This week, statistical offices of several countries with economies that are of key importance to the entire world economy will present fresh data on inflation. Today (at 12:30 GMT) such data will be presented by the US Bureau of Labor Statistics. The Consumer Price Index (CPI), which is a key indicator for assessing inflation and changes in consumer preferences, is expected to come out with a reading for August of +0.4% (versus +0.5% in July) and +5.3% in annual terms (versus +5.4% in July). Despite the relative slowdown, the indicator points to continued growth in US inflation.

Obviously, the huge amounts of liquidity pumped by the Fed into the financial system, and the trillions of government assistance programs, would sooner or later lead to higher inflation. Probably, very soon the issue of curbing the excessive growth of inflation in the country will become acute, despite the assurances of the FRS leadership that the rise in inflation is a temporary phenomenon. And this means that this year the Fed may begin to wind down its stimulus programs.

Many Fed officials have said in recent interviews and public speeches that they could begin to cut their monthly bond purchases by the end of this year if economic growth reaches expected levels. At the same time, inflationary pressures and the recovery of the labor market remain the key factors that may affect the timing of the curtailment of programs. However, it will be a big surprise for market participants if the leaders of the FRS announce this already at the September meeting (most economists still expect that the Fed will announce the beginning of a reduction in the volume of purchases on the government bond market in November).

Of course, one of the key priorities in determining the dynamics of the exchange rate is the monetary policy of the country's central bank.

So, the Australian dollar today fell sharply during the Asian trading session only because the Governor of the Reserve Bank of Australia Philip Lowe said about the restrained approach of the central bank to the issue of the possibility of tightening monetary policy. According to him, the targets for inflation and wage growth set by the central bank will not be achieved for a long time. "It is difficult for me to understand why the market quotes take into account the rate hike next year or early 2023", he said.

Tomorrow (at 06:00 GMT) the latest information on the inflation rate will be published by the UK Office for National Statistics, and at 12:30 - by the Statistics Canada.

The Canadian dollar receives support from rising oil prices (today OPEC raised its forecast for oil demand in 2022 by 1.1 million barrels per day, to 28.7 million barrels per day)

and from positive statistics on the national labor market, published last Friday. According to it, the unemployment rate fell to 7.1% in August (from 7.5% in July), which also turned out to be better than the forecast of 7.3%. Employment increased by 90.2 thousand in August. The index of capacity utilization, also published on Friday, indicated an increase in the value to 82.0% (against the forecast of 81.2% and 81.4% in July) was also positively received by market participants, providing support CAD.

Last week, the Bank of Canada left its key rate unchanged at 0.25%, and announced its intention to continue buying bonds at the same pace, having also announced its intention to raise interest rates in the second half of 2022. But that decision will also depend on the "strength and resilience" of Canada's economic recovery. “The growing number of coronavirus cases and continuing supply chain disruptions could impede economic recovery”, the Bank of Canada said.

However, we add that this (the growing number of cases of coronavirus infection and ongoing disruptions in supply chains) is an almost global problem at the present time.

Economists suggest that the consumer price index (CPI) from the Bank of Canada, which reflects the dynamics of retail prices of the corresponding basket of goods and services, rose by +0.1% (+3.9% in annual terms) in August against +0.6% (+3.7% YoY) in July 2021, which is likely to have a positive impact on CAD. The inflation target for the Bank of Canada is in the range of 1% -3%. Therefore, an increase in CPI is a harbinger of a rate hike and a positive factor for CAD.

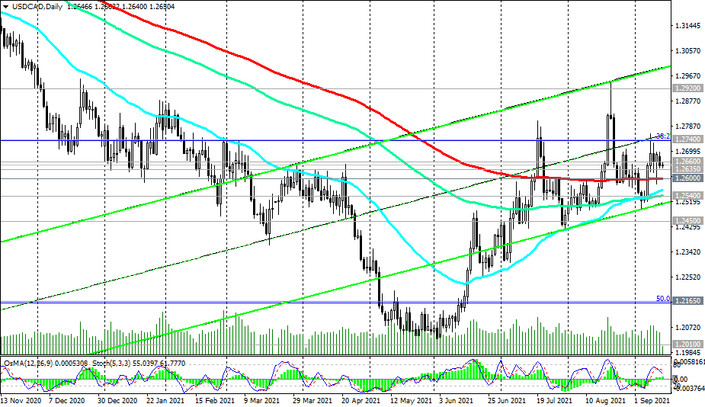

Returning to today's publication (at 12:30 GMT) of the CPI for the United States, economists expect the value of the annual core inflation rate (excluding food and raw materials prices) at 4.2%, which is below the July value of 4.3%. Probably, this still will not be enough for the FRS to start curtailing the quantitative easing program after the September meeting (September 21-22). If the annual indicators of CPI and Core CPI turn out to be even lower than the forecast, then the timing of the start of curtailing the Fed's QE program will move to a later date. In this case, the USD may fall sharply, including in the USD / CAD pair.