Market participants and economists were divided on the short and medium term prospects for the dollar. Some of them believe that the dollar will strengthen after the Fed signaled the possibility of starting to curtail asset purchases in November and raising interest rates by the end of next year.

Others believe that the dollar has exhausted its short-term upside potential after the US Federal Reserve, following its regular meeting on Wednesday, expectedly maintained its monetary policy parameters, although it signaled that it could begin to wind down its asset purchase program in November, and next year to raise interest rates. According to the official statement of the Federal Reserve Committee on Open Market Operations (FOMC), the slowdown in asset purchases may be announced at the next meeting, which will be held on November 2-3.

However, there is no consensus on this issue among the members of the FRS leadership. About half of them still believe that an increase in interest rates is possible only by the end of 2022.

Several executives have spoken in favor of slowing purchases as they are worried about high inflation and want the Fed to be ready to raise rates next year if needed. Another group of executives were more cautious, pointing out the risks associated with the rising incidence of Covid-19, which could lead to a slowdown in hiring.

A year ago, central bank executives talked about their intention to buy assets at the same pace until the economy makes "significant progress" towards the targets, in particular, the recovery of 10 million jobs lost since the start of the pandemic and the return of inflation to the target level of 2.0%. To date, annual inflation is 2 times the target, and the Fed's asset portfolio has grown to $ 8.4 trillion from $ 4.2 trillion in February 2020.

However, the rise in prices has largely reflected supply chain disruptions, a shortage of goods and a recovery in tourism activity associated with the lifting of coronavirus restrictions, and Fed Chairman Jerome Powell has repeatedly stated that he considers the rise in inflation to be temporary.

Most Fed executives also forecast inflation to slow to 2.3% in 2022 (up from the June forecast of 2.1%) and to 2.2% in 2023 (up from the 2.1% forecast in June).

New forecasts from the Fed indicate concern over rising incidences of the "delta" strain of coronavirus and continued lack of supply in the labor market, which have hurt the prospects for economic growth. The Fed's leadership is currently forecasting 5.9% GDP growth this year, versus 7% growth forecast in June.

The unemployment rate in August fell to 5.2% from 6.7% in December. However, the US economy has created an estimated 4.7 million jobs since the beginning of this year. This is less than half of those lost due to the coronavirus pandemic. Thus, employment remains the main obstacle to slowing asset purchases, and market participants will closely monitor the dynamics of the labor market recovery by thoroughly studying the weekly US Department of Labor reports, published on Thursday, and monthly reports, published on the first Friday of each month.

Before the next meeting of the FRS (November 2-3), the publication of the October report of the US Department of Labor with September data on the labor market is to be released, and if they turn out to be disappointing, the prospect of an increase in interest rates by the FRS will again move to a later date. This will negatively affect the position of the dollar, but will have a positive effect on US stock indices and quotes of commodities and commodity currencies.

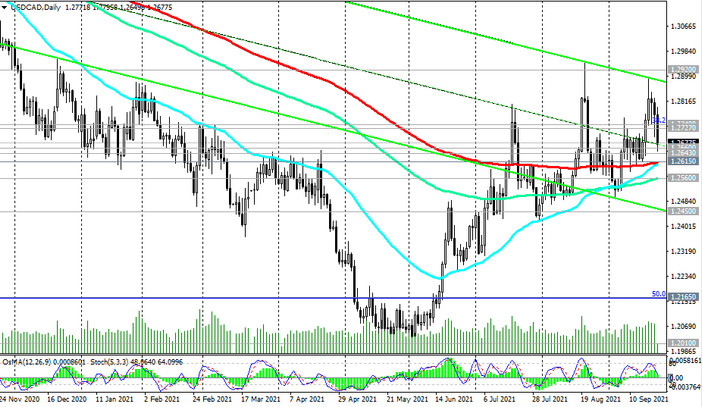

Today we see how the dollar is actively declining after the Fed meeting ended on Wednesday, and especially noticeable against the Canadian dollar, which receives additional support from the growth of oil and gas prices.

At the start of today's European session, the DXY dollar index (DXY futures) is traded 0.3% lower than yesterday's close at 93.7. At the same time, the USD / CAD pair continues to decline, today for the third day in a row, gaining acceleration at the beginning of today's European session.

Today (at 12:30 GMT) Statistics Canada is to release its Unemployment Benefit and Retail Sales Reports. The retail sales index, which is considered an indicator of consumer confidence and reflects the state of the retail sector in the near future, is expected to indicate another rise in the value. The growth of the index is a positive factor for the CAD. The previous value of the index (for June) was +4.2% after falling in March 2020 by -9.9%, in April - by -25% due to quarantine restrictions in connection with the coronavirus. If the data for July turns out to be weaker than the forecast of +4.4% and especially the previous value of +4.2%, then CAD may sharply decline in the short term.

At the same time (at 12:30 GMT) the next weekly report will be presented by the US Department of Labor. It is expected that the number of initial applications for unemployment benefits in the United States in the week to September 16 fell to 322 thousand from 332 thousand a week earlier, which is a positive factor for the dollar. According to the previous report, the total number of Americans receiving benefits fell to 2.665 million from 2.852 million a week earlier, and the average number on initial applications for the past 4 weeks on September 10 fell from 340 thousand to 335.75 thousand. The positive report of the US Department of Labor will strengthen dollar positions. Otherwise, the US dollar will continue to decline, including in the USD / CAD pair.

As we noted above, employment remains the main obstacle to the slowdown in asset purchases by the US central bank and, accordingly, to the strengthening of the US dollar.

Thus, at 12:30 (GMT) a sharp increase in volatility in the USD / CAD pair is expected, especially if the published statistics for the US and Canada differ sharply from the forecast values.