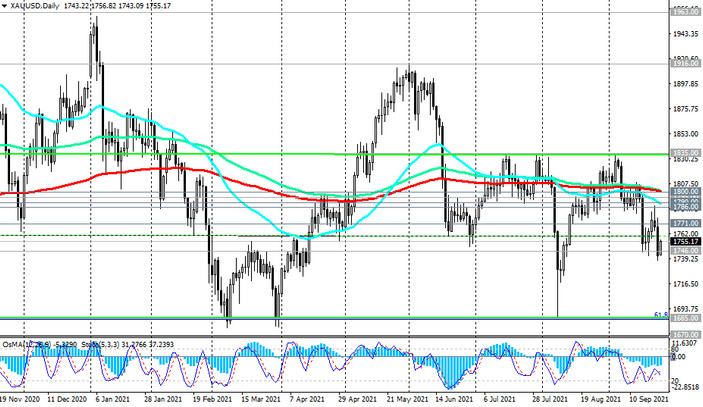

After yesterday's sharp (1.5%) decline, today, the XAU / USD pair corrected during the Asian trading session, managing to rise to the mark of 1756.00. However, further growth of the pair has stalled so far, and at the beginning of the European trading session, XAU / USD is traded near 1755.00 mark, in the zone below the important short-term resistance levels 1759.00 (ЕМА200 on the 15-minute chart), 1771.00 (ЕМА200 on the 1-hour chart).

Staying below the key resistance level 1800.00 (ЕМА200 on the daily chart), XAU / USD is in the mid-term bear market zone.

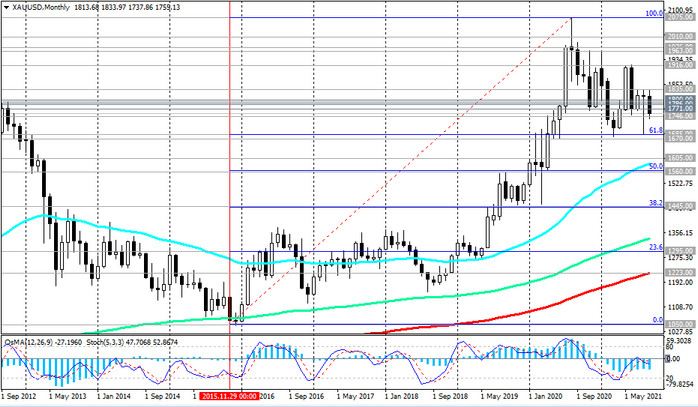

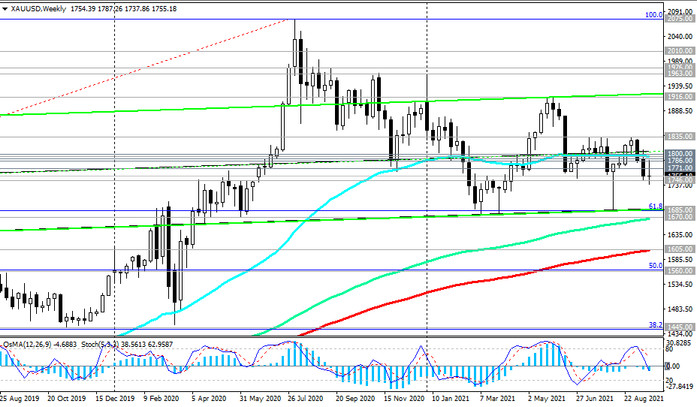

In the event of a breakdown of the local support level 1738.00 (yesterday's lows), the XAU / USD decline will continue towards the long-term support levels 1685.00 (Fibonacci level 61.8% of the correction to the growth wave since November 2015 and the level of 1050.00), 1670.00 (ЕМА144 on the weekly chart), 1605.00 (ЕМА200 on the weekly chart). A breakdown of the support level 1560.00 (Fibonacci level 50%) will increase the risks of the XAU / USD transition into a long-term downtrend.

In the alternative scenario and after the breakdown of the local resistance level 1771.00, further growth of XAU / USD is possible with intermediate targets at the resistance levels 1786.00 (ЕМА200 on the 4-hour chart), 1795.00 (ЕМА50 on the weekly chart), 1800.00.

Support levels: 1738.00, 1700.00, 1685.00, 1670.00, 1605.00, 1560.00

Resistance levels: 1759.00, 1771.00, 1786.00, 1790.00, 1795.00, 1800.00, 1835.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

Sell Stop 1737.00. Stop-Loss 1761.00. Take-Profit 1700.00, 1685.00, 1670.00, 1605.00, 1560.00

Buy Stop 1761.00. Stop-Loss 1737.00. Take-Profit 1771.00, 1786.00, 1790.00, 1795.00, 1800.00, 1835.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00