Despite the strengthening of the dollar, gold quotes rose again in the first half of today's trading day after a sharp drop on Thursday, which, in turn, was caused by the growth of government bond yields and expectations of an imminent increase in interest rates from the Fed.

As you know, following a regular meeting on Wednesday, the Fed leaders signaled the possibility of starting to curtail the incentive program for the purchase of assets in November and raising interest rates next year. In their view, if progress in achieving the economic targets set by the central bank continues to meet expectations, then the reduction in asset purchases may soon be justified.

According to the official statement of the Federal Reserve Committee on Open Market Operations (FOMC), the slowdown in asset purchases may be announced at the next meeting, which will be held on November 2-3.

The dollar strengthened sharply on Wednesday, but then also fell sharply on Thursday as market participants probably expected more harsh statements from the Fed leadership regarding the pace of curtailment of the stimulus program.

Based on forecasts presented on Wednesday, only half of the Fed's leaders believe that by the end of 2023 rates will need to be raised by 1 percentage point from current levels and by another three-quarters of a percentage point in 2024.

The other half of the Fed officials called for even greater caution in raising rates, pointing to the risks associated with an increase in the incidence of Covid-19, which could lead to another round of economic recession and a slowdown in the recovery of the labor market.

The unemployment rate in August fell to 5.2% from 6.7% in December. However, the US economy has created an estimated 4.7 million jobs to date, less than half of those lost since the start of the pandemic, when 10 million Americans lost their jobs.

Also, most Fed leaders believe that inflation will slow to 2.3% in 2022 and to 2.2% in 2023.

Thus, the disagreements among FOMC members regarding the timing and necessity of starting the stage of raising interest rates are a constraining moment for a more rapid strengthening of the dollar, and this is a positive factor for gold, which quotes are extremely sensitive to changes in the monetary policy of the world's largest central banks, above all, Fed.

Lingering fears about the growing number of people infected with coronavirus also contribute to the growth of demand for both the dollar and gold, which in this situation serve as protective assets. If inflation continues to grow high, then gold's advantage as a defensive asset will also grow against the dollar.

Gold does not bring investment income, but it is in demand as a protective asset in case of instability in the world and in financial markets, as well as in case of high or rapidly growing inflation.

Probably, the financial markets will be shaken more than once, and the passions will not subside before the Fed meeting in November. However, it is probably not worth waiting for a strong decline in gold quotes, and another or unexpected correction in the stock market will again cause purchases of this precious metal.

So, world stock indices are declining again today, while investors assess the risks due to concerns about the Chinese developer China Evergrande Group. It is one of the largest companies in China and the world, and if something slows economic growth in China, then the growth of the entire world economy will suffer. Today, Evergrande shares on the Hong Kong Stock Exchange have lost more than 12%, and since the beginning of the year - more than 80%. Evergrande is now close to a probable default that could affect global markets and exacerbate gloomy forecasts for the outlook for the global economy.

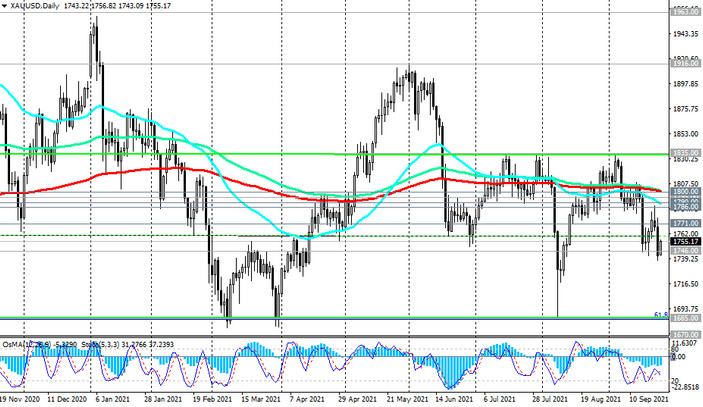

On Thursday, gold prices dropped to $ 1,738.00 an ounce on the back of rising Treasury yields to their highest since July, and today they are rising again, bouncing off 6-week lows. At the time of this posting, XAU / USD is traded near 1755.00 mark, 170 pips ($ 17) above yesterday's low of 1738.00, and a break of important short-term resistance levels 1759.00, 1771.00 (see Technical Analysis and Trading Recommendations) will signal long positions to resume.

Market participants will be watching closely today (at 14:00 GMT) by Fed officials Michelle Bowman, Richard Clarida and Fed Chairman Jerome Powell speeches for new signals about the central bank's monetary policy prospects. The harsh rhetoric of their statements is likely to contribute to the strengthening of the dollar and the fall in gold quotes.

But we emphasize once again that a strong decline in the XAU / USD pair is probably not worth expecting either due to the above factors. If the Fed representatives today do not add anything new to what was said following the Fed meeting on Wednesday, then the growth of gold quotes, even after possibly strong fluctuations, is likely to continue towards the key resistance level and the balance line passing through the 1800.00 mark (or $ 1,800.00 for the troy oz).