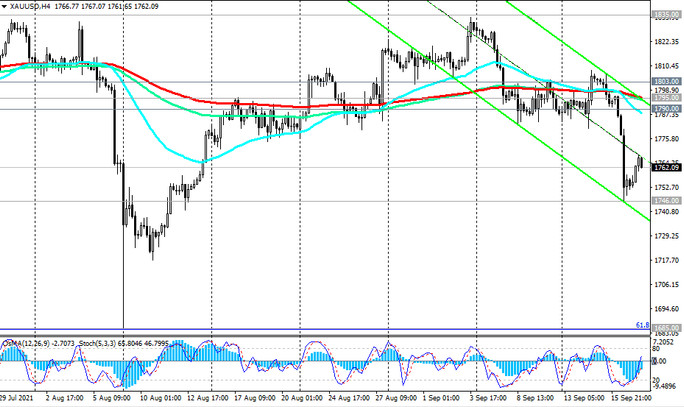

After yesterday's sharp (2.3%) decline today, the XAU / USD pair corrected during the Asian trading session, managing to rise to the mark of 1767.00.

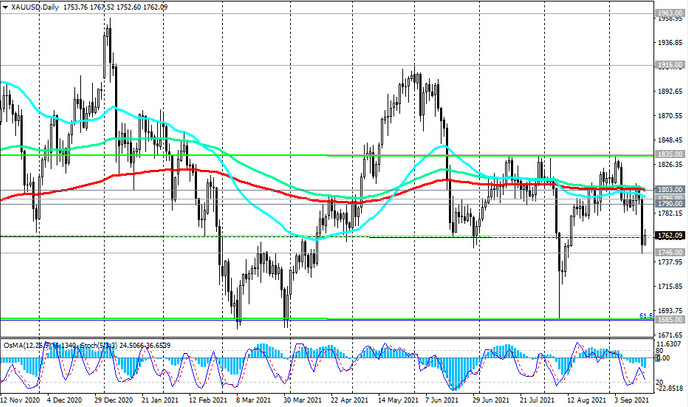

However, at the beginning of the European trading session, its decline resumed, and at the time of publication of this article, the XAU / USD pair is traded near the 1762.00 mark, in the zone below the important resistance levels 1790.00 (ЕМА200 on the 1-hour chart), 1795.00 (ЕМА200 on the 4-hour chart), 1803.00 (ЕМА200 on the daily chart).

Staying below the key resistance level 1803.00, XAU / USD is in the mid-term bear market zone.

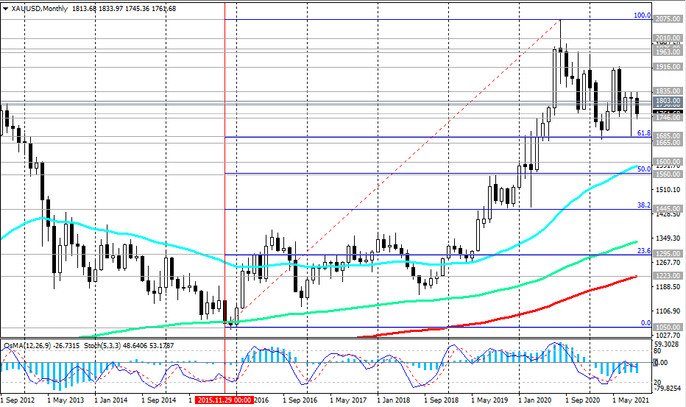

In the event of a breakdown of the local support level 1746.00 (yesterday's lows), the XAU / USD decline will continue towards the long-term support levels 1685.00 (Fibonacci level 61.8% of the correction to the growth wave since November 2015 and the mark of 1050.00), 1665.00 (ЕМА144 on the weekly chart), 1600.00 (ЕМА200 on the weekly chart). A breakdown of the support level 1560.00 (50% Fibonacci level) will increase the risks of the XAU / USD transition into a long-term downtrend.

In an alternative scenario and after the breakdown of the local resistance level 1767.00, further growth of XAU / USD is possible with intermediate targets at the resistance levels 1790.00, 1795.00, 1803.00.

Support levels: 1746.00, 1700.00, 1685.00, 1665.00, 1600.00, 1560.00

Resistance levels: 1767.00, 1790.00, 1795.00, 1803.00, 1835.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1744.00. Stop-Loss 1769.00. Take-Profit 1700.00, 1685.00, 1665.00, 1600.00, 1560.00

Buy Stop 1769.00. Stop-Loss 1744.00. Take-Profit 1790.00, 1795.00, 1803.00, 1835.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00