The dollar strengthened during today's Asian session, continuing to receive support from the growing yields on US government bonds. The DXY dollar index, reflecting the value of the dollar against a basket of 6 major currencies, added 0.14% last week, and today DXY futures (at the time of this article's publication) are traded near 93.41 mark, near the highs of this year and November 2020, in while the yield on US 10-year bonds is at 1.479%, corresponding to the levels of 4 months ago.

Despite the disagreements in the Fed leadership regarding the timing of the start of tightening monetary policy, market participants' expectations boil down to the fact that sooner or later the Fed will still have to start curtailing stimulus programs. The only question is when this process will begin.

While roughly half of Fed officials have called for even greater caution on rate hikes, pointing to the risks associated with rising incidence of Covid-19, which could lead to another round of economic downturn and a slowdown in the recovery of the labor market, the other half of the central bank leaders believes that by the end of 2023, rates will need to be raised by 1 percentage point from current levels and by another three-quarters of a percentage point in 2024.

Considering that the Fed's rates usually change at meetings by 0.25% when such a decision is made, this means that by the end of 2023 rates will increase 4 times and 3 more times in 2024, reaching the level of 2.0% from current 0.25%.

But almost no one doubts that the curtailment of the QE program may begin after the November meeting of the FRS.

This also follows from the official statement of the Fed's Open Market Committee (FOMC), according to which the slowdown in asset purchases may be announced at the next meeting, which will be held on November 2-3. The US Federal Reserve System, following its regular meeting on September 21-22, also signaled that it could raise interest rates next year.

Last year, Fed officials outlined three criteria for rate hikes, according to which annual inflation in the United States should have reached 2.0% and showed a propensity to exceed this level, while the labor market should have returned to levels that would correspond to full employment.

Now inflation has accelerated sharply. At the same time, core inflation, which does not take into account volatile food and energy prices, rose by 3.6% in July (in annual terms).

Thus, the level of employment remains the last obstacle on the way to tightening the Fed's monetary policy. Currently, the US economy has created approximately 4.7 million new jobs. This is less than half the 10 million jobs lost during the coronavirus pandemic.

Before the meeting on November 2 - 3, the next monthly report (with data on employment for September) of the US Department of Labor will be published (October 8). If it turns out to be as encouraging as the July and August reports (according to the August report, 943,000 new jobs were created in the economy, and the average hourly wage rose 4% year-on-year), then the supporters of a tougher position among the Fed leadership will have more arguments in favor of an earlier start of curtailing the stimulus policy.

Thus, the prospect of the imminent start of tightening the monetary policy of the FRS becomes the main driver in the upward dynamics of the dollar, however, provided that positive macro statistics continue to come from the US.

So, already today it is worth paying close attention to the publication (at 12:30 GMT) of the report of the US Census Bureau with data on orders for durable goods and capital goods (excluding defense and aviation). This indicator reflects the value of orders received by manufacturers of durable goods and capital goods (capital goods are durable goods used to produce durable goods and services), implying large investments. Previous values of the indicator "orders for durable goods": -0.1% in July, +0.9% in June, +2.3% in May, -1.3% in April, +1% in March, -1.2% in February, +3.4% in January 2021.

Previous values of the indicator "orders for capital goods excluding defense and aviation": 0% in July, +0.7% in June, +0.1% in May, +2.2% in April, +1% in March, -0.9% in February, +0.6% in January 2021.

The relative growth of the indicator (it is expected that in August the indicators will come out with the values of +0.7% and +0.4%, respectively) should have a positive impact on the dollar.

Data worse than the previous value and the forecast will negatively affect the dollar quotes in the short term.

Volatility in dollar quotes may also increase at 16:00 and 16:50 (GMT), when the speeches of FOMC representatives John Williams and Lael Brainard begin.

Last week, when a regular Fed meeting ended, its chief Jerome Powell said that the US economy had recovered enough for the central bank to announce the start of a reduction in bond buybacks at the next meeting.

If John Williams and Lael Brainard confirm the Fed's inclination to take such a step, then the dollar is likely to strengthen in the short term.

Meanwhile, futures for major US stock indexes are showing mixed performance. If during the Asian session they were growing, then in the first half of today's European session they went down again, returning to the closing levels last week.

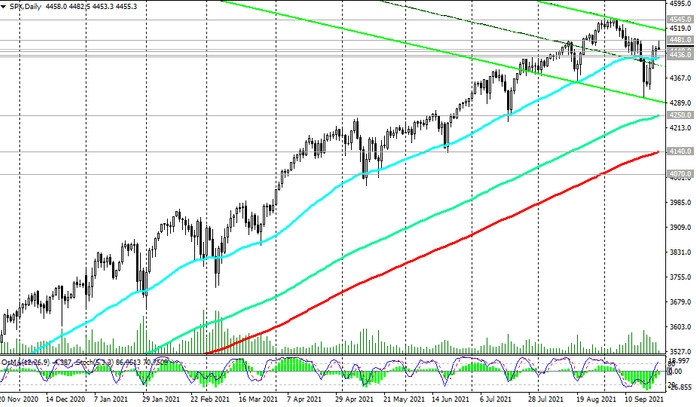

Thus, futures for the S&P 500 broad market index, which strengthened last week and grew in the last 3 trading days, are at 4455.0 at the time of publication of this article, which corresponds to the closing price last Friday.

Fears over the debt problems of the Chinese real estate developer Evergrande Group have eased, and investors are hoping for a further economic recovery after the pandemic.

However, expectations of the imminent start of curtailing the Fed's stimulating policy are a constraining factor for further and more rapid growth of US stock indices. The growing yield on US government bonds since August also indicates that the bond market is mainly dominated by sentiments in favor of leaving traditional defensive assets in favor of the dollar. Falling gold quotes confirm the emerging new trend in the financial market in favor of a new wave of dollar strengthening.