Contradictory macro data released last Thursday prevented the dollar from developing its upward trend. Thus, the growth of initial applications for unemployment benefits for the week of September 24 caused disappointment among market participants. The index rose from 351 thousand to 362 thousand against expectations of a decline to 335 thousand. The Chicago PMI index in September fell from 66.8 to 64.7 points (the forecast assumed a fall to 65 points).

At the same time, Fed Chairman Jerome Powell, speaking to members of the House of Representatives Committee on Financial Services, said on Thursday that he still believes that the acceleration of inflation will be replaced by its slowdown. The strong price increases this year "are driven by supply chain problems that we have no control over", Powell said.

Meanwhile, representatives of the Democratic Party in the House of Representatives rejected a plan to put to a vote on Thursday evening a bill on spending on infrastructure projects worth about $ 1 trillion, because they did not come to a consensus on the package of spending on social and environmental projects.

The dollar still received some support on Thursday, when the final release of the US annual GDP for the 2nd quarter was published, which turned out to be better than the previous second estimate (+6.7% versus +6.6%), although worse than the preliminary estimate +8.2%.

One way or another, market participants seem to have decided to fix some of their profits in long positions in the dollar at the end of the month and the 3rd quarter, which has significantly strengthened in recent days.

In addition, bidders fear the risks of a suspension of the work of the US government, although US President Joe Biden signed a law on Thursday to extend funding for the work of government agencies, but only until December 3.

The decline in the yield of US government bonds, obviously, also had a negative impact on the dollar quotes. As of this writing, it was at 1.486%, below the local nearly 4-month high of 1.567% reached on Tuesday. At the same time, the DXY dollar index is near 94.20, 32 points lower within the weekly and 12-month highs reached on Thursday.

Today investors will pay attention to the publication of a fresh new portion of US macro statistics. At 12:30 (GMT) inflation indicators (data on personal income / spending of Americans) for August and at 14:00 PMI index of business activity (from ISM) in the manufacturing sector of the US economy for September will be published. Another growth in income / expenses of Americans is expected and a slight relative decline in PMI (59.6 in September against 59.9 in August, 59.5 in July, 60.6 in June). The index is above the 50 level and has a relatively high value, which is likely to support the dollar, despite the relative slight decline in the indicator. The data above the value of 50 indicates an acceleration of activity, which has a positive effect on the quotes of the national currency.

Also at 14:00 will be published the updated consumer confidence index from the University of Michigan for September. Its value is expected to be the same as the preliminary estimate of 71.0. Despite the fact that it is below the previous values, which are above the 80.0 mark, this is still a good result. The index is an indicator of consumer confidence in economic growth. A high result usually strengthens the USD, a low result weakens.

If the aforementioned data turns out to be worse than the forecast values, then the dollar may react with a short-term sharp decline. In general, the upward dynamics of the dollar remains, fueled by expectations of the imminent start of the curtailment of the Fed's stimulus program (last week Powell signaled that the central bank was ready to start phasing out the stimulus program in November, and the Fed leaders indicated that they could raise interest rates next year against the backdrop of risks of a more sustained-than-expected rise in inflation, unless the economy shows significant weakening).

Meanwhile, the main competitor of the dollar in the currency market euro received support at the beginning of today's European session, when inflation indicators for the Eurozone were published. According to preliminary data provided by Eurostat, consumer inflation in September increased by +3.4% (in annual terms), which is the highest level in 13 years (against the forecast of +3.3% and the previous value of +3.0%), which may be due to a jump in energy prices.

The core consumer price index (Core CPI) rose 1.9% on an annualized basis in September after rising 1.6% in August. The acceleration in annual inflation in the Eurozone is further evidence of increased price pressures amid the economic recovery from the impact of the pandemic. Economists expect inflation in the Eurozone to rise to 4% in the 4th quarter and remain above 2% in the first half of 2022.

Data released on Thursday pointed to an acceleration in inflation in Germany, whose economy is the locomotive of the entire European economy. Inflation reached 4.1% in September, the highest level in 29 years.

Nonetheless, the euro has so far reacted with restraint to the acceleration of inflation in the Eurozone after the ECB President Christine Lagarde on Tuesday warned market participants against overreacting to this phenomenon, considering it a temporary factor. Despite the acceleration of inflation in the Eurozone, market participants seem to be in no hurry to take into account the normalization of the monetary policy of the European Central Bank.

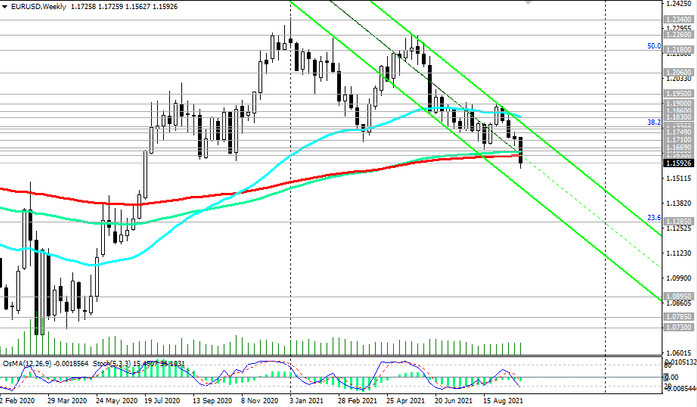

This week the EUR / USD broke the key support level 1.1630 (see Technical Analysis and Trading Recommendations), which separates the long-term bullish trend from the bearish one. Considering the positive dynamics of the dollar, most likely, the decline in EUR / USD will resume, and in the coming days the pair will test the support level of 1.1500, a breakdown of which will open the way towards the support level of 1.1285.