the current extra soft policy.

In statements made by him last week, it is said that Fed officials are extremely worried about the continued spread of the coronavirus in the world and the United States, which poses the threat of a new economic slowdown. The sharp increase in the number of cases of Covid-19 infection in the United States forces the US government and the Federal Reserve to look for new ways to support the population and the economy, expressed, among other things, in additional "pumping" of liquidity into the financial system. This, in turn, leads, on the one hand, to an increase in inflation, and on the other, to a cheaper dollar.

However, in the current situation, the growth in demand for the dollar as a defensive asset supports its quotes.

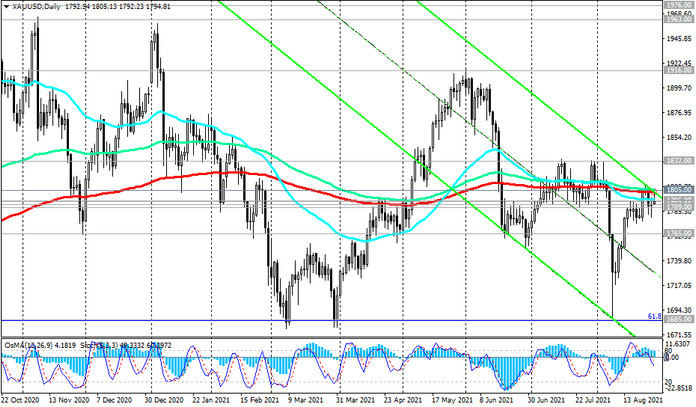

Uncertainty regarding the spread of the coronavirus, the possibility of a new slowdown in the global economy remains high. Investors, just in case, are cautious, hedging by purchases not only of the dollar, but also of gold, the quotes of which recovered after a deep fall at the beginning of the month, and the XAU / USD pair returned into the zone of the balance line and the 200-period moving average on the daily price chart, which passing near mark of 1800.00 dollars per troy ounce (see Technical Analysis and Trading Recommendations).

Gold does not bring investment income, and is in demand, mainly as a hedging asset that is in demand in times of uncertainty and soft monetary policy of world central banks. Its quotes are extremely sensitive to changes in the interest rates of the Fed and other major central banks in the world.

Therefore, participants in the precious metals market and, in particular, gold, also expect Powell to clarify the situation regarding the prospects for the Fed's monetary policy.

If Powell really announces the start of a reduction in the volume of monthly asset purchases this year, or at least such an opportunity, then sharp movements may begin in the financial market, which will be expressed by a strengthening dollar and, most likely, by a downward correction in the global stock market and by a drop in quotations gold.

The “dovish” rhetoric of Powell's speech will most likely be a signal for dollar sales, including in the XAU / USD pair.