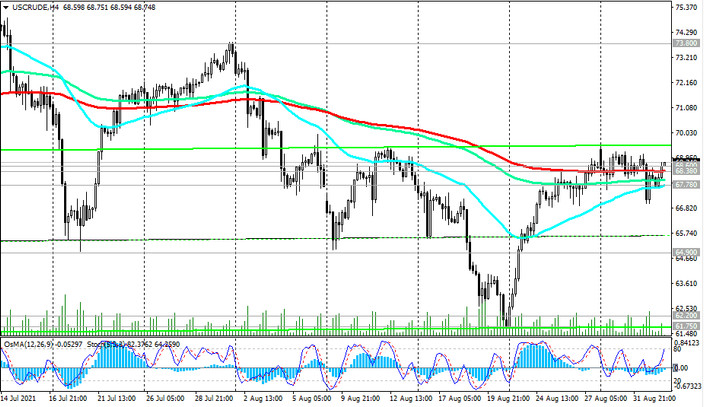

To date, the price of WTI has recovered by about half after falling in the first half of August.

At the time of publication of this article, WTI crude oil futures are traded above important support levels 67.78 (EMA200 on the 1-hour chart), 68.38 (EMA200 on the 4-hour chart), trying to gain a foothold in the zone above the support level 68.60 (EMA50 on the daily chart).

The breakdown of the resistance levels 69.50, 70.20 (the upper border of the descending channel on the daily chart) will be another confirming signal in favor of the resumption of long positions with targets at resistance levels 73.80, 76.43 (local multi-year highs and a maximum in a wave of growth from absolute lows near 3.42, reached during the collapse of prices in April 2020).

In an alternative scenario, a breakdown of the support level 67.78 will be a signal to open short positions with targets near the key support level 62.20 (ЕМА200 on the daily chart).

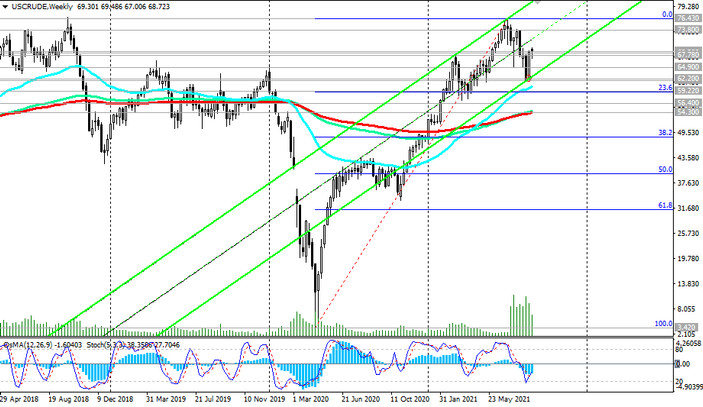

Further decline and a breakdown of the support level 54.30 (ЕМА200 on the weekly chart) will bring WTI oil back to the bear market.

Support levels: 68.60, 68.38, 67.78, 64.90, 62.20, 61.75, 60.00, 59.22, 56.40, 54.30

Resistance levels: 69.50, 70.20, 71.00, 72.00, 73.80, 75.00, 76.43

Trading recommendations

Sell Stop 66.90. Stop-Loss 69.60. Take-Profit 66.00, 64.90, 62.20, 61.75, 60.00, 59.22, 56.40, 54.30

Buy Stop 69.60. Stop-Loss 66.90. Take-Profit 70.20, 71.00, 72.00, 73.80, 75.00, 76.43