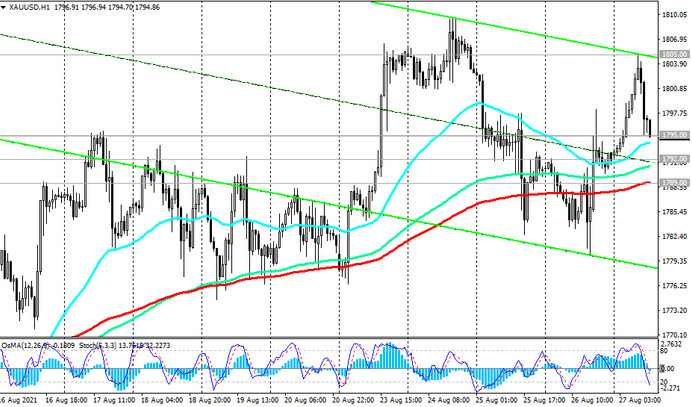

Gold quotes are extremely sensitive to changes in the interest rates of the Fed and other major central banks in the world. Therefore, today at 14:00 (GMT), when the speech of the head of the Fed Jerome Powell begins, the XAU / USD pair may have new drivers to move in one direction or another.

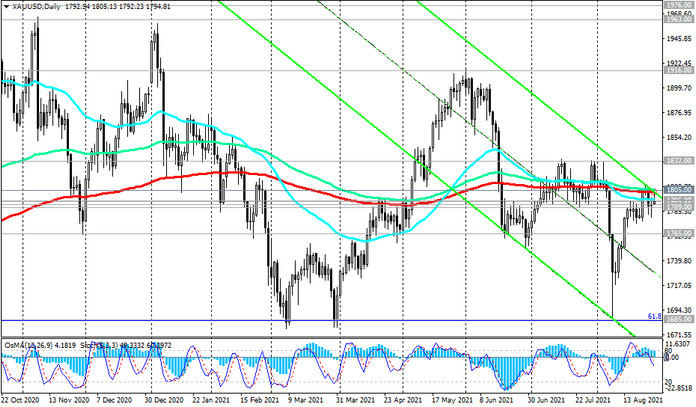

A breakdown of the key resistance level 1805.00 (ЕМА50 on the weekly chart, ЕМА200, ЕМА144 and the upper line of the descending channel on the daily chart) will signal the growth of XAU / USD in the direction of the local resistance level 1832.00. Its breakdown will provoke further growth, first to the local resistance level 1916.00, and then, in case of its breakdown, to the local resistance levels 1963.00, 1976.00, 2000.00.

In the alternative scenario, and in case of further strengthening of the dollar, the XAU / USD decline will resume with targets at support levels 1685.00 (Fibonacci level 61.8% of the correction to the growth wave since November 2015 and the level of 1050.00), 1665.00 (ЕМА144 on the weekly chart), 1595.00 (ЕМА200 on the weekly chart), 1560.00 (50% Fibonacci level).

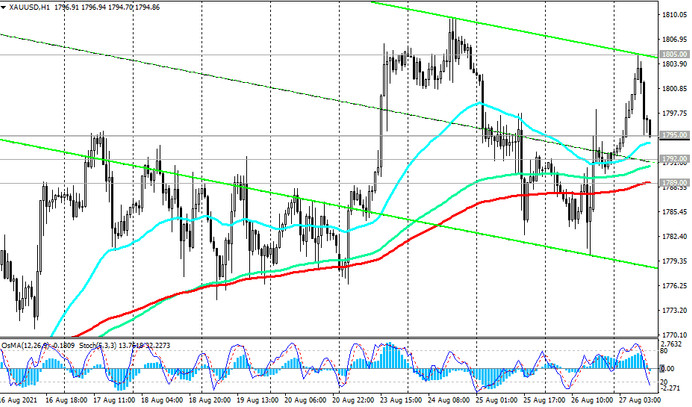

A breakdown of short-term support levels 1792.00 (ЕМА200 on the 4-hour chart), 1789.00 (ЕМА200 on the 1-hour chart) may become a signal for the implementation of this scenario.

Support levels: 1792.00, 1789.00, 1765.00, 1685.00, 1665.00, 1595.00, 1560.00

Resistance levels: 1805.00, 1832.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1778.00. Stop-Loss 1811.00. Take-Profit 1765.00, 1685.00, 1665.00, 1595.00, 1560.00

Buy Stop 1811.00. Stop-Loss 1778.00. Take-Profit 1832.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00