Despite the current decline in US government bond yields, the dollar continues to rise, receiving support from both expectations of a tightening of monetary policy in the US, and as a defensive asset.

The DXY dollar index, reflecting the value of the dollar against a basket of 6 major currencies, added +0.14% last week, and at the time of publication of this article, DXY futures are traded near 93.82, slightly declining from today's intra-week high of 93.90, which, in turn, corresponds to the levels of November 2020.

At the same time, the yield on the American 10-year bonds is at around 1.508%, corresponding to the levels more than 3 months ago. Yesterday it reached a local high of 1.567%. Despite today's decline, which can be attributed to a correction after strong growth the day before, the yield on US government bonds is likely to continue to grow due to the prospect of a soon start to reduce the volume of purchases in the bond market by the Fed. This reduction will lead to a gradual decline in the price of bonds, which, in turn, implies an increase in their yield. A decrease in the volume of purchases in the government bond market by the FRS will also mean a reduction in the volume of dollar liquidity in the financial market and, accordingly, to a rise in the dollar's price.

Having dealt with the factors that contribute to the growth of the dollar, now it is worth paying attention to the dynamics of the British pound, which, like the dollar, is one of the main world currencies and is included in the dollar index along with 5 other currencies (euro, yen, Canadian dollar, Swedish kroon and Swiss franc).

Pound quotes dropped sharply yesterday. Ironically, the announcement by Bank of England Governor Andrew Bailey that interest rates could be raised before Christmas caused the pound to weaken. Andrew Bailey hinted on Monday that despite weak economic growth, the Bank of England may soon raise interest rates to moderate inflation. While tighter central bank monetary policy usually strengthens the national currency, Bailey’s announcement backfired.

Given the challenges facing the UK economy, including post-Brexit, and rising energy prices, which continue to hit record highs, and UK households and businesses find it increasingly difficult to pay their gas, electricity and oil bills, a rise in interest rates could turn out to be a political mistake, which in turn will cause a deterioration in the long-term outlook for the pound, economists say. In the UK, the population is making panic purchases of fuel, many gas stations are closed due to the lack of gasoline, and with the beginning of the heating season, the situation may worsen, which creates preconditions for the exacerbation of the economic crisis in the country.

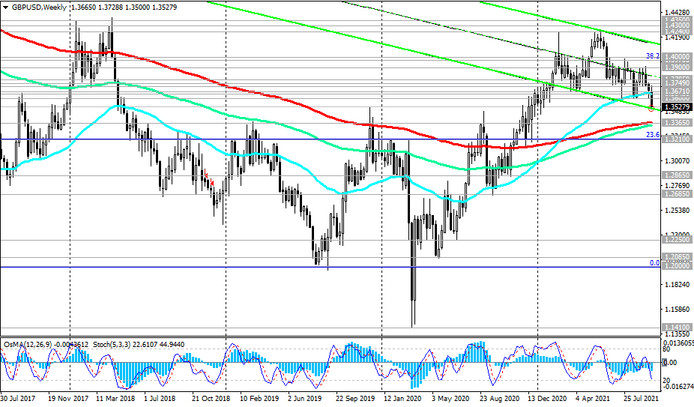

The GBP / USD pair dropped 1.2% yesterday, reaching its lowest level in more than 8 months at 1.3521, and continues to decline today. At the beginning of today's European trading session, the price dropped to 1.3500. A correction is possible today after yesterday's sharp decline, especially if Fed Chairman Jerome Powell, who is scheduled to speak at 15:45 (GMT), does not make tougher statements regarding the monetary policy of the US central bank. In this case, the dollar may decline slightly, retreating from local highs.

In general, the downward trend in GBP / USD towards the key support level 1.3365 is still prevailing (see Technical Analysis and Trading Recommendations). Its break will open the way for a deeper decline and signal a return of GBP / USD to long-term bear market territory.

On Thursday (at 06:00 GMT) another batch of macro statistics from the UK will come, including the final release on UK GDP for the 2nd quarter.

The indicator is expected to deteriorate by -1.5% (after falling by -1.6% in the 1st quarter of 2021 and by -19.8% in the 2nd quarter), which is a negative factor for the pound.