The dollar continues to strengthen in the foreign exchange market, futures for major US and world stock indices are falling. Apparently, our assumption that market participants considered the dollar weakening after the NFP publication and over the past 2 weeks to be excessive, turns out to be correct.

DXY dollar index futures are traded near 92.70 in early European session today, 90 pips above a local 9-week low of 91.80 hit late last week.

The general trend of dollar strengthening is likely to continue in the near future. The increase in the number of infected COVID-19 in the United States and the possible extension of lockdowns in various countries with the largest economies outside the United States create the prerequisites for this.

In addition, despite contradictory data from the US Department of Labor, published last Friday (the number of jobs outside agriculture in the country in August rose by 235,000 instead of the expected +750,000, but the unemployment rate fell to 5.2% from 5.4% in July), many market participants and economists suggest that the Fed may indeed start phasing out its stimulus policy soon.

Although the opinions of economists and market participants on this matter were divided, a significant part of them still believe that, based on the continuing improvement in the state of the labor market, albeit at a slower pace in August, the Fed is likely to report on the pace of the upcoming withdrawal of stimulus at the November meeting. In their opinion, the Fed's plans can change only if the data on the labor market in September and October also turn out to be disappointing.

“The Fed is ready to adjust its approach to monetary policy if necessary”, said an accompanying statement following a recent central bank meeting, and the FOMC “will take into account a wide range of information, including data on the epidemiological situation, labor market conditions, inflationary pressures and inflation expectations, events in financial markets, as well as international events". While risks to the economic outlook remain due to the pandemic, progress in vaccinations will help reduce the economic impact of the coronavirus.

Consumer price inflation may exceed 2% for some time, the Fed believes. However, it is already about 2 times higher than the target level of 2%. Its further growth, nevertheless, will force the leaders of the FRS to pay attention to this.

And if this is so, then a decrease in the volume of cheap liquidity entering the markets (since July 2020, the Fed has been buying back assets in the government bond market in the amount of $ 120 billion every month), will contribute to the strengthening of the dollar, even if the Fed's interest rate remains at the same level of 0.25 %.

This week, two more of the world's largest central banks (Bank of Canada and the ECB) are deciding on their monetary policies. The decision on the interest rate of the Bank of Canada will be published today (at 14:00 GMT), and we talked about this in our review yesterday. The ECB meeting will be held on Thursday, and its decision on the interest rate will be published at 11:45 (GMT). At 12:30 a press conference by the ECB will begin, during which the largest surge in volatility in euro quotes is expected, which will also affect the entire financial market. In previous years, based on the results of some ECB meetings and subsequent press conferences, the euro exchange rate could change by 3% -5% in a short time.

ECB leaders will assess the current economic situation in the Eurozone and comment on the bank's decision on rates. The softer tone of the statements will have a negative impact on the euro. Conversely, a tough tone from ECB officials on central bank monetary policy will strengthen the euro.

Recently, there have been signals from some ECB officials that the central bank may soon begin phasing out the Emergency Bond Purchase Program (PEPP).

And now market participants will be waiting for news that an increasing number of ECB leaders are in favor of cutting stimulus. If indeed such signals from the ECB leadership appear, then one should expect the euro to strengthen, including in the EUR / USD pair. Although, in general, the prevailing opinion is that the ECB will leave the current policy and inflation forecasts for 2022 and 2023 unchanged tomorrow, expressing a tendency to continue soft policy. According to the revised data released on Tuesday, in the second quarter the Eurozone GDP grew by 2.2%, but was 2.5% below the pre-crisis level. Although strong growth is expected in the 3rd quarter, according to some economists, a sharp slowdown in Eurozone GDP growth in the 4th quarter is expected, and this will put pressure on the ECB to maintain a supportive monetary policy.

According to some reports, net purchases of corporate bonds of the ECB in the week of August 28 - September 3 rose by 1.874 billion euros, reaching the highest weekly level since mid-June. Despite the expected slowdown in the PEPP program in the 4th quarter, purchases of corporate bonds under the QE program, which account for about 90% of total purchases of ECB corporate bonds, are likely to remain unchanged on average, economists say.

In the meantime, the dynamics of EUR / USD largely depends on the dynamics of the dollar. If the Fed representatives continues to signal about the need to tighten the current monetary policy already this year, then against the background of the continuing spread of the coronavirus, the strengthening of the dollar and the fall of the EUR / USD pair will become almost inevitable.

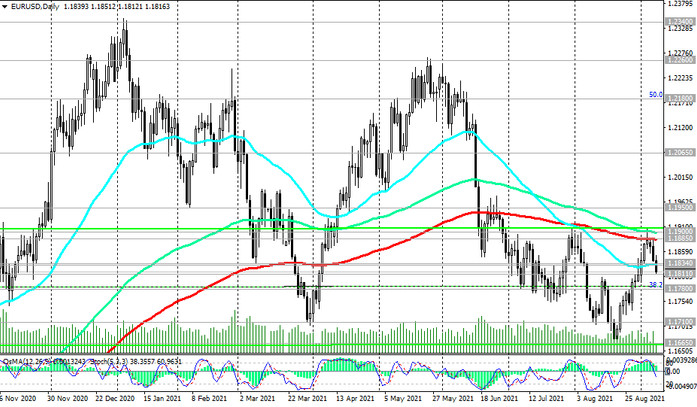

In the short term, a breakout of the 1.1811 support level will trigger a further decline in EUR / USD (see Technical Analysis and Trading Recommendations).