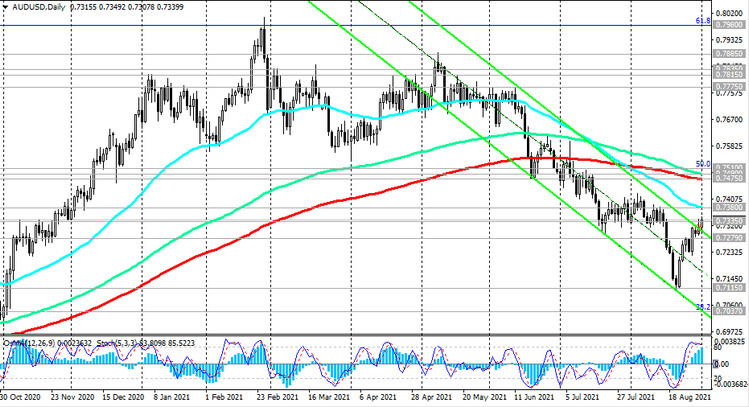

Over the past few days, AUD / USD has consistently broken through the resistance levels 0.7279 (ЕМА200 on the 1-hour chart), 0.7300 (the upper line of the descending channel on the daily chart), 0.7335 (ЕМА200 on the 4-hour chart) and is now heading towards the strong resistance level 0.7380 (ЕМА50 on the daily chart).

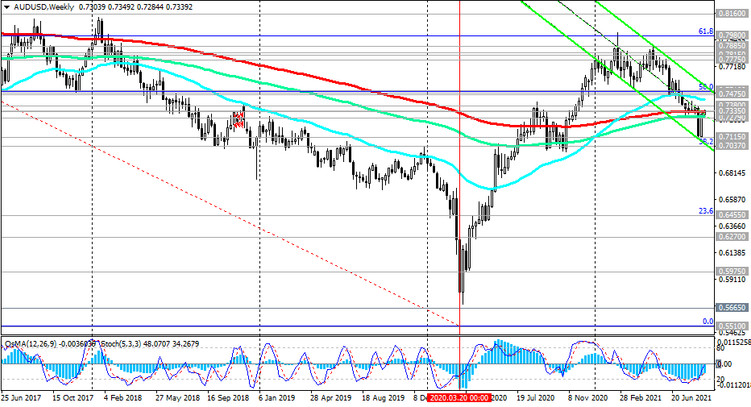

Technical indicators OsMA and Stochastic on 4-hour, daily, weekly charts also switched to the buyers' side.

At the start of today's European session, the AUD / USD pair is traded near 0.7340, at yesterday's high, maintaining positive momentum.

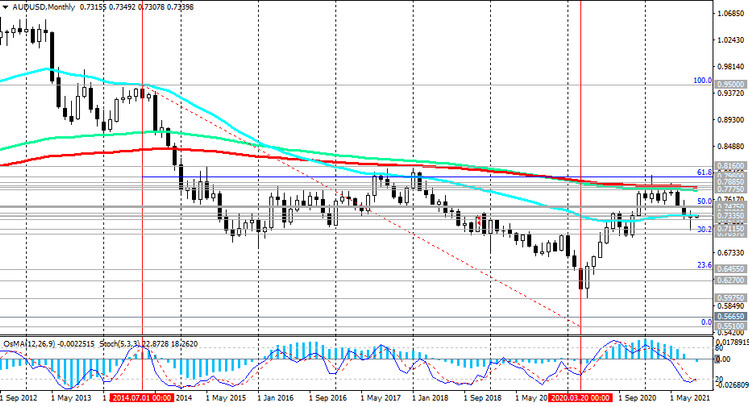

In case of a breakdown of the resistance level 0.7380, the prospect of further growth towards the key long-term resistance levels 0.7475 (ЕМА200 on the daily chart), 0.7490 (ЕМА144 on the daily chart), 0.7510 (50% Fibonacci retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510) opens. However, only a convincing rise into the zone above these resistance levels will indicate the resumption of the long-term upward trend in AUD / USD.

In an alternative scenario, the first signal for a reversal and resumption of the downtrend will be a breakdown of the short-term support level 0.7335 (EMA200 on the 4-hour chart). A breakdown of the support level 0.7279 will confirm this scenario, and AUD / USD will go deep into the descending channel on the daily chart, towards its lower border and support level 0.7037 (Fibonacci level 38.2%).

Support levels: 0.7335, 0.7279, 0.7115, 0.7037

Resistance levels: 0.7380, 0.7475, 0.7490, 0.7510

Trading Recommendations

Sell-Stop 0.7330. Stop-Loss 0.7355. Take-Profit 0.7300, 0.7279, 0.7115, 0.7037

Buy Stop 0.7355. Stop-Loss 0.7330. Take-Profit 0.7380, 0.7475, 0.7490, 0.7510