The dollar continued to decline during today's Asian session, while futures for major US stock indexes resumed gains after the S&P 500 and NASDAQ100 hitting on Monday record highs at 4537.0 and 15622.0, respectively.

As of this writing, DXY dollar futures are traded near 92.52, 13 points below Monday's close and 123 points below the local 9-month high of 93.75 reached on Aug.20.

The dynamics of the dollar and stock indices continues to be influenced by the speech last Friday at a symposium in Jackson Hole by FRS Chairman Jerome Powell. He confirmed that the Fed is ready to begin phasing out stimulus (this cut could begin as early as this year), despite concerns about the coronavirus delta strain. However, Powell also said that the timing of the winding down of bond purchases would have no impact on subsequent decisions to raise interest rates.

In these conditions, when the markets continue to be flooded with cheap liquidity, and interest rates remain close to zero, American stocks and stock indices will tend to grow further, and the dollar - to decline, especially against the currencies of developed countries that are exporters of commodities, in particular such like Canadian, Australian and New Zealand dollars.

As for the NZD and the NZD / USD pair, we can also add that they have sharply strengthened during today's Asian session.

The NZD / USD has fully recovered after falling on Aug.19, when new cases of coronavirus infection were detected in New Zealand for the first time in several months. In this country, the first cases of Covid-19 infection have been identified since February, as a result of which a lockdown was introduced, schools and most businesses were closed.

Now the rate of increase in the incidence has slowed down again, which, in turn, has supported expectations of an increase in interest rates this year. This possibility was previously announced in the RB of New Zealand. The central bank forecasts a rate hike to 0.6% by December of this year and to 1.6% by December next year, based on the fact that rising government spending and lower interest rates in response to the pandemic have overheated the New Zealand economy, pushing inflation higher target level of RBNZ.

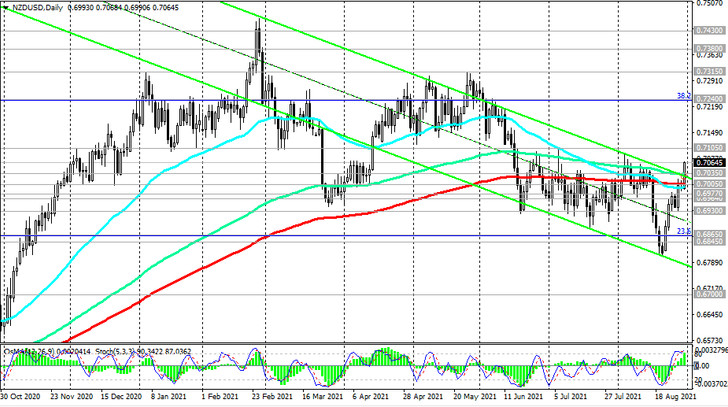

Thus, two overlapping factors (expectations of an increase in interest rates in New Zealand and promises from the Fed's leadership not to raise rates earlier than the target date, i.e. the end of 2023) create prerequisites for further growth in NZD / USD. Probably, the breakdown of the resistance level of 0.7100 will provoke further growth of NZD / USD towards the levels of 0.7300, 0.7315 (see "Technical analysis and trading recommendations").

Jerome Powell urged market participants not to rush with expectations of an imminent increase in the Fed's interest rates, since the rise in inflation is still temporary, and the American economy, in his opinion, has not yet reached full employment. In this regard, market participants will closely follow the publication on Friday (at 12:30 GMT) of the US labor market report for August. It is assumed that the US economy created 728 thousand jobs outside agriculture in August (against 943 thousand in July), and unemployment fell to 5.2% from 5.4% in July. In general, the indicators are encouraging, indicating a continued improvement in the US labor market after its collapse in the first half of 2020 and its gradual approach to pre-coronavirus levels.

If they turn out to be worse than forecast, then the dollar may sharply decline, as expectations of the imminent start of curtailing the Fed's stimulating policy will weaken.

From the news for today, which can cause an increase in volatility in USD quotes and in financial markets, it is worth paying attention to the publication at 14:00 (GMT) of the consumer confidence index from the Conference Board, which reflects the confidence of American consumers in the economic development of the country. A high level indicates economic growth, while a low level indicates stagnation. The previous value of the indicator (for July) was 129.1.

An increase in the indicator will strengthen the USD, while a decrease in the value will weaken the dollar. This indicator is expected to come out with a value of 122.9, which may negatively affect the dollar if the forecast is confirmed.