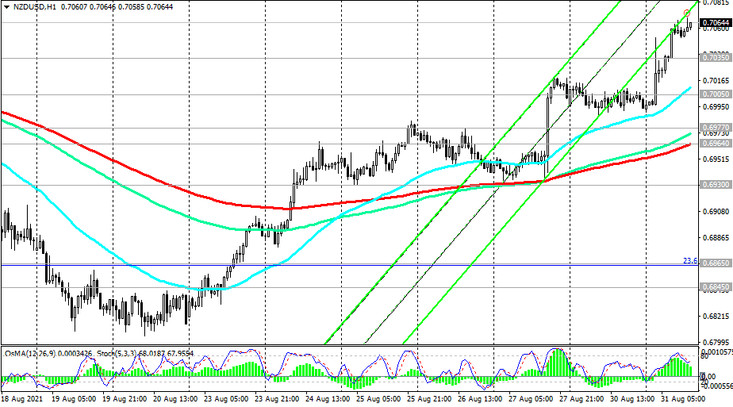

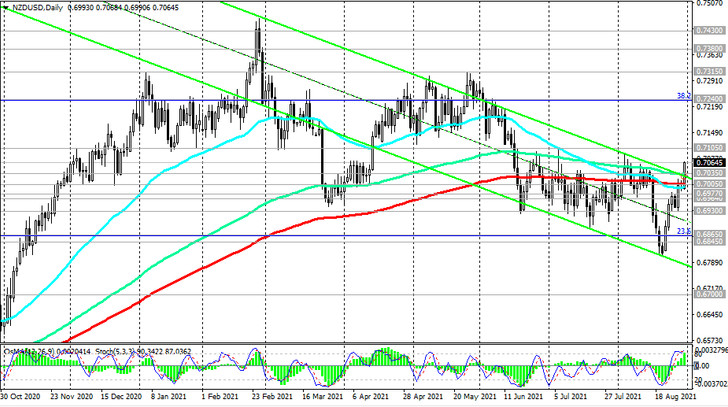

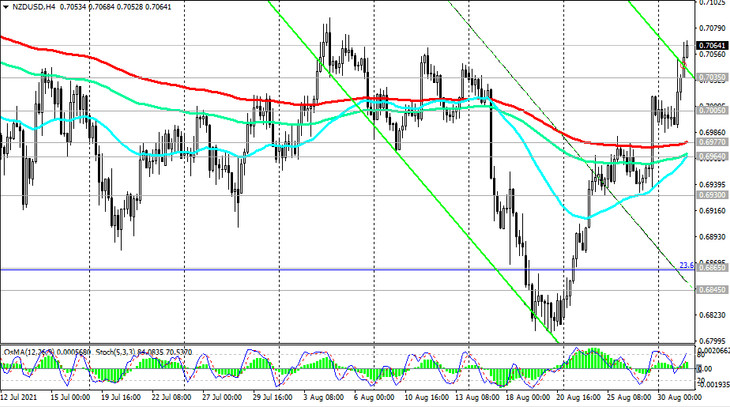

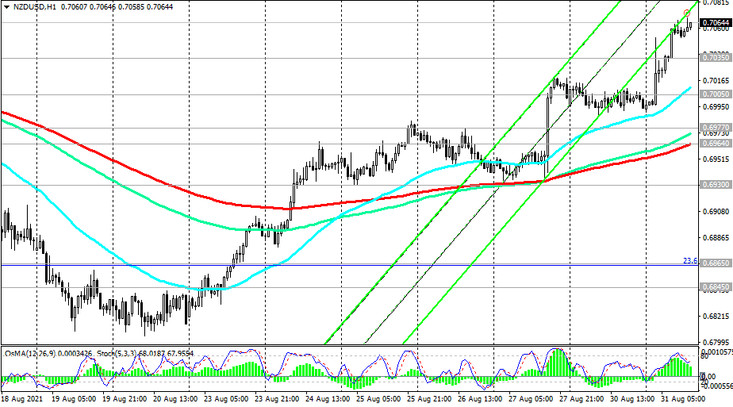

Having broken through the important resistance level 0.7025 (ЕМА144 and the upper line of the descending channel on the daily chart), NZD / USD continues to develop an upward trend, trading in the bull market zone above the important short-term support levels 0.6964 (ЕМА200 on the 1-hour chart), 0.6977 (ЕМА200 on the 4-hour chart) and long-term support levels 0.6845 (ЕМА200 on the weekly chart), 0.7005 (ЕМА200 on the daily chart).

Technical indicators OsMA and Stochastic on 1-hour, 4-hour, daily, weekly charts are also on the buyer's side.

A breakdown of the local resistance level of 0.7105 (July highs) may provoke further growth in NZD / USD to resistance levels of 0.7240 (38.2% Fibonacci retracement in the global wave of the pair's decline from 0.8820), 0.7300. More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

In an alternative scenario and after a confirmed breakout of the support levels 0.6865 (23.6% Fibonacci level), 0.6845 NZD / USD will head towards the support level 0.6750 (the lower line of the descending channel on the weekly chart). Its breakout could finally push the NZD / USD into the bear market zone and return it to the global downtrend that began in July 2014. The first signal for the implementation of this scenario is a breakout of the key support level 0.7005.

Support levels: 0.7025, 0.7005, 0.6977, 0.6964, 0.6930, 0.6865, 0.6845, 0.6750, 0.6700

Resistance levels: 0.7105, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

NZD / USD: Sell Stop 0.7020. Stop-Loss 0.7070. Take-Profit 0.7005, 0.6977, 0.6964, 0.6930, 0.6865, 0.6845, 0.6750, 0.6700

Buy by market, Buy Stop 0.7070. Stop-Loss 0.7020. Take-Profit 0.7105, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600