The dollar continues to decline after the last week's economic symposium in Jackson Hole. As of this writing, DXY dollar futures are traded near 92.45 mark, 25 points below Friday's close.

Investors continue to assess statements by Fed Chairman Jerome Powell regarding the central bank's plans to move to phasing out stimulus policy later this year. Powell's speech did not contain a clear signal of the timing of the start of such a roll-off. At the same time, Powell expressed concern about the continued spread of the coronavirus, still considering the rise in inflation in the United States to be a temporary phenomenon. Fed executives “are ready to adjust (policy) as appropriate to achieve our goals”, Powell said, implying, above all, a complete labor market recovery.

Based on the rhetoric of Powell's statements, market participants suggested that hardly any changes in the Fed's policy should be expected, at least until the November meeting of the central bank.

In this regard, market participants will closely follow the publication on Friday (at 12:30 GMT) of the monthly data on the US labor market. It is estimated that 750,000 new jobs outside agriculture were created in August, and unemployment fell to 5.2% (from 5.4% in July). In July, 943 thousand jobs were added in the United States as a whole, but their number remained 5.7% less than in the pre-crisis February 2020. In the spring and early summer, the number of Covid-19 cases and hospitalizations declined, which boosted employment. Now, the spread of the delta strain is negatively affecting business activity and may slow the recovery of the labor market.

The unexpectedly weak ADP private sector employment report released on Wednesday disappointed market participants. According to this report, 374 thousand jobs were created in the private sector of the US economy in August, while the forecast assumed an increase of 613 thousand after an increase of 326 thousand in July. This is the second in a row (after the June report) an openly weak ADP report, which is almost 2 times less than the forecast values. This report does not directly correlate with the report from the US Department of Labor, but is often viewed by its predecessor. If the official data of the US Department of Labor also turn out to be significantly worse than the forecast, then the dollar may sharply decline, as a weak report will reduce the likelihood of a soon start to curtail the Fed's stimulating policy. A recovery in the labor market is a prerequisite for raising interest rates by the US Federal Reserve. In the absence of positive indicators of the state of the labor market, further growth of the dollar will obviously be difficult.

Thus, a sharp increase in volatility in financial markets is expected at the beginning of the American trading session on Friday.

Market participants will receive additional information on the state of the US labor market today, when at 12:30 (GMT) the latest data on applications for unemployment benefits will be published, which can be used to judge the number of layoffs. According to economists, at the end of August the number of initial jobless claims was close to a pandemic low, at about 345 thousand applications. If the weekly data on the number of jobless claims also turn out to be worse than the forecast, then the sentiment of the dollar buyers will worsen even more on the eve of tomorrow's publication of the monthly report of the US Department of Labor. At the same time, every deterioration in the macroeconomic situation, especially in the labor market, gives investors and stock market participants hope that the US central bank will continue to support the markets.

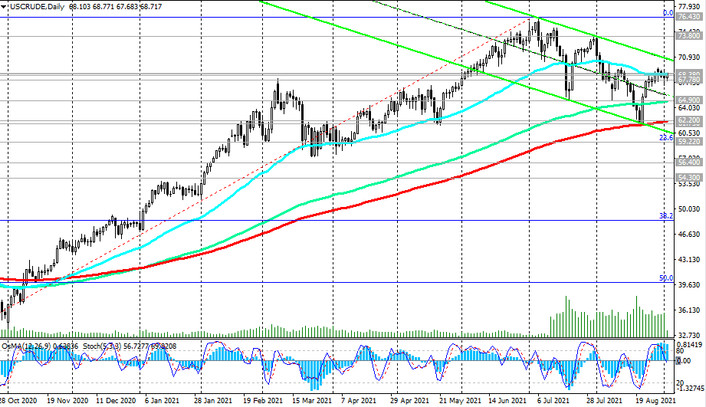

Meanwhile, commodity prices have moved up again, including amid a weakening dollar. Oil prices are also rising after the decline the day before. As of this writing, WTI crude oil futures are traded near $ 68.73 per barrel, remaining in the bull market zone.

Meanwhile, oil market participants continue to analyze the conflicting information received yesterday from the Energy Information Administration (EIA) of the US Department of Energy. According to it, commercial oil reserves in the week of August 21-27 fell by 7.2 million barrels to 425.4 million barrels (the forecast assumed a decrease in reserves by 2.8 million barrels) and remain about 6% below the average 5-year value for this time of year. Crude oil inventories fell again last week after three consecutive weeks of decline. This is a positive factor for prices.

At the same time, production volumes climbed to a 15-month high. According to the EIA, oil production in the United States increased by 100,000 barrels per day, to 1.5 million barrels per day, the highest since May 2020.

The mood of the oil market participants also slightly deteriorated after the OPEC+ meeting on Wednesday. In July, the oil alliance agreed to increase production by 400,000 barrels per day each month, before completely winding down production cuts imposed last year at the height of the coronavirus pandemic.

Some traders had previously hoped for a pause in the implementation of OPEC+ plans to increase oil production. However, a press release issued following Wednesday's meeting indicated that OPEC+'s total oil production in October will be increased by 400,000 barrels per day. Thus, OPEC+ intends to follow the agreements providing for the increase in production. And this is a negative factor for oil prices in conditions when it is not fully understood how the demand for oil will grow in the face of the possibility of new lockdowns due to the coronavirus.

Another negative factor for prices may be the publication tomorrow (at 17:00 GMT) of a report on oil platforms from the oilfield services company Baker Hughes. Previous data from Baker Hughes reflected an increase in the number of active rigs to 410 units (versus 405, 397, 387, 385, 387, 380, 378, 376, 372, 365, 359, 356, 352, 344 in previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil quotes, although it will be of a short-term nature, especially after the publication of monthly data from the US labor market.