On the eve of the publication (at 12:30 GMT) of the monthly data on the US labor market, the dollar remains under pressure, although its decline has also stopped. As of this posting, DXY dollar futures are traded near yesterday's close at 92.22, 150 pips below the local 9-month high of 93.75 reached on Aug.20.

Futures on major US stock indices, although maintaining positive dynamics, are traded in narrow ranges. Just in case, investors remain cautious ahead of the publication of data on the US labor market. It is estimated that 750,000 new jobs outside agriculture were created in August, and unemployment fell to 5.2% (from 5.4% in July). This, in general, is positive data, although it is worse than the previous data (in July, 943 thousand jobs were added in the USA).

The possibility of a new round of cases of infection with Covid-19, now with its new strain "delta", carries the threat of new lockdowns, a slowdown in business activity and a recovery in the labor market.

Earlier, the head of the Fed, Jerome Powell, repeatedly stated that the main reference point for the central bank when deciding on monetary policy is the full recovery of the labor market and its return to pre-crisis levels, when the American economy created an average of 150-250 thousand new jobs every month and unemployment was between 4% and 5%.

Now, despite the impressive growth in the number of jobs (+938 thousand and +943 thousand in June and July), there are still 5.7 million less than in the pre-crisis February 2020.

Based on the rhetoric of recent statements Powell made last week during the Jackson Hole economic symposium, market participants suggested that it is unlikely to expect any changes in the Fed's policy, at least until the November meeting of the central bank. Powell did not set a timeline for a possible start to curtail the Fed's stimulus program, expressing concern about the continued spread of the coronavirus, still considering the rise in inflation in the United States to be a temporary phenomenon.

The unexpectedly weak ADP report on employment in the private sector, published on Wednesday, which for the second time in a row (after the June report) is almost 2 times below the forecasted values, disappointed market participants. This report does not directly correlate with the report from the US Department of Labor, but is often viewed by its predecessor. If the official data of the US Department of Labor also turn out to be significantly worse than the forecast, then the dollar may sharply decline, since the weak report will reduce the likelihood of an early start to curtail the Fed's stimulating policy.

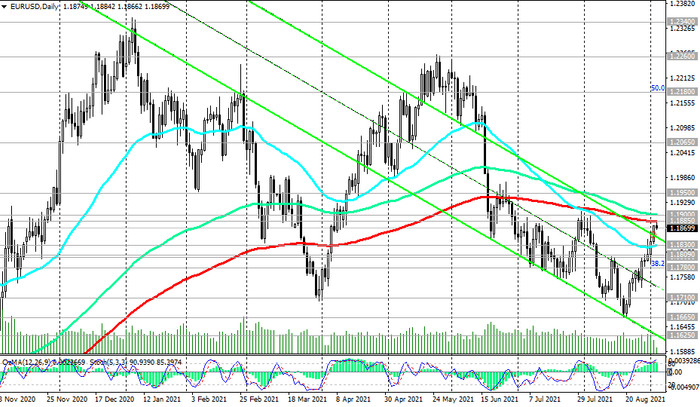

The main competitor of the dollar in the foreign exchange market, the euro, has significantly strengthened against it in the last 2 weeks. At the time of publication of this article, the EUR / USD pair was traded near the 1.1870 mark, close to the key long-term resistance level 1.1885. In the previous review for Aug.30, we assumed that “if the resistance level 1.1800 is broken, further growth of EUR / USD should be expected. In this case, the growth of EUR / USD may accelerate in the direction of 1.1885, 1.1905 marks”. Today's intraday high is fixed at 1.1884 mark. Thus, our forecast was fully justified. But what's next? Will there be a breakout of the resistance levels 1.1885, 1.1900?

The euro has hardly reacted to the publication at the beginning of today's European session of the data provided by the agency Eurostat.

Eurozone retail sales in July fell 2.3%, while in June it rose 1.8%, according to revised data. Compared to the same period last year, retail sales rose 3.1% in July after rising 5.4% in June. Earlier data showed that Eurozone GDP grew 2.0% in Q2, and economists expect Q3 to be good as well, despite delta coronavirus concerns and supply chain problems remain a bearish factor.

Earlier this week, ECB officials Robert Holtzmann and Klaas Noth suggested that the central bank will soon begin phasing out its Emergency Bond Purchase Program (PEPP).

Some representatives of the ECB have previously expressed a tendency to tighten policy. As you know, the meeting of the European Central Bank will be held next week, September 9. And now market participants will wait for new signals that more ECB leaders are in favor of cutting stimulus. If indeed such signals from the ECB leadership appear, then one should expect the euro to strengthen, including in the EUR / USD pair. However, on condition - if the leaders of the FRS continue to signal their commitment to the implementation of the stimulating policy in the same parameters.

In the meantime, the dynamics of EUR / USD largely depends on the dynamics of the dollar. Market participants fear that today's data on the US labor market may turn out to be significantly worse than the forecasted values. A decrease in the employment rate may push the Fed to postpone the reduction in the volume of purchases of government bonds, the possibility of which was previously suggested by the FRS. In this case, you should wait for the breakout of the resistance levels 1.1885, 1.1900 (see Technical Analysis and Trading Recommendations).

A recovery in the labor market is a prerequisite for raising interest rates by the US Federal Reserve. In the absence of positive indicators of the labor market, further growth of the dollar, obviously, will be difficult.

In any case, on Friday at the beginning of the American trading session, one should be prepared for a sharp increase in volatility in financial markets, and above all in dollar quotes.