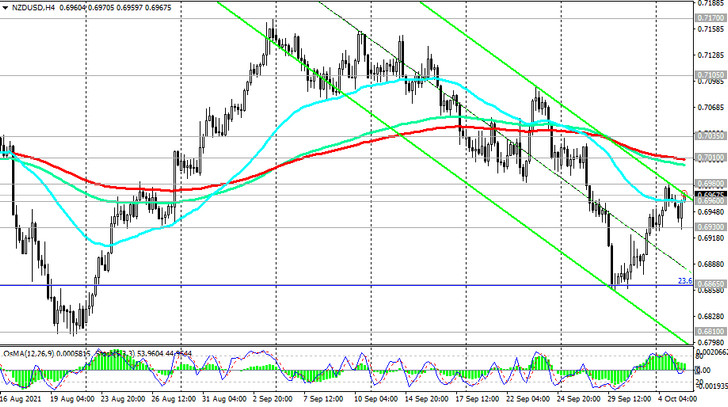

Yesterday, the NZD / USD pair broke through the important short-term resistance level 0.6960 (ЕМА200 on the 1-hour chart), and today is trying to develop an upward correction after a strong decline last month.

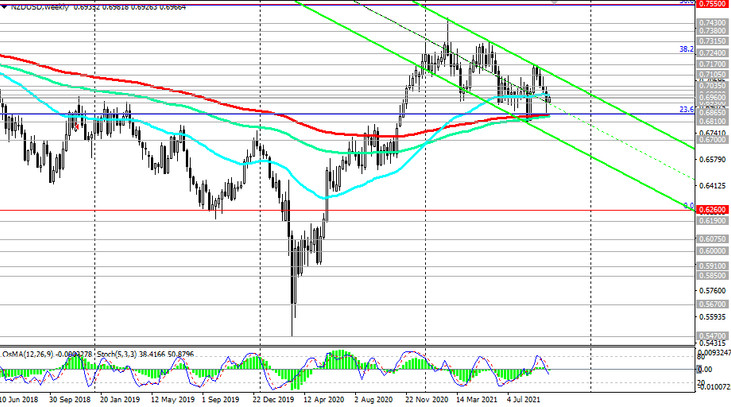

However, in order, as they say, to break out into the operational space, the price needs to gain a foothold in the zone above the key long-term resistance level 0.7010 (ЕМА200 on the daily chart). Break of another strong resistance level 0.7035 (ЕМА144 on the daily chart) will confirm the resumption of long-term bullish dynamics in NZD / USD. More distant growth targets are located at resistance levels 0.7430, 0.7550 (50% Fibonacci level), 0.7600.

In the meantime, the current growth of the pair should be considered as corrective. The breakdown of the support levels 0.6960, 0.6930 (local minimum) will be a signal for resumption of sales with intermediate targets at support levels 0.6865 (ЕМА200 on the weekly chart and 23.6% Fibonacci retracement in the global wave of the pair's decline from 0.8820), 0.6810 (local multi-month lows).

A breakout of the 0.6700 support level (the lower line of the descending channel on the weekly chart) could finally push NZD / USD into the bear market zone and return it to the global downtrend that began in July 2014.

Support levels: 0.6960, 0.6930, 0.6865, 0.6810, 0.6750, 0.6700

Resistance levels: 0.6980, 0.7010, 0.7035, 0.7105, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.6925. Stop-Loss 0.6985. Take-Profit 0.6900, 0.6865, 0.6810, 0.6750, 0.6700

Buy Stop 0.6985. Stop-Loss 0.6925. Take-Profit 0.7010, 0.7035, 0.7105, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600