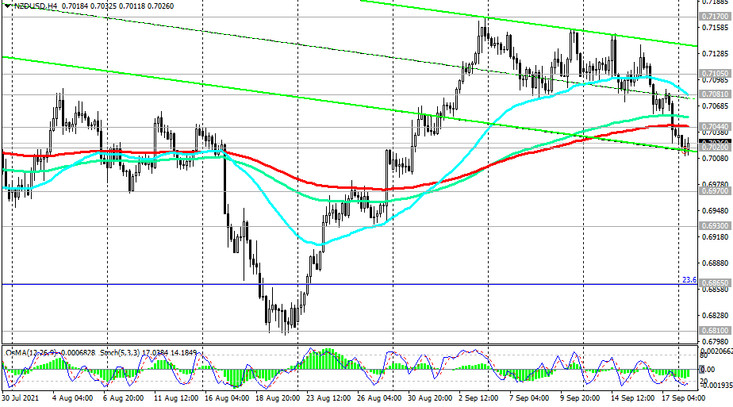

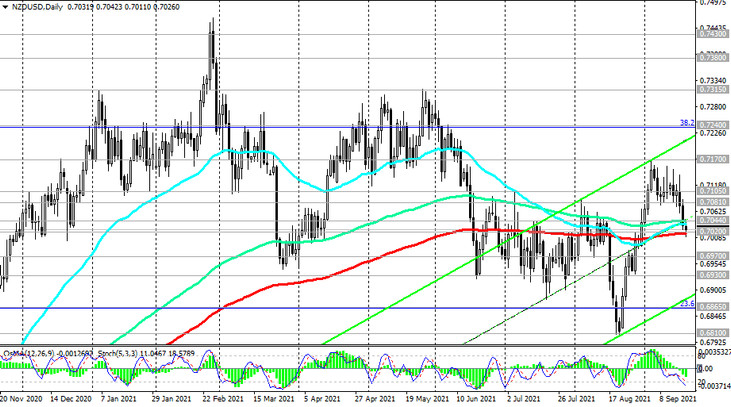

Last week, NZD / USD broke through important short-term support levels 0.7081 (EMA200 on the 1-hour chart), 0.7044 (EMA200 on the 4-hour chart and EMA50, EMA144 on the daily chart) and found support at the key level 0.7020 (EMA200 on the daily chart).

Nevertheless, technical indicators OsMA and Stochastic on the daily chart recommend short positions.

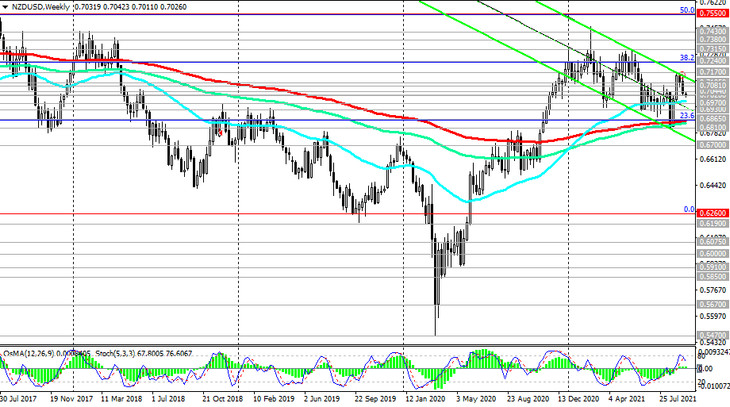

Therefore, a breakdown of the support level 0.7020 can provoke a deeper decline within the descending channel on the weekly chart towards the support level 0.6700 (the lower line of the descending channel on the weekly chart) with intermediate targets at support levels 0.6865 (ЕМА200 on the weekly chart and Fibonacci level 23.6% retracement in the global wave of the pair's decline from the mark of 0.8820), 0.6810 (lows of the year).

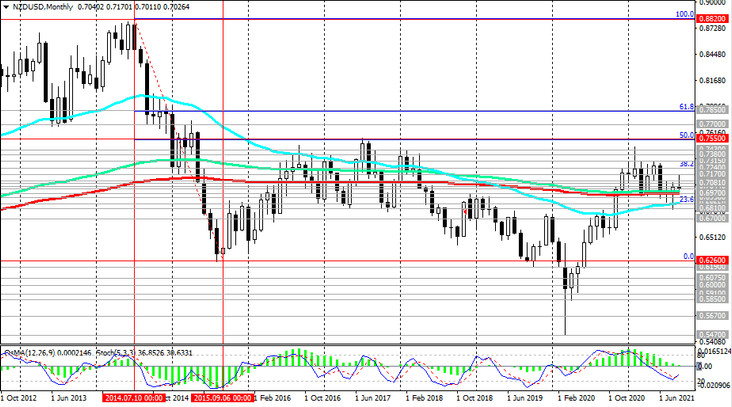

A breakout of the 0.6700 support level could finally push the NZD / USD into the bear market zone and return it into the global downtrend that began in July 2014.

In an alternative scenario and after the breakdown of the resistance level 0.7044, the growth of NZD / USD may resume with targets at the resistance levels 0.7170, 0.7240 (Fibonacci 38.2% and the upper border of the ascending channel on the daily chart). More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

Support levels: 0.7020, 0.7000, 0.6970, 0.6930, 0.6865, 0.6810, 0.6750, 0.6700

Resistance levels: 0.7044, 0.7081, 0.7105, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.6990. Stop-Loss 0.7050. Take-Profit 0.6970, 0.6930, 0.6865, 0.6810, 0.6750, 0.6700

Buy Stop 0.7050. Stop-Loss 0.6990. Take-Profit 0.7081, 0.7105, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600