On Tuesday, the dollar was actively declining in the first half of the trading day, especially against the commodity currencies. The dollar was weakening as the market took into account the lower likelihood that the Fed will announce a stimulus cut in September. Despite some support received by the dollar at the beginning of the American trading session from the Standard and Poor's published house value index, which indicated a strong (+19.1% YoY) rise in prices, the DXY dollar index nevertheless closed yesterday's trading day with a decline (-7 points), at the level of 92.63.

On the whole, August was successful for the dollar. The DXY dollar index rose by 0.5% (+48 points) last month. In early August, the dollar was actively strengthening after some Fed officials signaled their inclination to start phasing out the stimulus policy this year amid rising inflation. Now the dynamics of the dollar and financial markets are highly dependent on the Fed's monetary policy. And in late August, the dollar came under pressure after Fed Chairman Jerome Powell spoke at a conference in Jackson Hole. Powell, although he admitted the fact that recently the Fed's leadership has been discussing the possibility of an earlier than originally planned reduction in the volume of asset purchases under the QE program, however, he did not announce a clear time frame for the start of the stimulus curtailment. Powell also said the timing of the rollback of bond purchases would have no impact on subsequent decisions to raise interest rates.

Moreover, he reiterated his extreme concern about the continuing spread of the coronavirus in the United States and the world, which is likely to require the continuation of programs to support the population and business. In his opinion, the rise in inflation is still temporary, and the American economy and the labor market have not yet reached levels before the pandemic.

Thus, the opinions of market participants and economists as to whether the stimulus curtailment will begin this year, and possibly even in the fall, or the Fed will adhere to the previously planned pace and timing, are divided.

In this regard, data on the US labor market, which will be released on Friday (at 12:30 GMT), will be of particular importance. If the report of the US Department of Labor turns out to be significantly better than expected in the market, then talk about the curtailment of stimulus and the increase in the FRS rates will again intensify, which will give the dollar a new positive impetus.

If the data on the US labor market turn out to be significantly worse than the forecast (it is assumed that the US economy created 750 thousand jobs outside agriculture in August, and unemployment fell to 5.2% from 5.4% in July), then the dollar will be under pressure, as a weak report will reduce the likelihood of an early start to curtail the Fed's stimulating programs.

Yesterday, the dollar was also under pressure from weak macro statistics, according to which consumer confidence in the US deteriorated in August, having rolled back to its minimum since February. Consumer confidence fell to 113.8 in August from the revised downward revision of 125.1 in July, according to the Conference Board data released on Tuesday. Purchasing Managers' Index (PMI Chicago) in August fell to 66.8 from 73.4 in July, hitting a two-month low.

Market participants will now monitor the release of US manufacturing data today (at 14:00 GMT) to assess the impact of the delta coronavirus strain on economic growth. The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) is expected to indicate a slowdown in August (58.6 from 59.5 in July). The employment and inflationary acceleration indices (from ISM) in the US manufacturing sector are also expected to decline (to 51.4 and 83.8 from 52.9 and 85.7, respectively, in July).

Not less important today will also be the ADP report on employment in the private sector. This report does not directly correlate with the official report from the US Department of Labor, but is often considered its predecessor. The unexpectedly weak previous ADP report disappointed market participants betting on the strengthening of the dollar. According to this report, 330 thousand jobs were created in the private sector of the US economy in July, while the forecast assumed an increase of 695 thousand after a similar increase (+680 thousand) in June. The US private sector created 613,000 jobs in August, according to today's ADP report, which is slated for release at 12:15 pm (GMT). If the data coincide with the forecast or turn out to be better than it, then the dollar is likely to strengthen. Otherwise, the dollar will weaken.

Thus, one should expect a significant increase in volatility in the first half of today's American trading session.

Returning to the topic of the dynamics of the US dollar in relation to the main commodity currencies, today its weakening against the Canadian, New Zealand, Australian dollars continues.

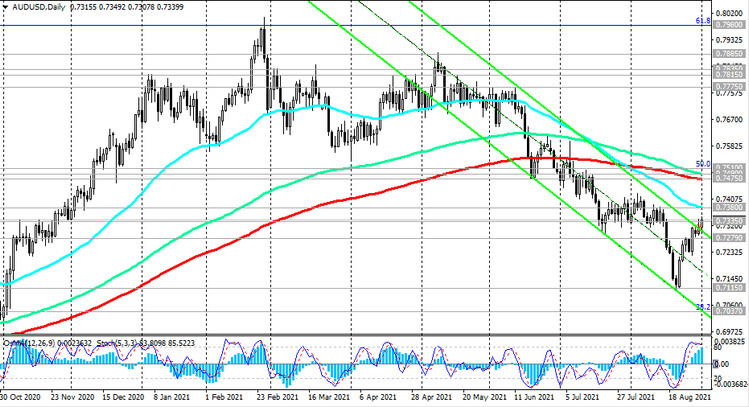

At the time of this posting, AUD / USD is traded near 0.7340, at yesterday's high.

This morning, the Australian dollar received support from the Australian Bureau of Statistics data, according to which, in the 2nd quarter, Australian GDP grew by +0.7% (vs. +0.5% forecast) and +9.6% in annual terms (vs. forecast +9.2%). The data, which indicated that Australia's economy grew faster than expected in the 2nd quarter, eased fears of a recession and raised the likelihood of a cut in RBA monetary stimulus (a quantitative easing program has been running since late 2020, helping the Australian economy recover). The central bank believes that with the abolition of lockdowns, costs will begin to grow to such an extent that economic growth will quickly recover and will reach pre-crisis levels in 2022. However, there is almost no guarantee that growth will recover quickly. In some parts of Australia, it has not yet been possible to contain the spread of the virus. This could predetermine the decision of the RBA next week not to change the parameters of the current monetary policy and not to begin to reduce stimulus. And this is still a negative factor for the AUD.