As of this posting, DXY dollar futures are traded near 92.80 mark, declining from an intra-week high reached Thursday at 92.94, which is also corresponding to the levels of 3 weeks ago.

Probably, the buyers of the dollar took a break, deciding to also fix the profit at the end of the week, before the next jerk of the dollar “to the north”.

Many economists believe that it is unlikely to expect a stronger weakening of the dollar on the eve of the Fed meeting next week.

Since March 2020, the Fed has maintained its key rate at 0.25%, purchasing at least $ 120 billion in government bonds and mortgage bonds every month since June 2020. The next Fed meeting will be held on September 21-22, and, most likely, the leaders of the central bank will keep the soft monetary policy in force, but may declare the possibility of starting the curtailment of the QE program this year. Many economists believe that the Fed may begin this process after the November meeting. Recently, the positive macro data came from USA indicating the ongoing recovery of the labor market and economics amid continued high inflation rates.

On Thursday, the USD received a new impetus to growth after the publication of strong statistics on the dynamics of retail sales, the volumes of which increased by +0.7% in August (against the forecast of -0.8% and a fall of -1.1% in July). Retail sales of the control group of goods showed an increase in August by +2.5%.

The index of activity in the manufacturing sector of the Federal Reserve Bank of Philadelphia published yesterday also turned out to be positive, indicating an increase in activity in September from 19.4 to 30.7 (the forecast assumed its decline to 19).

Also released on Thursday, the US Department of Labor's weekly report was generally positive. Although the number of initial applications for unemployment benefits in the United States increased and amounted to 332 thousand compared to 312 thousand a week earlier, the total number of people receiving benefits fell to 2.665 million from 2.852 million a week earlier, and the average number of initial claims for the past 4 weeks on September 10 decreased from 340 thousand to 335.75 thousand

Published weekly data from the US Department of Labor did not make any significant changes in the sentiment of market participants and economists expecting further improvement in the state of the economy and the labor market in the country.

Strong macro data once again strengthened market confidence that the US Federal Reserve will resort to tightening monetary policy by the end of this year. The prospect of a reduction in the QE program is once again becoming one of the main drivers of the dollar's growth.

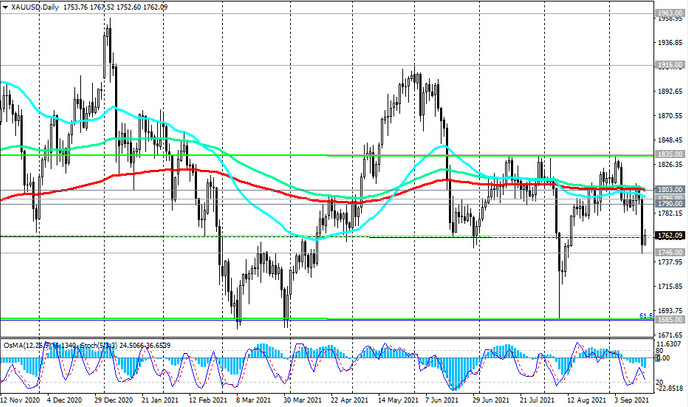

In this regard, it is worth paying attention to yesterday's sharp decline in gold quotes, which renewed 5-week lows. The XAU / USD pair was down 2.3% yesterday, hitting a low since Aug.12 at 1746.00.

During today's Asian trading session, the XAU / USD pair was correcting, having managed to rise to the level of 1767.00. However, at the time of publication of this article, its decline has resumed, and the pair was traded near the mark of 1762.00.

The resumed growth in the yield of US government bonds since the beginning of August also contributes to the fact that investors give preference to government bonds over gold, which, as you know, does not bring investment income. At the same time, gold quotes are extremely sensitive to changes in the Fed's monetary policy.

During a late August speech at Jackson Hole, Fed Chairman Jerome Powell said that "if the economy as a whole evolves as expected, it might be appropriate to move to a slowdown in asset purchases later this year".

The expected tightening of the Fed's monetary policy this year (many economists believe that the Fed will announce asset roll-off at its November meeting, and start curtailing asset purchases in December) will contribute to a decrease in gold quotes. The reduction in the volume of purchases by the Fed in the US government bond market will be a harbinger of an increase in interest rates. And this is an extremely negative factor for gold, since the cost of borrowing for its purchase and storage will grow.

Today, market participants will pay attention to the publication at 14:00 (GMT) of the preliminary consumer confidence index of the University of Michigan. This indicator reflects the confidence of American consumers in the economic development of the country. A high level indicates economic growth, while a low level indicates stagnation. Previous values of the indicator: 70.3 in August, 81.2 in July, 85.5 in June, 84.9 in March, 76.8 in February, 79.0 in January 2021. This indicator is expected to be released in September with a value of 72.2. The data show an ongoing, albeit uneven, recovery in consumer confidence. The data worse than the forecast may negatively affect the dollar, but, most likely, only in the short term. Better-than-forecast data will strengthen the dollar and may give the XAU / USD pair a new downward impetus.

And next week the focus of investors will be on the Fed meeting, which will end on Wednesday September 22nd with the publication (at 18:00 GMT) of the decision on the interest rate.